They inherit it.

Bank accounts. Super funds. Property ladders. Managed portfolios. Fractional reserve banking in the background, expanding credit, diluting currency, recycling deposits into leverage. It is the financial equivalent of a migration pattern. Repeated, unquestioned, socially reinforced.

Safety through belonging.

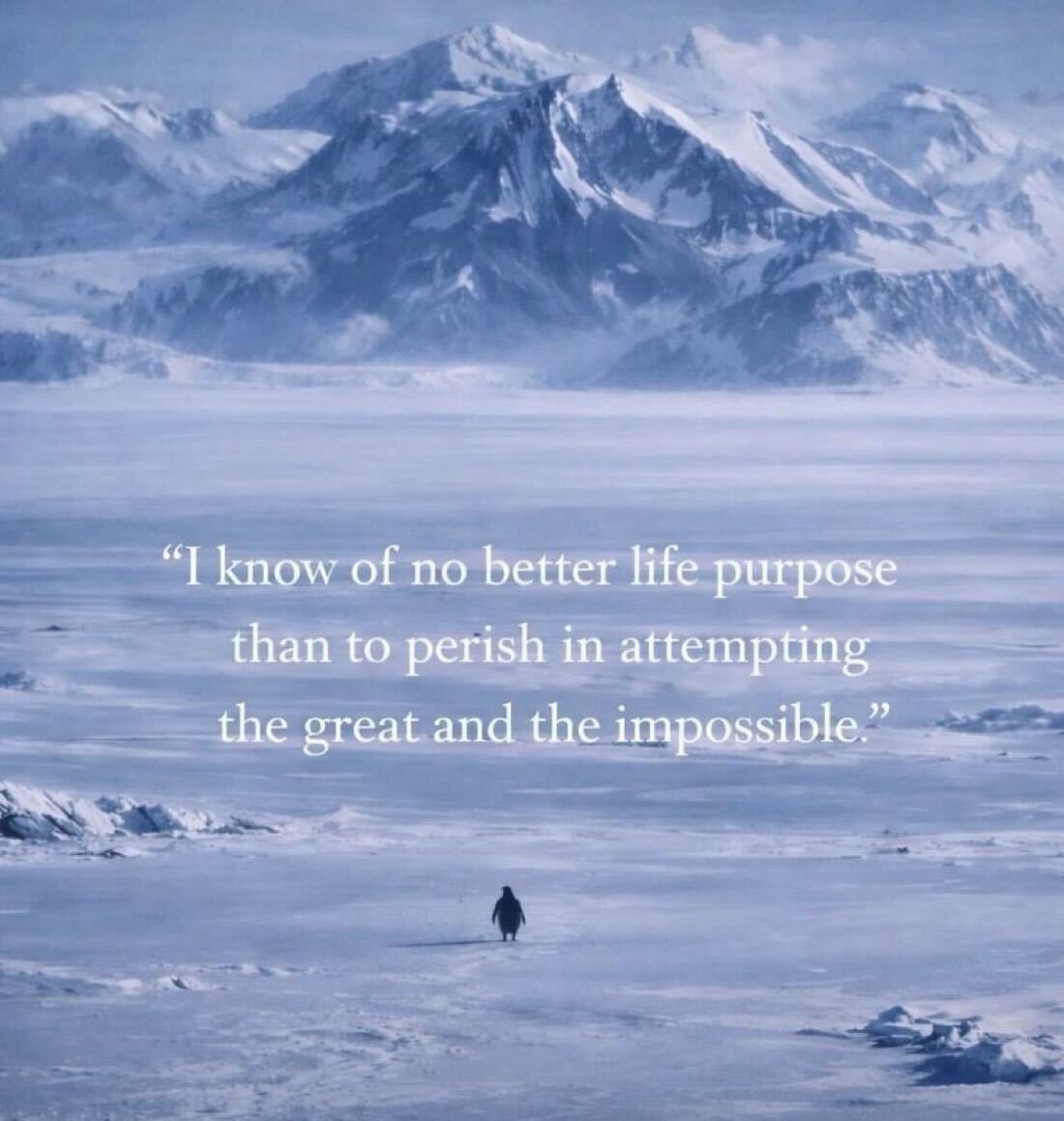

Then one faces the mountains.

A lone penguin breaks from the colony and walks into the interior. No shelter. No food trail. No approval. Just wind across open ice and a horizon that offers nothing but distance.

That is not confusion. That is separation.

That is the Bitcoiner.

Nietzsche wrote about the will to power as the drive to expand one’s capacity to act. Not control over others. Control over oneself. The refusal to live inside constraints one never examined.

Fractional reserve banking is a constraint most people never examine. Your savings become someone else’s loan. Your purchasing power depends on policy. Your access depends on permission. The system feels stable because dependency has been normalized.

Bitcoin rejects that premise at the root.

Fixed supply. Self custody. No central issuer. No balance sheet above you. Ownership without counterparty. That is not an investment feature. That is a different philosophy of existence applied to money.

This is where the Nietzsche parallel sharpens.

The herd seeks comfort, predictability, reassurance. It values smoothness over truth. It stays inside systems that weaken slowly because the weakening is gradual.

The individual who steps out accepts friction. Volatility. Social doubt. Responsibility. There is no one to blame when you hold your own keys. No institution to appeal to. No illusion of protection.

That is self overcoming in financial form.

You outgrow the need for the system to feel safe. You begin to care whether it is sound.

Debt levels are rising globally. Policy makers intervene faster and more aggressively. Currency supply expands as a solution to structural stress. These are not temporary distortions. They are features of a late stage monetary regime.

Remaining fully inside that structure is not neutral. It is a decision to accept erosion in exchange for familiarity.

Bitcoin is the walk into the cold.

It strips away comfort narratives. It exposes price swings. It forces long time horizons. It demands conviction when others doubt. This is not accidental. Difficulty filters participants. It builds resilience. It aligns ownership with understanding.

The penguin leaving the colony looks irrational to those still inside it. So did every structural shift in capital before it became obvious.

The will to power in markets is not larger leverage or faster trades. It is increasing sovereignty over your capital. Reducing reliance on discretionary systems. Holding value in a network that does not bend when pressure rises.

Bitcoin is not an escape from volatility. It is an exit from dependency.

Few will choose it early. Most will move when the environment forces them to. By then the ice will already be marked with tracks.

Every major monetary transition begins with individuals willing to stand apart before it feels safe.

That is not rebellion.

That is evolution.

Written by Bisher Khudeira

Create a brokerage account today

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved