To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin has been climbing since forming a higher low earlier this week, with signs that smart money may be returning and whale activity picking up once again. It is currently hovering around $92.5K and continues to battle the yearly open at $93.5K.

Overnight, a whale alert was triggered as over 2,000 BTC was withdrawn from Binance, likely indicating significant spot buying from exchanges. This is a constructive sign. Whale spot buyers at this level are often associated with long term holders who typically accumulate during consolidation periods and hold for the long game.

A long term holder is defined as an address that has held Bitcoin for more than 155 days. While it may not seem like a long stretch of time, it is the standard metric used when assessing holder behaviour on chain.

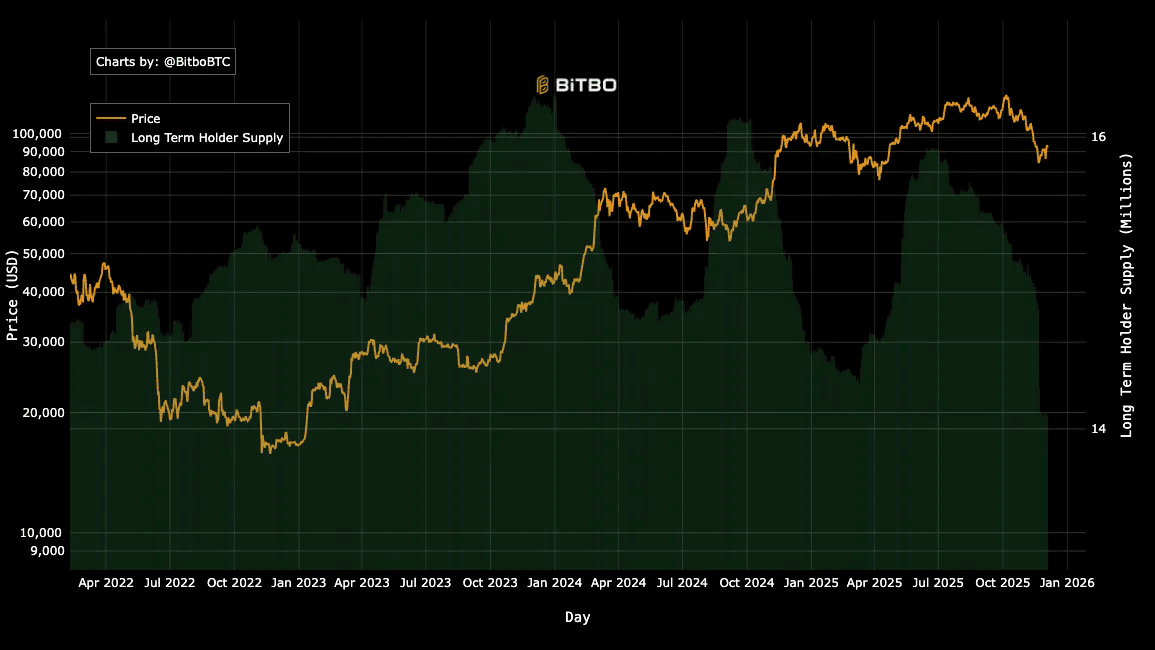

The chart below shows the correlation between long term holder supply in green and Bitcoin’s price in yellow. Historically, when long term holder supply increases, Bitcoin’s price follows. When supply begins to fall and holders start taking profits, the price usually draws down.

This cycle has seen long term holder supply steadily grow from 2022 through to early 2024. Bitcoin moved higher throughout this accumulation phase. The first major wave of selling came as Bitcoin approached its then all time high of $74K in early 2024. Shortly after long term holders began to exit, the top was in and a multi month correction followed.

The next key stage was in late 2024 and early 2025. Once again, long term holder supply peaked before tapering off. Bitcoin printed another all time high soon after. Then supply started climbing again, supporting another push higher. Since July, however, long term holder supply has been falling steadily. Bitcoin set a new all time high shortly after but is now in another corrective phase.

Supply has dropped from nearly 16 million to around 14 million, marking the lowest level of long term holders since 2021. This suggests that large holders and whales have been exiting, positioning for a more prolonged correction. However, since Bitcoin bottomed at $80K a couple of weeks ago, long term holder supply has stabilised near 14 million. This indicates that selling pressure may have subsided and buying interest could be returning.

