To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

May is drawing to a close, and it’s been a strong month for Bitcoin—multiple new all-time highs punctuated a bullish run. However, renewed tariff fears have resurfaced, casting a shadow over an otherwise positive month.

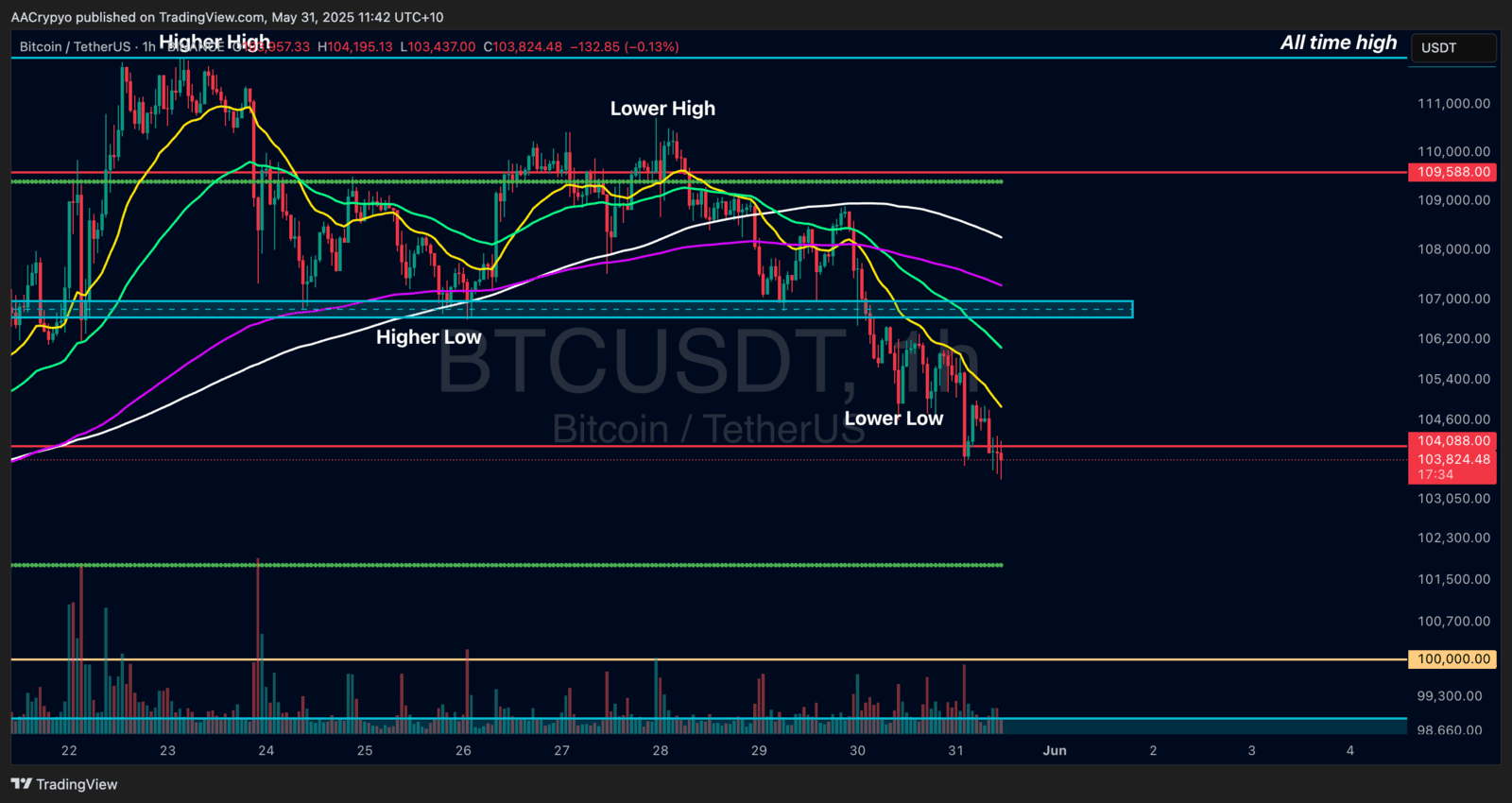

Over the past week, Bitcoin surged to a new all-time high just shy of $112K. But that momentum was abruptly halted when Trump announced sweeping tariffs on the entire European Union. Despite a pause being placed on their implementation, the damage to sentiment was already done. The market struggled to regain its bullish footing and has since continued its pullback—now down 7% from the highs. With fresh tariff headlines emerging overnight, this retracement looks set to continue.

Rising Trade Tensions and Tariff Escalations

Overnight, we’ve seen a flurry of announcements pointing to renewed friction between the US and China. President Trump has doubled steel tariffs—from 25% to 50%—and the rhetoric is intensifying.

US Trade Representative Greer labelled China’s behaviour “completely unacceptable,” expressing serious concerns over Beijing’s trade non-compliance. Trump followed up by accusing China of having “totally violated its agreement with us,” with reports suggesting the US is preparing broader technology sanctions targeting Chinese subsidiaries.

