To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The race that stops the nation but the crypto space will not stop and the bears are relentlessly punishing those in overleveraged positions.

Bitcoin has fallen nearly 4% over the last 24 hours and hovers above $106K. We pointed out yesterday that the weekend of consolidation was setting up for either side to take control and dictate the direction for the week ahead. Unfortunately for the bulls, the key support was broken and price has since moved lower, giving full control to the bears.

Altcoins suffered even more, with almost every one in the red. Your majors are down at least 6% and most others are in double-digit deficits for the day. A brutal day for altcoins.

This was a crypto-related pullback, as equities closed higher during their session overnight, gold remained flat on the day, and the US dollar has now seen its fourth consecutive green trading day. It seems this drop was once again a flush to wipe out overleveraged positions. Over $1.1 billion in long positions were liquidated in the last 24 hours, including the ‘perfect trader’ that people had been hyping online.

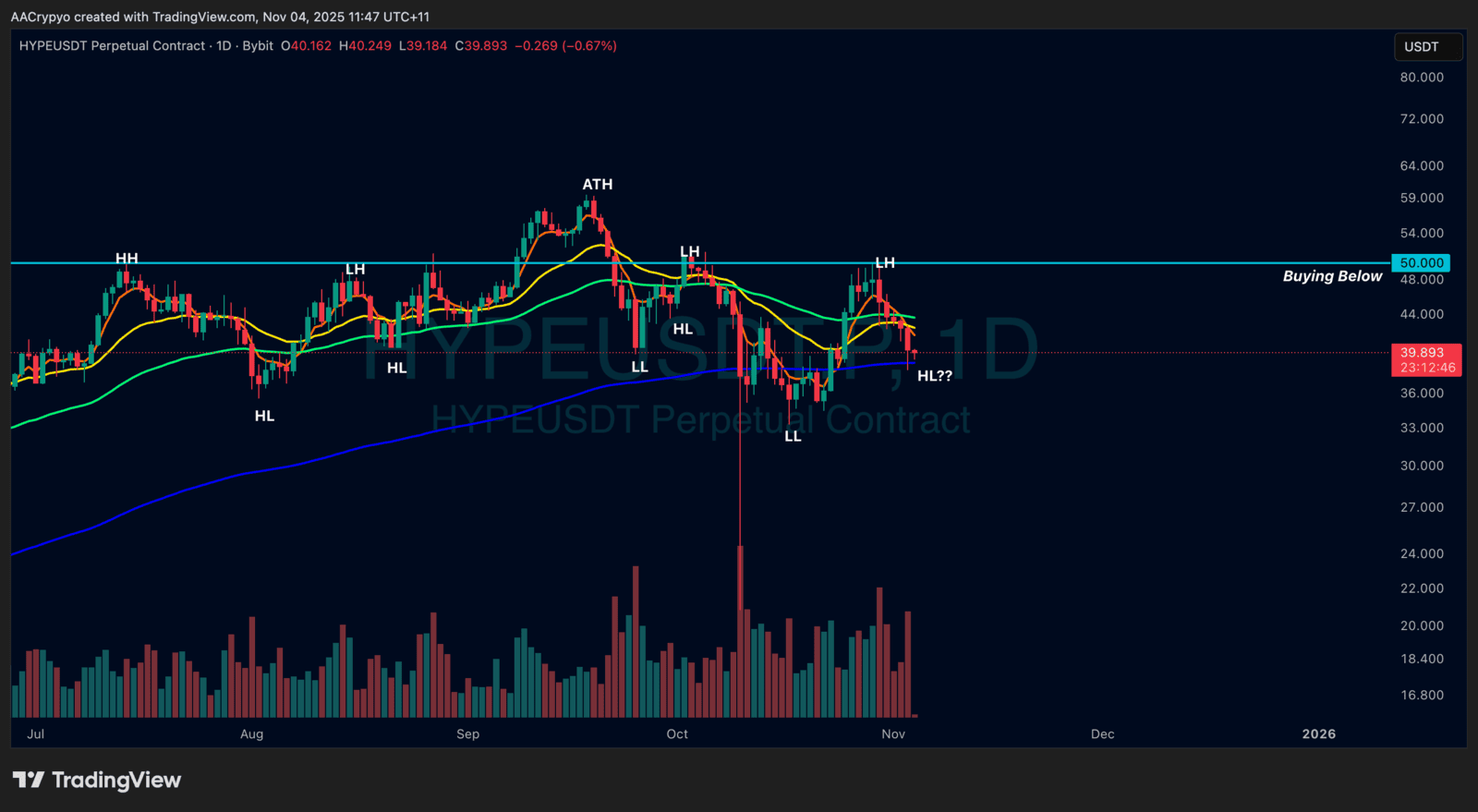

As many of our articles covering leverage and the dangers of it have pointed out, you can have a perfect strategy, or what you think is the perfect strategy, but all it takes is one thing to go against you to wipe you out completely. That is exactly what happened. Throughout October, a whale trading on Hyperliquid had a perfect 100% strike rate and perfectly timed their entries before announcements that moved the market. They had grown their balance to over $33 million after just 14 trades. Many speculated it was insider trading, but that remains speculation. What we do know is that they went all in on longs over the last few days, and this morning that $33 million and 100% success rate has turned into a current drawdown and unrealised loss of $18 million. A near $50 million reversal from one trade going wrong.

No one is safe in this market. Except for spot holders. They are using these dips to accumulate more Bitcoin and altcoins that have really taken a beating. Michael Saylor has just purchased more Bitcoin. Make sure you are on the right side of this liquidation event.

Yesterday we covered ASTER and how it ran 30% off the back of CZ’s tweet saying he bought more. It went from $0.91 to over $1.20. Today it is at $0.89, which just backs up what we were saying yesterday, that these moves based purely on hype often reverse soon after. That is exactly what happened. Stay away from the distractions and stay focused.

Overnight we also saw Balancer Protocol, a decentralised exchange and AMM built on Ethereum, hacked. Over $100 million worth of Ethereum staking derivatives were stolen. As a result, Ethereum recorded over $400 million in outflows from the network.

Stormrake Spotlight: Hyperliquid (HYPE) ($42.60)

Stormrake Spotlight: Hyperliquid (HYPE) ($42.60)