To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

After breaking below the key $88K level, Bitcoin virtually teleported down to $80K in less than 24 hours. While most of the market panics, with the Fear & Greed Index crashing back down to 11 in extreme fear, smart money is quietly dollar cost averaging into these levels.

The liquidity crunch continues. It’s not just crypto facing selling pressure, even precious metals are cooling off. Gold has now posted two consecutive red days as it fights to stay above $4,000, while silver is pulling back from all time high territory and potentially flashing bearish signals with a double top forming.

This broad based selloff is being driven by institutions offloading assets to repay yen denominated debt, as rising yields in Japan drive up borrowing costs. But in a surprising twist, there’s some good news. The probability of a US rate cut next month has surged to 71%, a major swing from just 33% only two days ago after the FOMC minutes. This shift has come off the back of fresh dovish commentary from Federal Reserve member Williams.

While the market pulls back, smart money continues to DCA and take advantage of these lower prices. Retail tends to do the opposite, buying at highs and panic selling at lows. A consistent DCA strategy allows investors to lower their average entry price over time rather than sitting on the sidelines waiting for the impossible task of picking the bottom. Remember, only one person buys the bottom. Those who DCA understand that time in the market beats timing the market. The old virtue still rings true.

At Stormrake, we’re strong advocates of DCA as it not only takes advantages of lower prices but also removes emotions from investing, which is a major hinderance for most. We offer a dedicated DCA service. If you’re looking to join the smart money and take advantage of current price action, contact your Stormrake broker today.

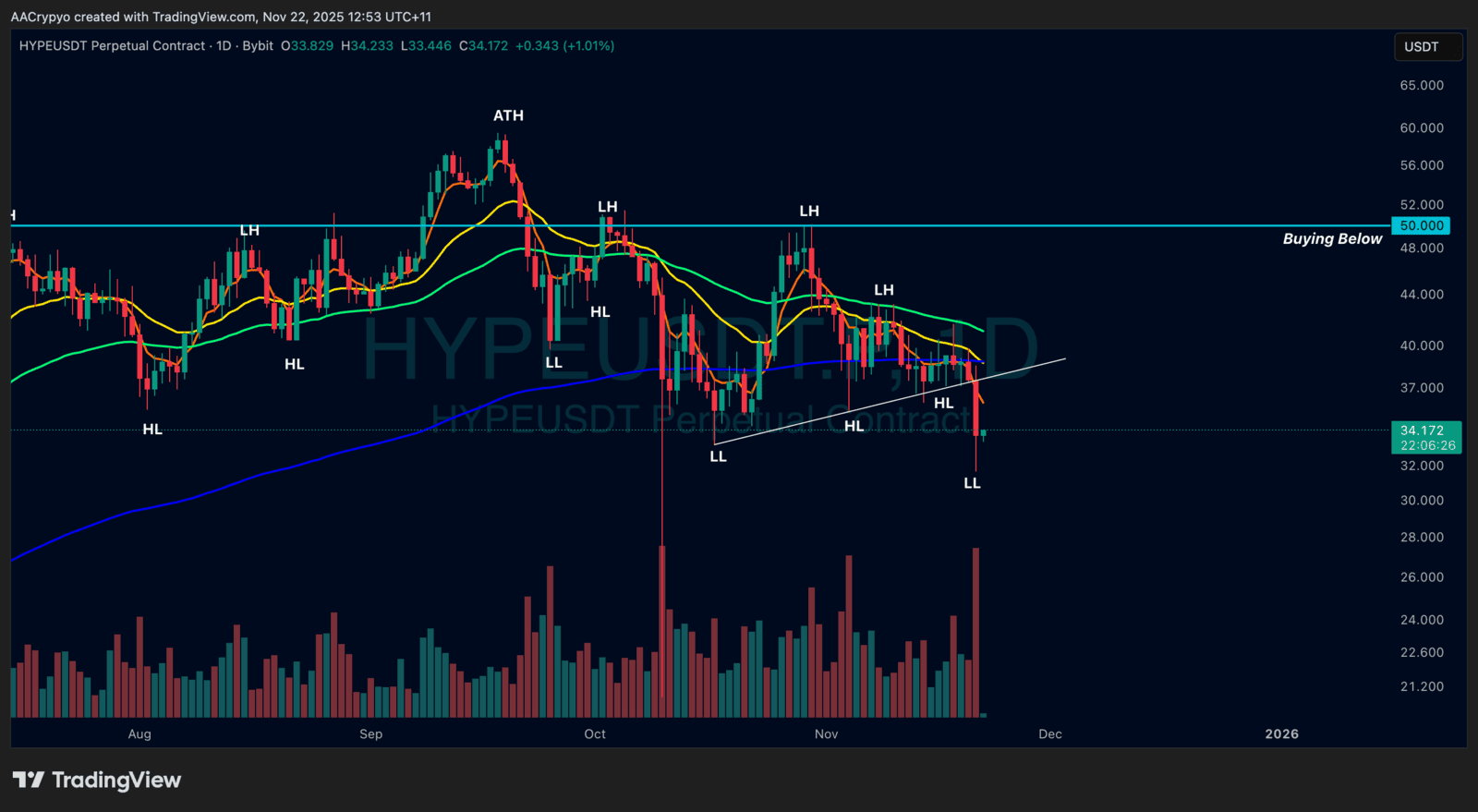

Stormrake Spotlight: Hyperliquid (HYPE) ($34.19)

Stormrake Spotlight: Hyperliquid (HYPE) ($34.19)