As we approach the end of the financial year, here’s a quick way to stay prepared for tax time.

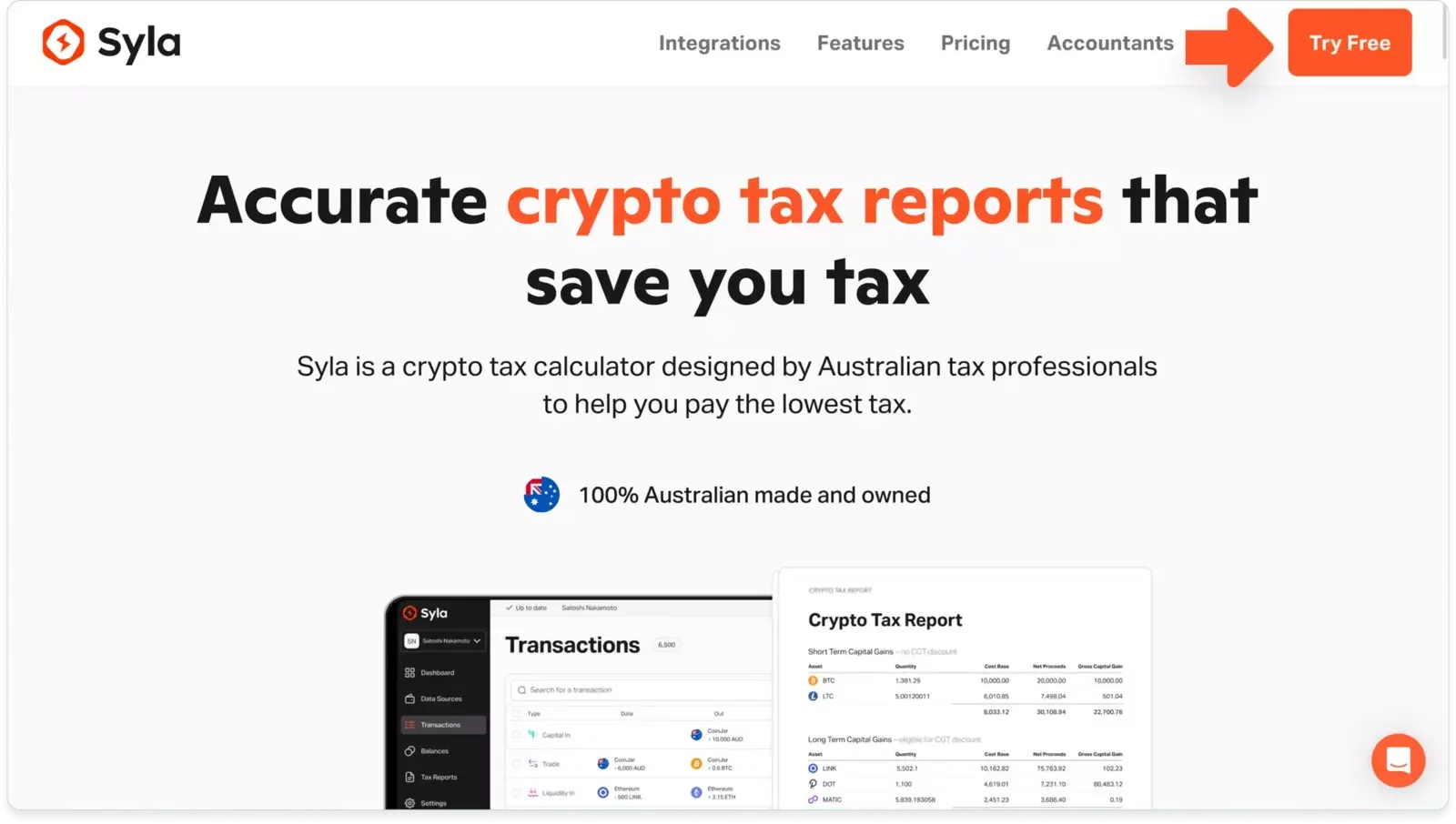

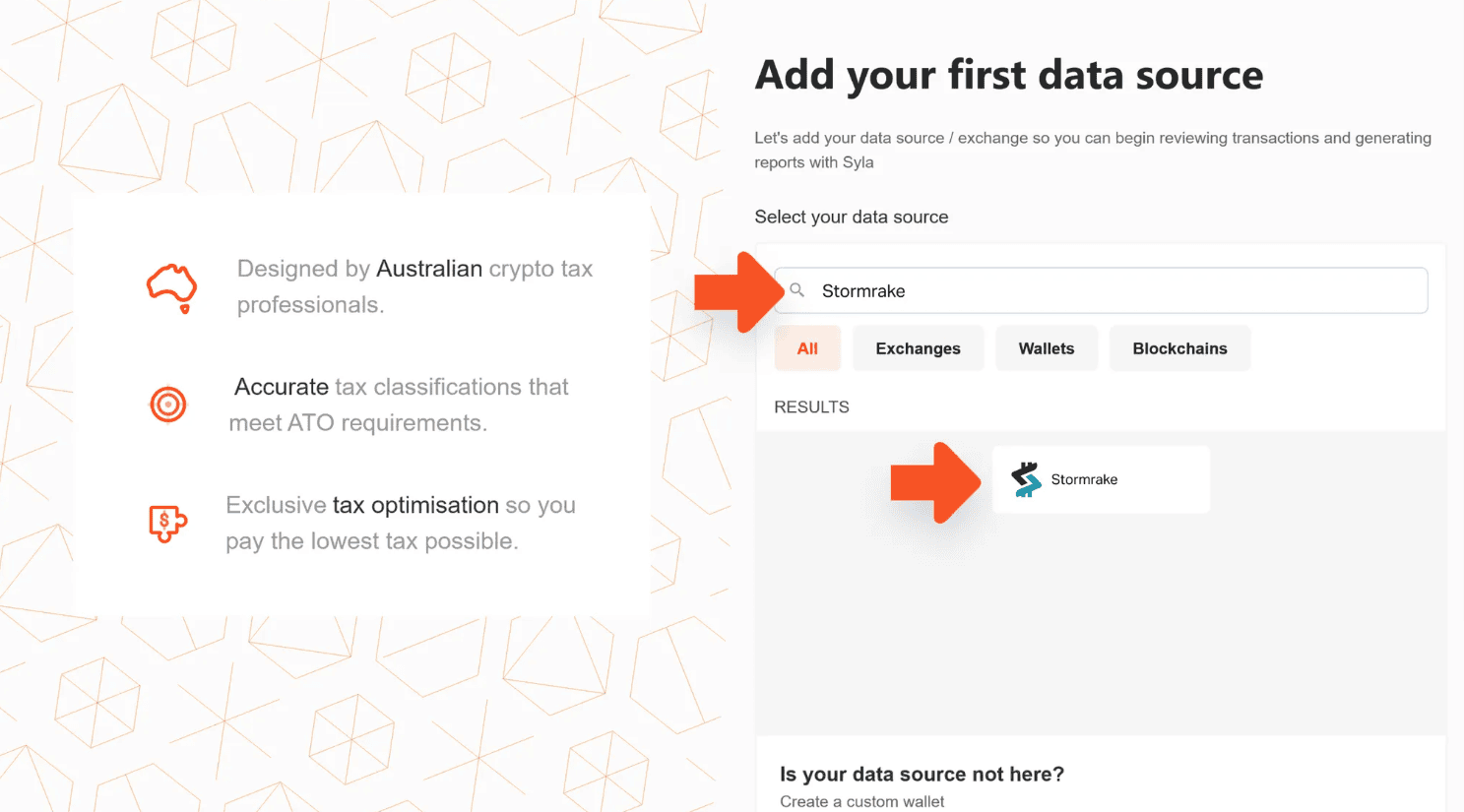

Stormrake has partnered with Syla to provide a complete crypto tax report, fully tailored to Australian tax requirements. Whether you're lodging yourself or working with an accountant, Syla makes it simple to import your Stormrake transactions and calculate your crypto tax.