In what appears to be a total breakdown of recent trade progress, Trump declared, “So much for being Mr. Nice Guy.” This follows just two weeks after the US and China had struck a major tariff reduction agreement. Adding fuel to the fire, the US recently halted exports of chip software and jet engine technology to China, significantly escalating tensions.

What June Might Hold for Bitcoin

Historically, June has been a mixed bag for Bitcoin—bullish in six out of the past fourteen years. But this June is expected to begin under the shadow of intensifying trade disputes. Tariff talk, the increase in steel import duties, potential resumption of EU tariffs, and the growing rift with China will likely dominate the macro narrative in the first half of the month.

While these macro headwinds have clearly stalled Bitcoin’s upward momentum, the current 7% drawdown still qualifies as a pullback rather than a deeper correction—for now. As long as BTC holds the $100K–$101K zone, which is backed by strong demand, the larger bullish structure remains intact.

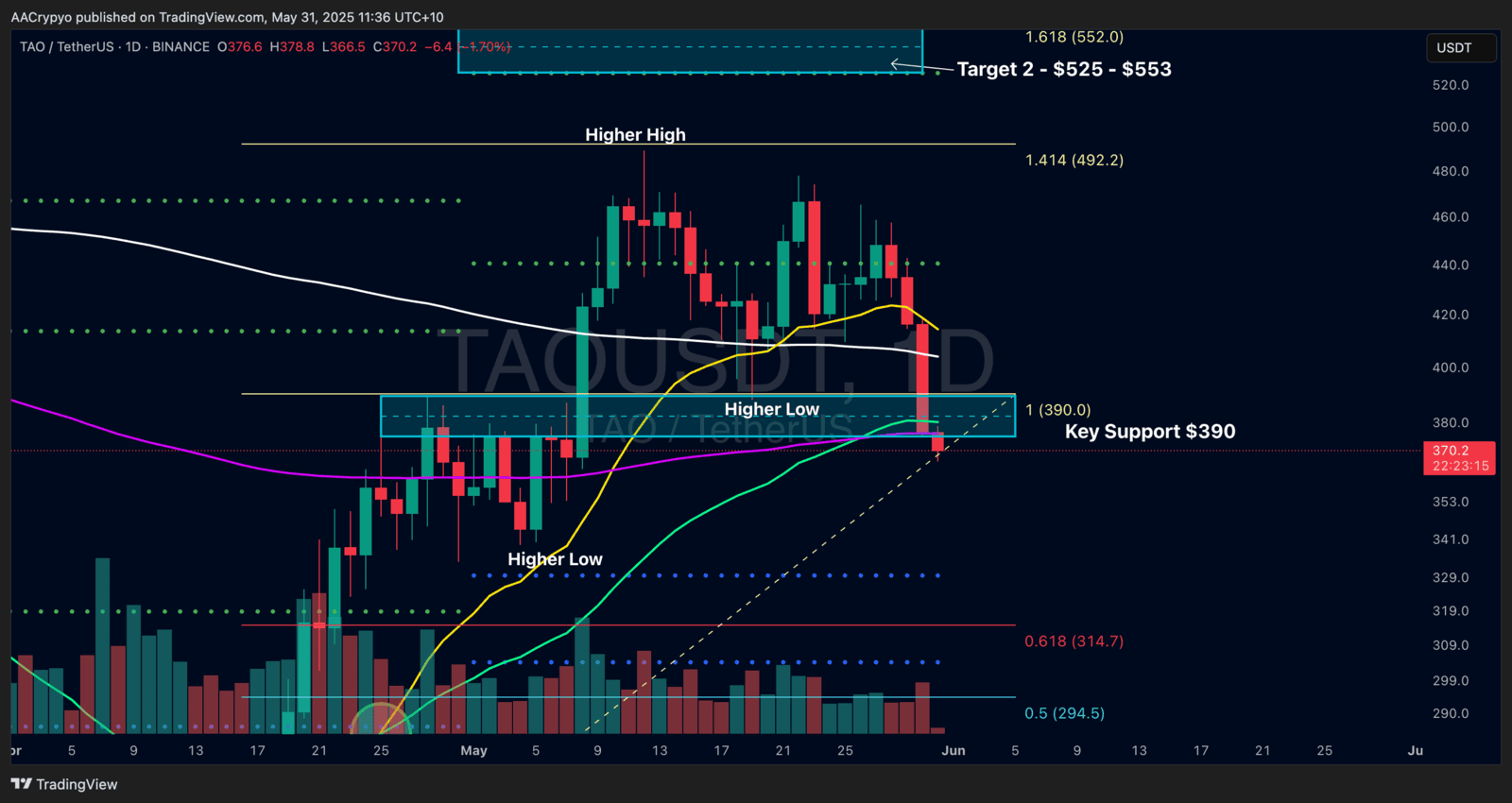

Stormrake Spotlight: Bittensor (TAO) ($370)

Stormrake Spotlight: Bittensor (TAO) ($370)

TAO has fallen 11% since yesterdays morning note and has created a new lower low officially confirming a bearish structure. TAO must reverse and reclaim the key level that was $390 quickly, otherwise a sustained move below this level will likely send TAO lower. TAO will continue to follow Bitcoin and the broader market, so it will rely on Bitcoin to reverse.

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action:

Source: