For thousands of years, gold and silver have acted as anchors of monetary discipline. When capital rotates back into hard assets, it signals something important. Investors are looking for protection from currency debasement, financial repression and systemic risk. That instinct is not speculation. It is monetary self defense.

Silver’s recent performance deserves recognition. It has rewarded patient holders and reminded markets that tangible scarcity still matters. That is a healthy development. It reflects a broader return to sound money thinking. But strong performance as an asset is not the same as suitability as money. Money is not only about storing value. It is about moving value.

Physical silver has real world frictions:

It must be stored

It must be transported

It must be verified

It is sold through dealers who control spreads and liquidity

Those constraints are not flaws in silver. They are simply the realities of a physical commodity in a digital world. Now compare that to Bitcoin. Bitcoin is scarce like silver, but native to the internet. It moves at the speed of global communications. It settles without vaults, trucks or intermediaries. It trades continuously across borders in a single global market.In 2026, economic life is not local. It is networked. Capital flows, businesses, trade and individuals operate across jurisdictions, platforms and time zones. A monetary asset that depends on physical handling is structurally mismatched to that environment.

Silver represents the return to hard money principles. Bitcoin represents the digitisation of those principles.

Gold and silver solved the problem of trust in a pre digital world. Their scarcity and physicality made them reliable anchors of value. Bitcoin solves the same problem for a digital civilisation. Scarcity is enforced by code. Ownership is secured by cryptography. Settlement happens on a decentralised network that does not close and does not rely on a central issuer. Silver’s strength is not competition for Bitcoin. It is confirmation that the monetary cycle is turning.

This Is Not Digital Versus Physical. This Is Portfolio Construction.

From a portfolio theory perspective, the debate is not binary. Serious capital does not choose between physical and digital hard assets. It combines them.

Physical metals and Bitcoin share core drivers:

Scarcity

Independence from fiat debasement

Protection from monetary mismanagement

But they behave differently in liquidity, volatility and market structure. That difference is powerful.Physical gold and silver bring:

Thousands of years of monetary history

Lower technological dependency

Strong behavioural demand in times of fear

Bitcoin Brings:

Global 24 hour liquidity

Instant settlement

Portability at scale

Asymmetric upside in a monetisation phase

These characteristics are complementary, not conflicting. In portfolio terms, combining digital and physical hard assets improves structure:

Diversified liquidity profiles

Different adoption curves

Different market participants

Different reactions under stress

That mix can improve risk adjusted returns over the long run. One asset is rooted in the past architecture of money. The other is built for the current and future architecture of the global economy. Silver’s rally is a reminder that the world is rediscovering monetary discipline. Bitcoin is the extension of that discipline into a digital, interconnected system. The future of sound money is not metal alone. It is metal plus code.

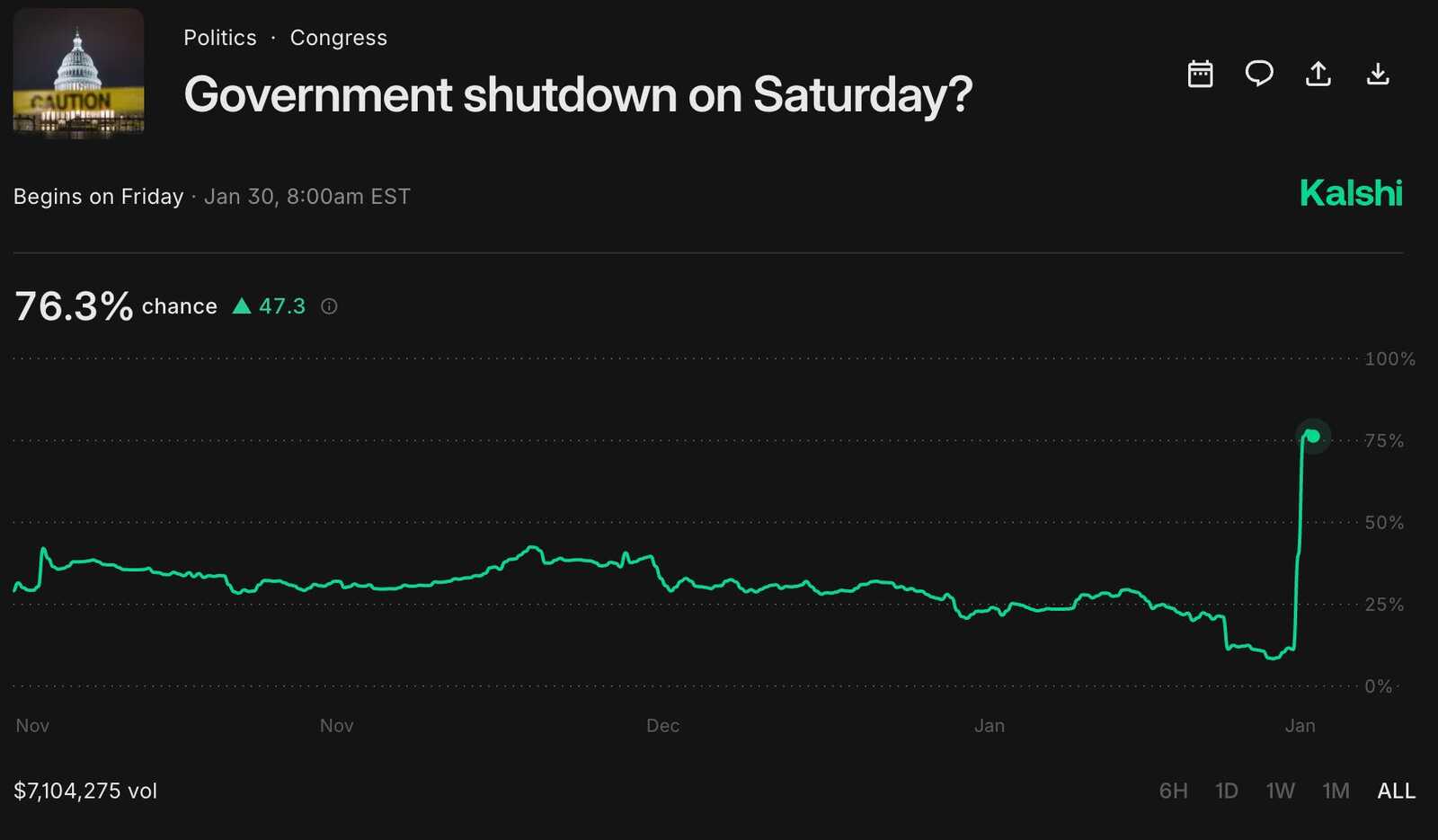

Macro Update: A Second Government Shutdown?