To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

When Financial Markets are soaring, everyone loves to chase the trend, hopefully make a quick-buck (or two..) and maybe even enjoy the profits, but when the market provides the rare glimpse of exceptional discounts - why do some participants shy away and let generational opportunity slip by? The answer is one word; Psychology.

Crypto follows retail-driven hype and mania better than almost any other market available. This is why in our industry, eye-watering gains are up for grabs to those that hold their nerve over a long period of time, whilst folks looking to get-rich-quick can find themselves sitting through drawdowns perhaps longer than anticipated.

As previously mentioned in our DCA vs Lump Sum strategic Morning Note a few days ago, ultimately it’s smart positioning either way and nerves of steel bound in true conviction that takes the cake for the winning strategy in the long run. These same nerves must also be present when the markets are roaring green, day after day, week after week and so on…

Many investors assume that identifying market bottoms is the greatest challenge. In practice, managing exposure during periods of strong appreciation can be equally demanding. When sentiment is overwhelmingly positive and prices are rising rapidly, it becomes psychologically difficult to reassess position sizing, rebalance portfolios, or revisit original investment objectives.

This is not necessarily about attempting to call a precise market top. Rather, it is about understanding your strategy in advance. Investors who define their allocation targets, liquidity requirements, and long-term goals before entering a position are better equipped to make measured decisions during both euphoric and corrective phases.

Market cycles inevitably test discipline on both ends. In strong uptrends, there can be a natural temptation to increase risk beyond intended levels. During corrections, there can be equal pressure to reduce exposure at precisely the wrong time. A clearly articulated strategy helps remove emotion from these decisions.

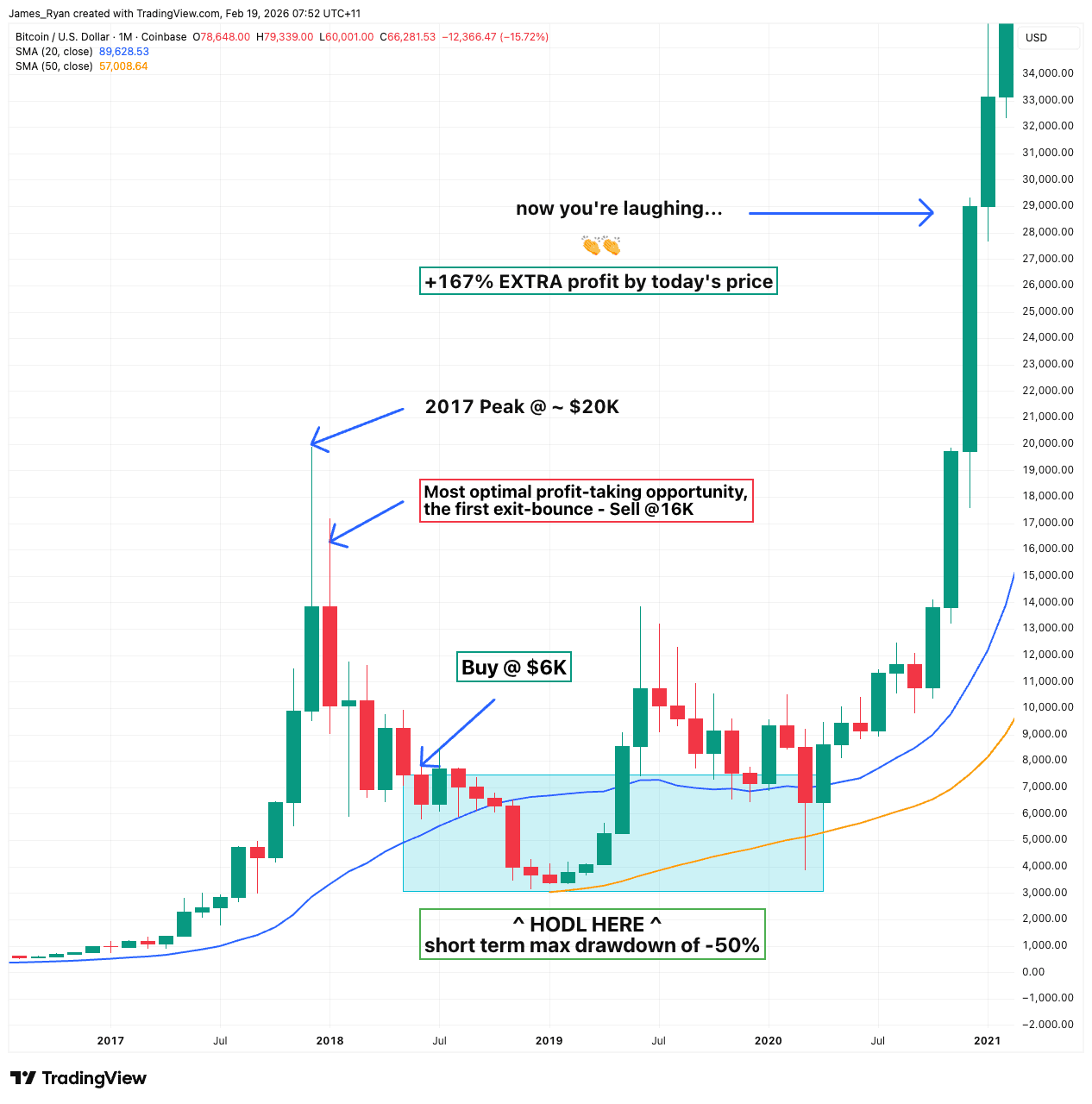

The 2017 to 2018 Bitcoin cycle provides a useful example. Following its peak near $20,000, Bitcoin experienced a prolonged decline, eventually reaching levels around $3,200. Along the way, there were periods of temporary recoveries before further downside followed. Investors who had predefined allocation bands or staged exit and re-entry frameworks were better positioned to navigate this volatility than those reacting solely to price movements.

The key lesson is not about exiting at the exact top or re-entering at the precise bottom. Very few participants consistently achieve that outcome. Instead, it is about ensuring that capital deployment and risk management decisions are aligned with a broader investment thesis. Over multi-year time horizons, disciplined strategy has historically mattered far more than short-term precision.

Ultimately, successful participation in volatile asset classes requires clarity of purpose. When investment decisions are anchored to defined objectives rather than market noise, both bull markets and bear markets become environments to manage thoughtfully rather than react to emotionally.