The major headline this week has been the US intervention in Venezuela, with President Maduro captured and, more importantly for financial markets, oil back in focus. Venezuela holds the world’s largest proven oil reserves, yet risk-on markets have remained largely unaffected by the developments so far.

There is plenty of speculation as to why the US made this move, from regime change to oil opportunism to midterm election strategy. We are not here to settle the why, but to explore how this plays into Bitcoin. While no one has a crystal ball, we can assess how the situation fits into the broader macro picture and what it could mean for the ultimate asset.

Bitcoin thrives on two things: liquidity and systemic failure. Over the last few days, we have been tracking both themes, and the Venezuelan situation adds further weight to our 2026 thesis. It supports the idea of incoming liquidity and continued institutional fragility.

Looking at the political calendar, the US midterm elections are due later this year. As it stands, the Democrats are favoured to take the House of Representatives, with prediction markets giving them a 77% chance. Inflation remains the top concern for voters, with gas prices still the clearest day-to-day indicator of rising costs. If the goal of this intervention is to secure cheap, extractable Venezuelan oil, then a flat or falling oil price alongside rising GDP would be viewed as a win, particularly for Republicans.

Under Trump, we have seen a clear playbook of aggressive liquidity injections aimed at stimulating markets. That approach has driven all-time highs across commodities, equities, and even Bitcoin over the past year. If securing more oil leads to further liquidity and a stable energy supply, that strategy is likely to continue. But this creates a tightrope. More liquidity may lift markets, but it also risks reigniting inflation. The administration is caught between stimulating growth and controlling prices, both of which feed directly into how assets like Bitcoin behave.

What it means for Bitcoin

Bitcoin is well positioned either way. If the US manages to stabilise oil prices and keep liquidity flowing, risk assets will benefit. Bitcoin, sitting furthest out on the risk curve, typically outperforms when capital is abundant.

But if oil prices climb instead, whether from failed policy, prolonged conflict, or global contagion, then inflation once again takes centre stage. In that scenario, Bitcoin’s appeal as a hedge against fiat debasement and fiscal excess becomes more pronounced. Investors facing rising energy costs and macro instability may begin to rotate out of traditional financial assets, especially bonds, which lose their appeal as real yields fall.

Bitcoin thrives in this kind of uncertainty. It benefits when trust in institutions weakens, when traditional hedges falter, and when capital seeks scarce, liquid, and politically neutral stores of value. The key metrics to watch now are bond yields and volatility in the rates market. If yields push higher and volatility spikes, that signals stress in the fiat system. Historically, Bitcoin has responded well to those dislocations.

Whether policymakers choose to inject more liquidity to stabilise markets or markets force their hand through higher inflation and volatility, Bitcoin remains a viable response to both outcomes. It is not reliant on political success or failure. It absorbs both.

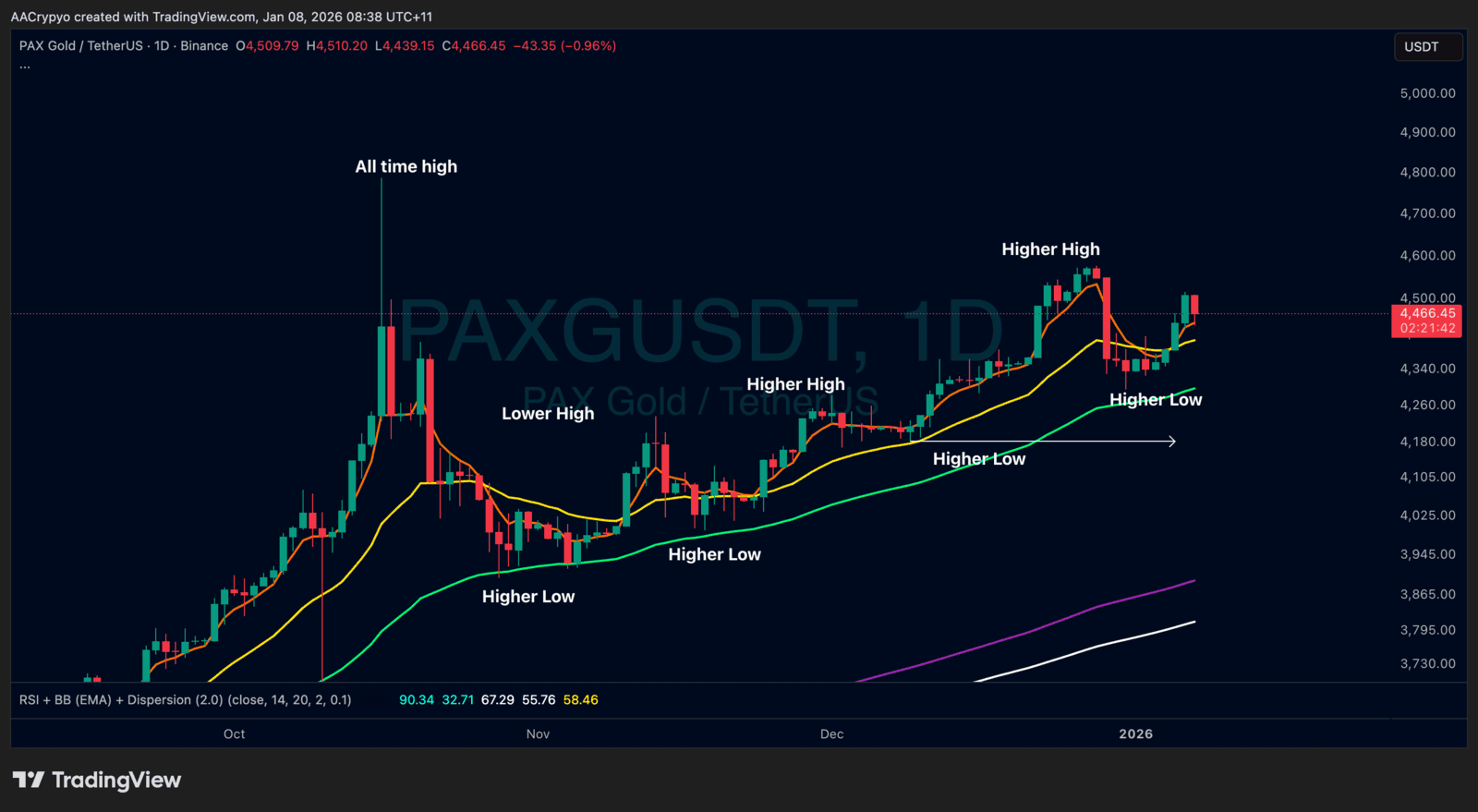

Stormrake Spotlight: Pax Gold (PAXG) ($4,466)