To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

When it comes to a bear market, only the most disciplined investors tend to survive, and ultimately they are the ones who benefit most over the long term. For readers experiencing their first crypto cycle, and even for those who have navigated multiple cycles before, it is always worth reinforcing the fundamentals.

Bear markets are typically where short term participants and many retail investors exit the market, realising losses and never returning. As we covered a couple of weeks ago, short term holders are currently realising losses at the highest rate ever recorded. This is a clear sign of bear market behaviour and historically these periods have marked opportunity rather than failure. It is also one of the most common mistakes retail investors make when it comes to Bitcoin.

Bear markets also amplify emotion. Some investors may be down close to 50% on their Bitcoin holdings in just a few months. Altcoins have, in many cases, performed significantly worse. When emotions begin to influence decision making, it becomes essential to return to the original reason for owning Bitcoin, its long term potential rather than short term price action.

Common Mistakes Investors Make in a Bitcoin Bear Market

One of the biggest mistakes during a bear market is panic selling. As prices decline and sentiment turns negative, many investors sell into weakness, locking in losses rather than stepping back and reassessing their long term thesis. Historically, periods of maximum fear have aligned closely with some of the best long term accumulation opportunities.

Another common mistake is abandoning conviction entirely. Many investors enter Bitcoin near cycle highs driven by momentum, headlines, or short term narratives, without fully understanding why they own it. When the market turns, that lack of conviction leads to emotional decisions. A lower price does not invalidate a sound investment thesis, but it does test it.

A closely related mistake is exiting Bitcoin to chase whatever narrative appears strongest at the time. During bear markets, capital often rotates into short lived trends that promise quick relief from drawdowns. While some narratives may outperform temporarily, chasing them after they have already gained attention often results in poor risk to reward. Historically, many investors sell Bitcoin near relative lows only to re enter at higher prices once sentiment improves.

Overtrading is also a frequent issue during bear markets. Increased volatility and choppy price action tempt investors to constantly buy and sell in an attempt to time the bottom. In reality, this often results in missed opportunities, higher transaction costs, and weaker long term positioning.

Ignoring risk management and liquidity planning is another costly mistake. Investors who overextend during bull markets often find themselves forced to sell during downturns due to cash flow needs or excessive exposure. Having capital set aside and a clear allocation strategy allows investors to act strategically rather than reactively.

Finally, many investors disengage completely. They stop following the market, stop learning, and mentally check out until prices recover. Bear markets are where conviction is built, understanding deepens, and the groundwork for future gains is laid.

Key Things to Remember

Manage your emotions and take a moment before making any rash decisions that may be regretted later. Bear markets are designed to test conviction and patience.

Investing in Bitcoin comes with significant volatility. Those who understand and manage that volatility, rather than fear it, are often the ones who benefit most from lower prices.

Have a clear plan. Whether that is dollar cost averaging, staged accumulation, or holding through the cycle, a predefined strategy removes emotion from decision making when conditions become uncomfortable.

Time in the market consistently outweighs attempts to time the market.

Historically, those who deploy capital during bear market periods, when sentiment is weak and participation is low, are the ones who yield the greatest returns in future expansion phases.

As always, your dedicated Stormrake broker is available for consultations and can assist with navigating the current market environment and identifying how to position effectively, so your future self will be thanking you.

To book a complimentary consultation with Managing Director, Bisher Khudeira, please click here.

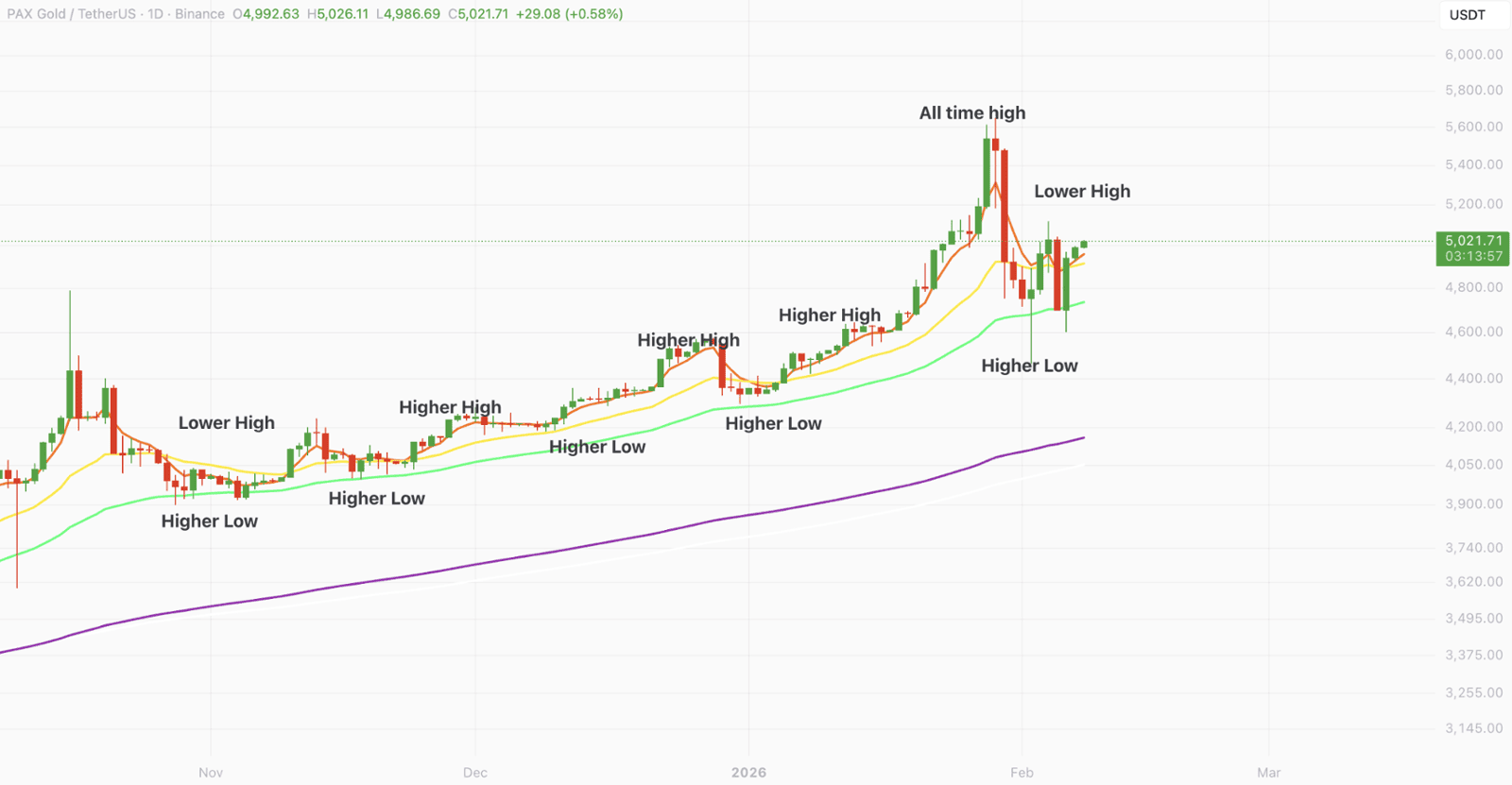

Stormrake Spotlight: Pax Gold (PAXG) ($5,021)

Stormrake Spotlight: Pax Gold (PAXG) ($5,021)