Stormrake exclusive offer:

Get 30% off any Syla plan with the code STORMTAX at checkout. Register here.

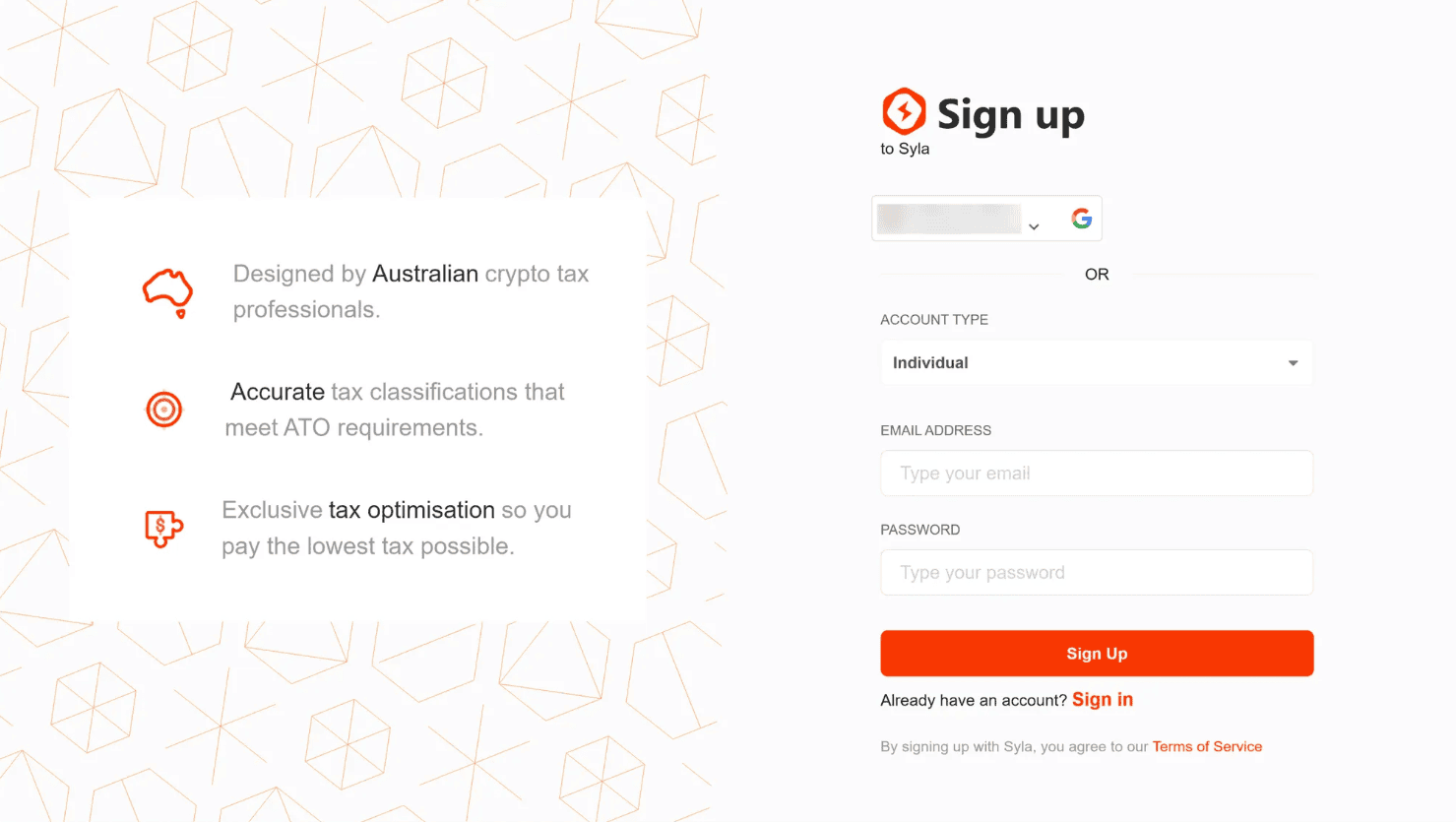

How to register an account on Syla

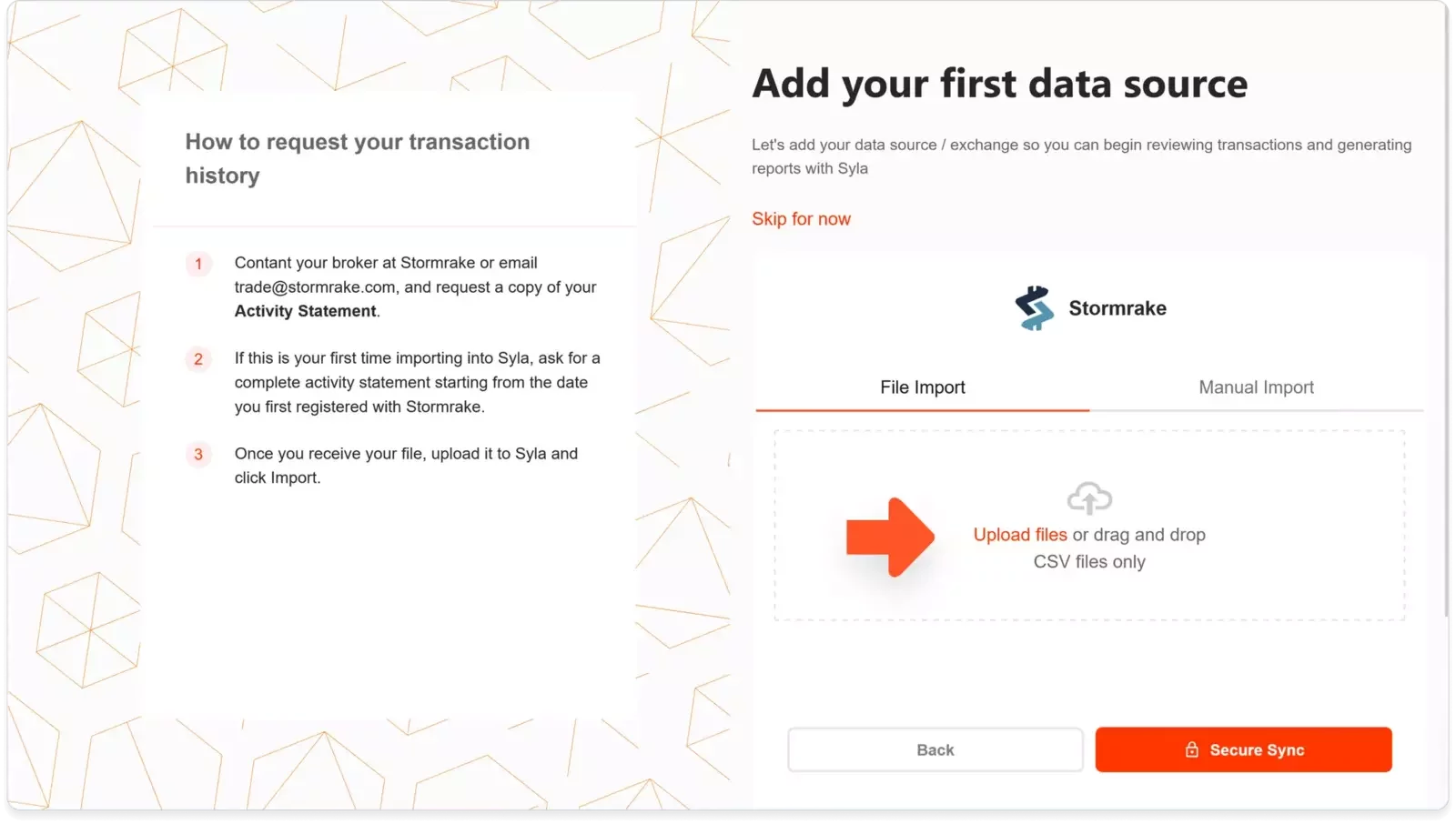

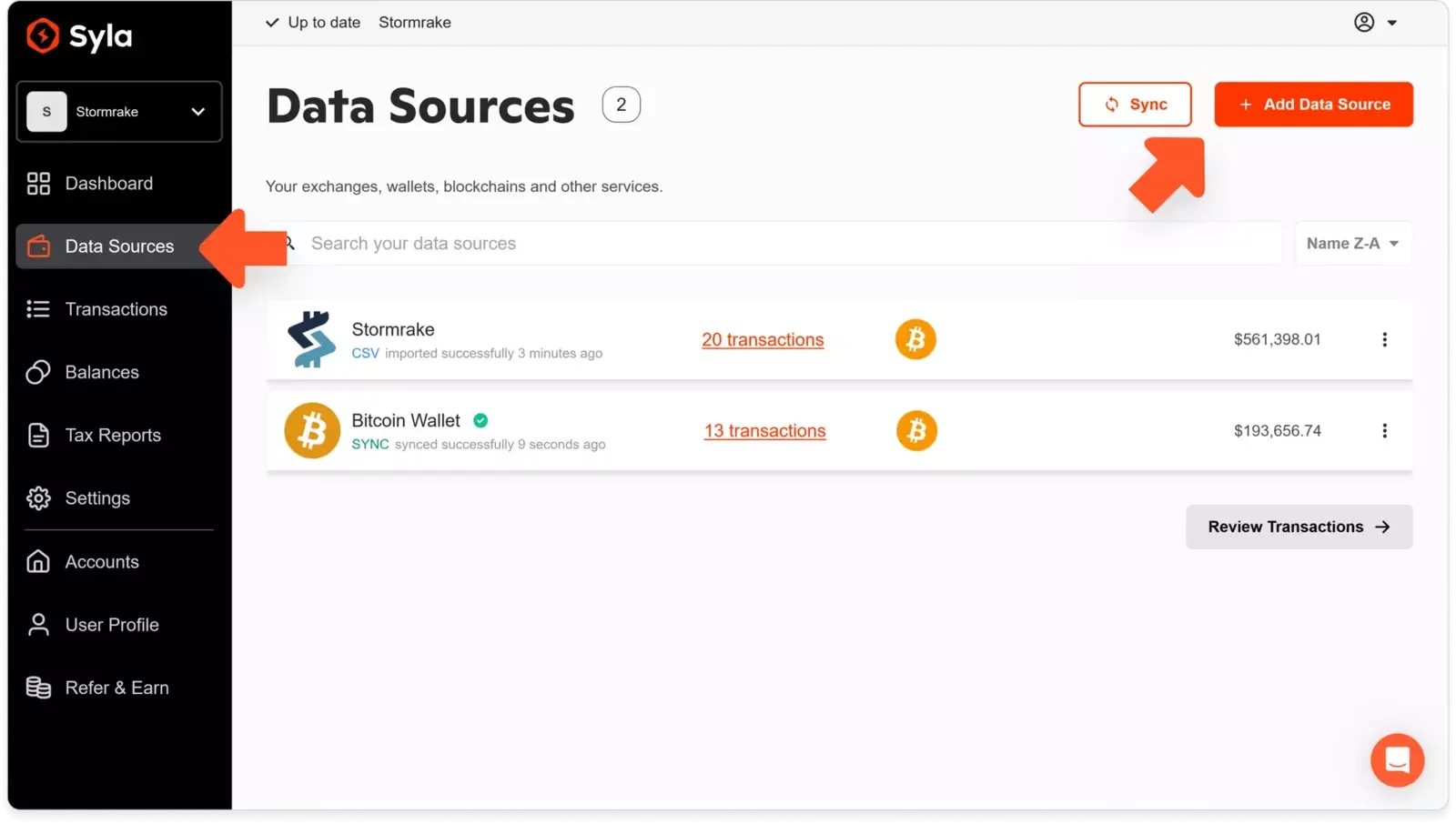

