To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bear markets are boring and tedious and often shake out 99% of retail investors. It is important that you remain in the 1% and stay active and aware. They are dull, drawn out periods of consolidation before another move lower, rinse and repeat until we eventually see the bottom and reverse.

When I say active, I do not necessarily mean just accumulating Bitcoin. Of course, bear markets are when this historically offers the strongest long term returns and should be taken seriously. But being active also means staying informed, refining your strategy and identifying the projects that continue building while attention disappears.

These are the times when people who bought the highs check out. They sell into drawdown and crystallise the loss, or they forget about their holdings entirely. Historically, this is when opportunity quietly compounds for those paying attention.

4 Key Things to Stay Active with the Market:

Stay plugged into trusted sources

You do not need to watch the chart every hour, but you do need reliable information. Bear markets are when noise increases and engagement drops, which makes it even more important to lean on your trusted sources for market updates, macro analysis, on chain data and regulatory developments.

Be Smart with your Allocations:

Those who bought high can use this period to reduce their average entry. Dollar cost averaging removes the pressure of trying to call the exact bottom. Instead of reacting emotionally to volatility, you build exposure methodically over time.

However, as discussed in our recent article, lump sum deployment during deep bear market conditions has historically been an extremely profitable strategy. When valuations are compressed, sentiment is weak and liquidity is thin, decisive capital allocation can offer significant upside once the cycle turns. The key is recognising when price is trading at meaningful discounts relative to long term value.

Whether you choose DCA, lump sum, or a combination of both, sustainability remains critical. Allocate only what you can afford to hold through volatility. Bear markets reward conviction and patience. A structured plan keeps you active without overextending and positions you strongly for the next expansion phase.

Accumulate conviction, not just coins

It is easy to buy when price is low. It is harder to hold when sentiment is negative. Use this time to deepen your understanding of Bitcoin’s fundamentals and critically evaluate your portfolio.

Learn from your mistakes

Bear markets are not just for accumulation. They are for reflection. If you are down from the highs, ask yourself why. Did you over allocate to altcoins? Did you ignore risk management? Did you buy purely based on hype and momentum?

Use this period to refine your process. Develop clearer entry criteria. Define exit strategies. Improve position sizing. The next bull market will reward preparation, not impulse. The investors who analyse their mistakes now are the ones who execute with discipline when momentum returns.

The Reality of Bear Markets

They feel endless while you are in them. Sentiment turns negative. Media coverage fades. Retail participation drops. But structurally, this is where foundations are built.

Every cycle follows a similar rhythm. Euphoria. Distribution. Capitulation. Boredom. Then recovery. The boredom phase is where discipline compounds.

You do not need to time the exact bottom. You need to remain present. Stay informed. Build conviction. Deploy capital responsibly.

Bear markets reward patience and preparation. The 1% are not necessarily smarter. They are simply still here when the next expansion begins.

And remember, Stormrake is in your corner through both bull and bear cycles. These quieter phases are often when guidance matters most. Lean on the Stormrake team, use this period wisely, and position yourself now so you are ready when the bull market returns.

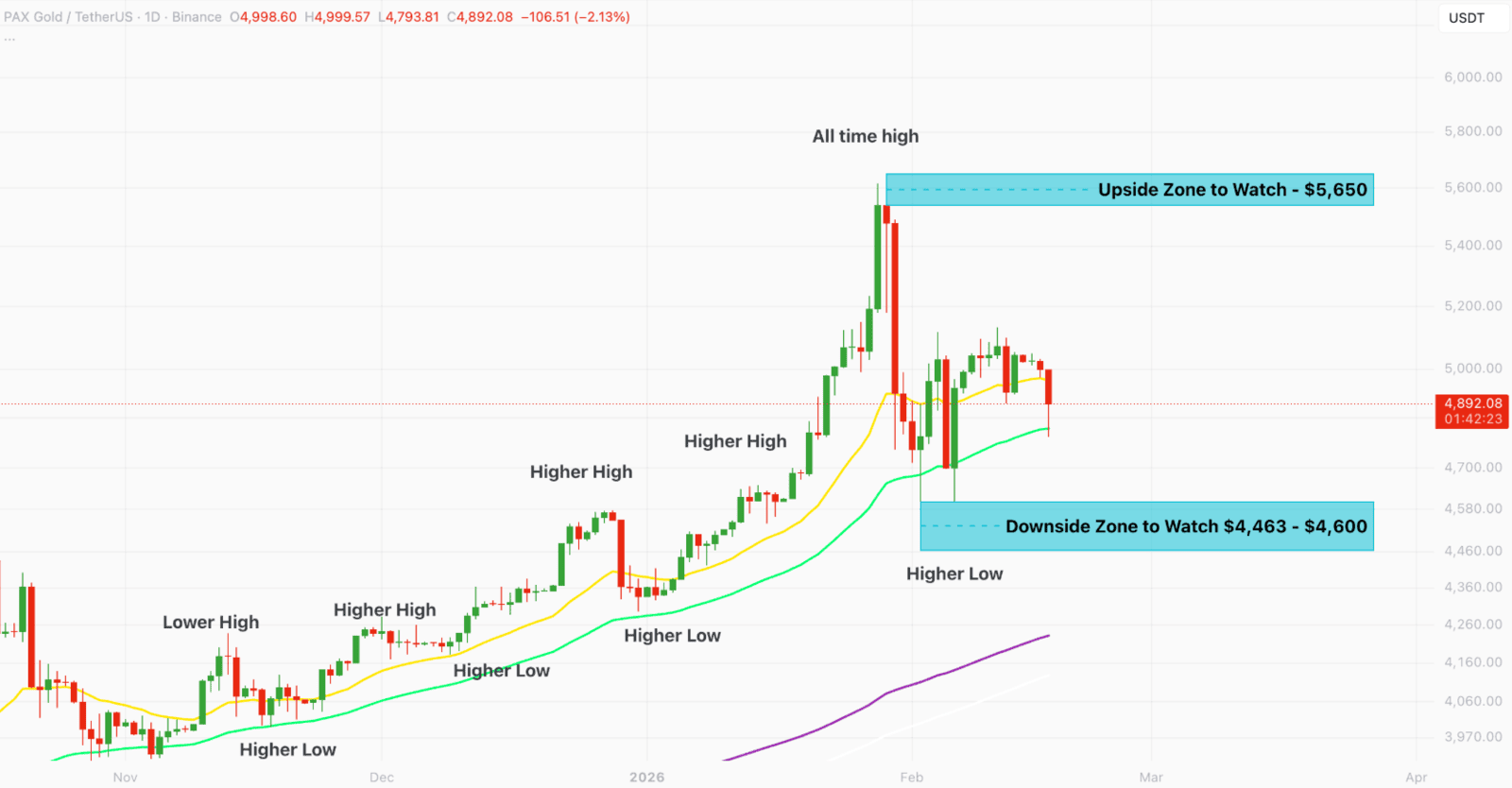

Stormrake Spotlight: Pax Gold (PAXG) ($4,892)

Stormrake Spotlight: Pax Gold (PAXG) ($4,892)