Historically, when long term holder supply begins to rise again, it often precedes a new leg higher in price. This is something we will continue to monitor closely.

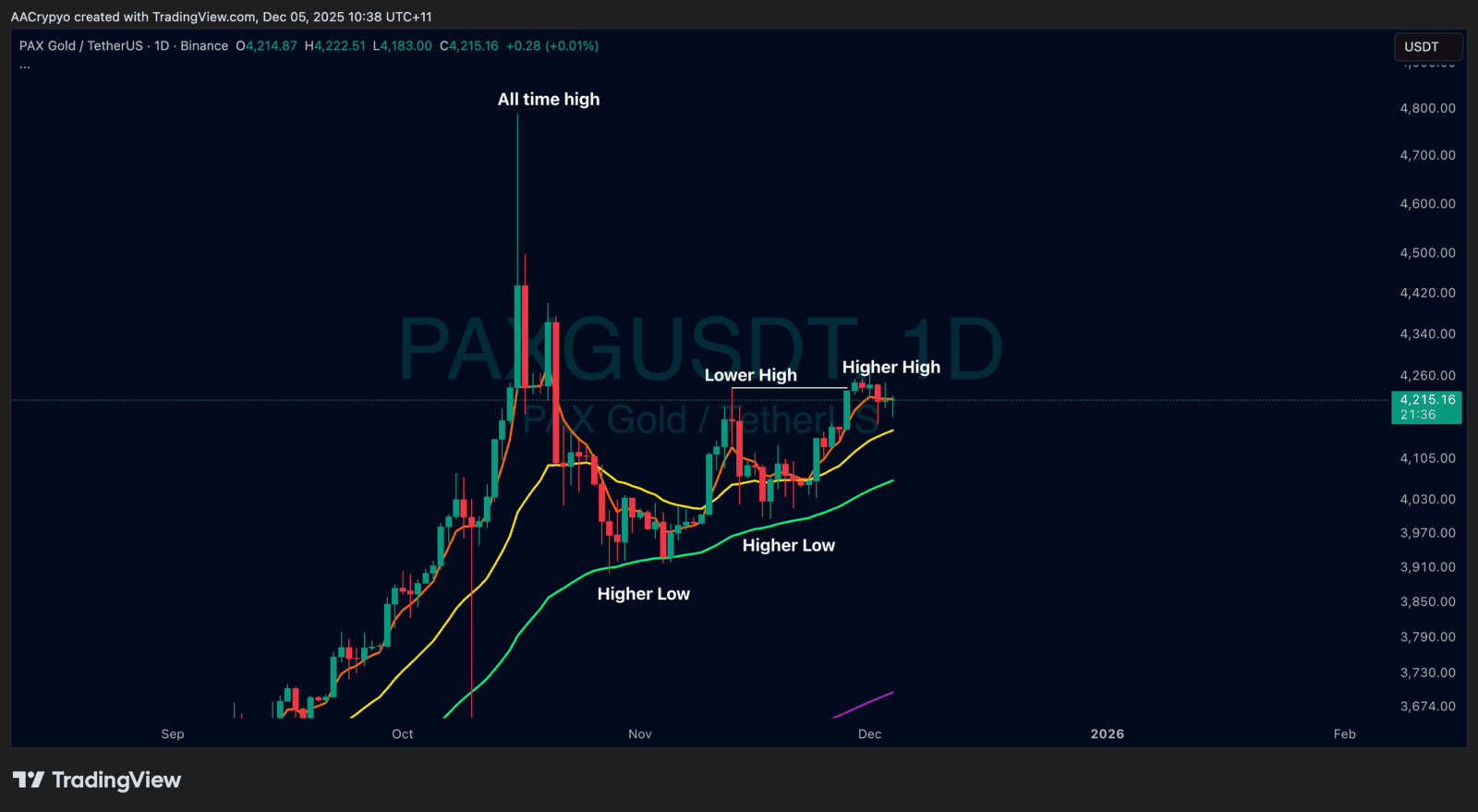

Stormrake Spotlight: Pax Gold (PAXG) ($4,215)

Stormrake Spotlight: Pax Gold (PAXG) ($4,215)