Importing your Activity Statement CSV

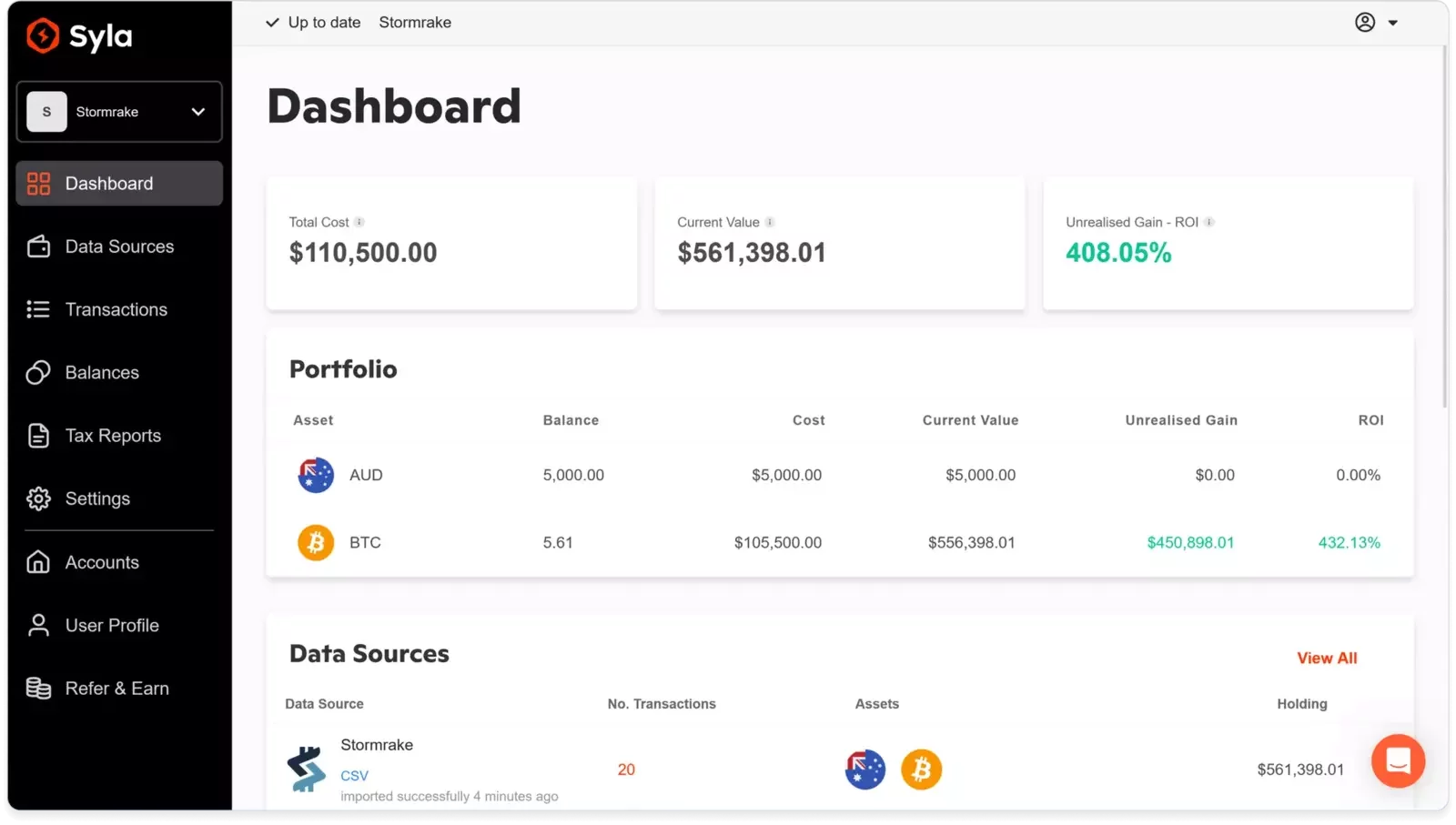

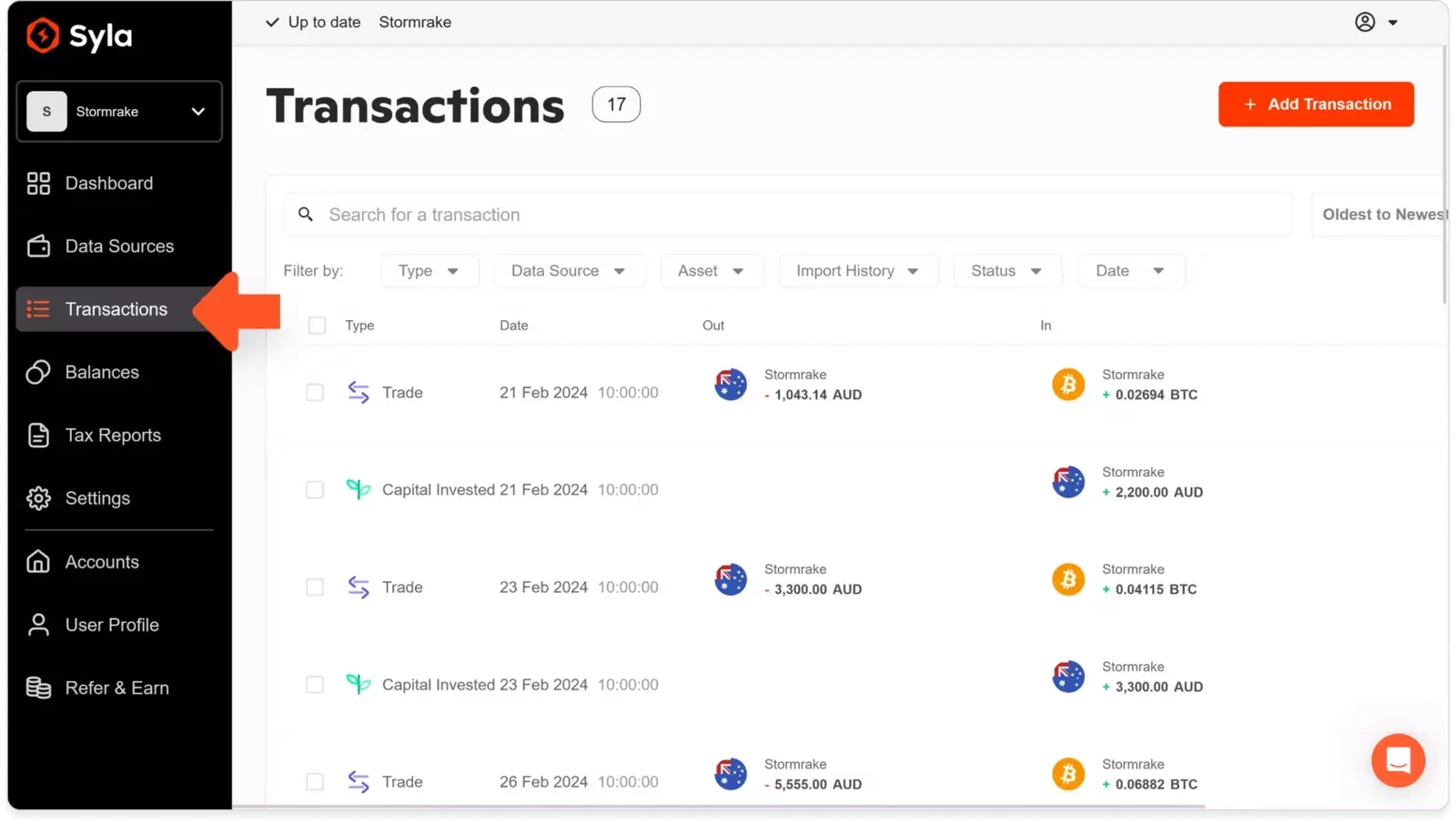

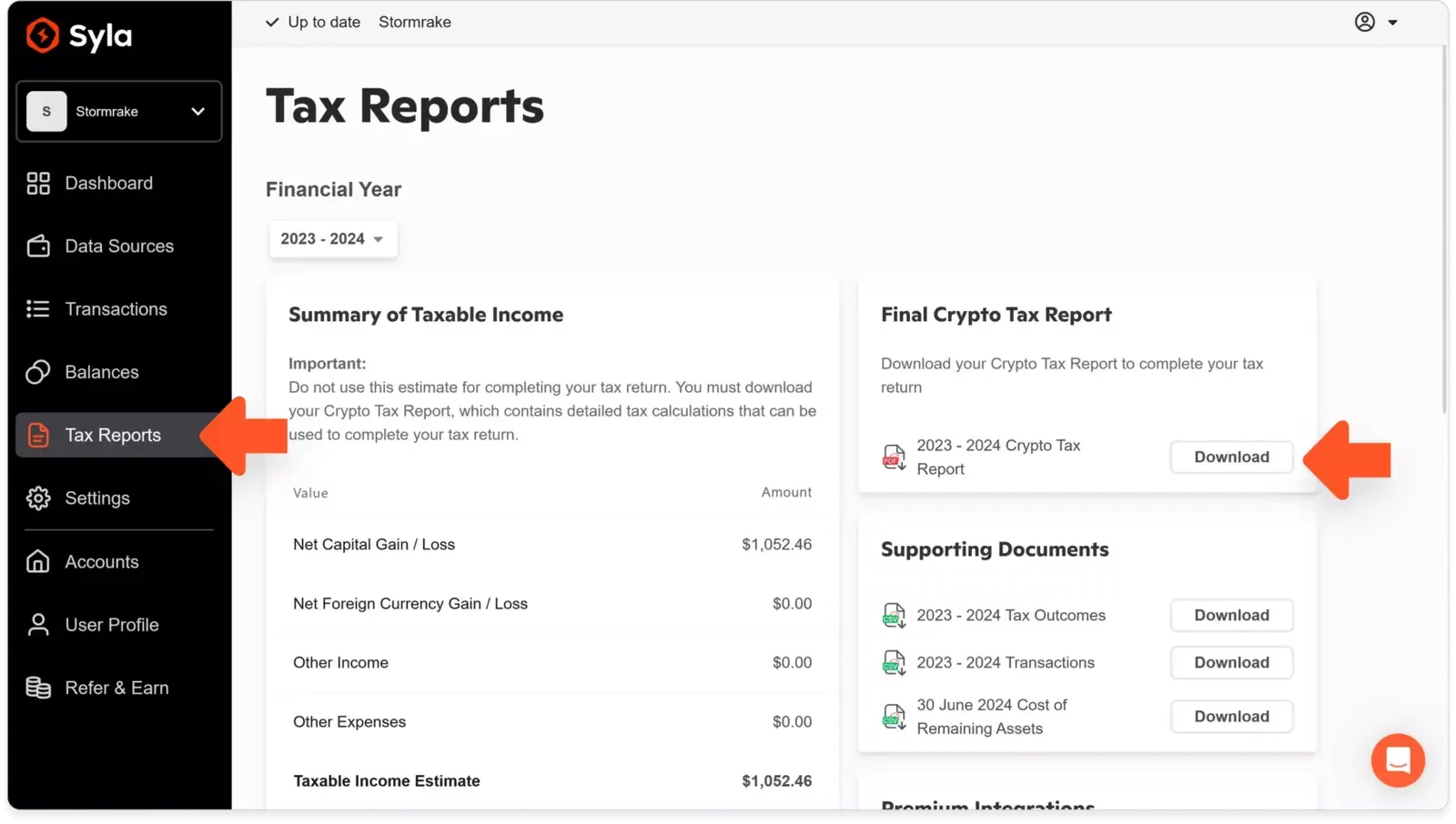

Review and download your Crypto Tax Report

Need Help

Create a brokerage account today

Reach out to us at Stormrake for further market insight and allow us to help you navigate the sea of mania and laser-eye memes, so that you can realise your goals in the market!

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved