April Hints at Bitcoin’s True Potential

April Hints at Bitcoin’s True Potential

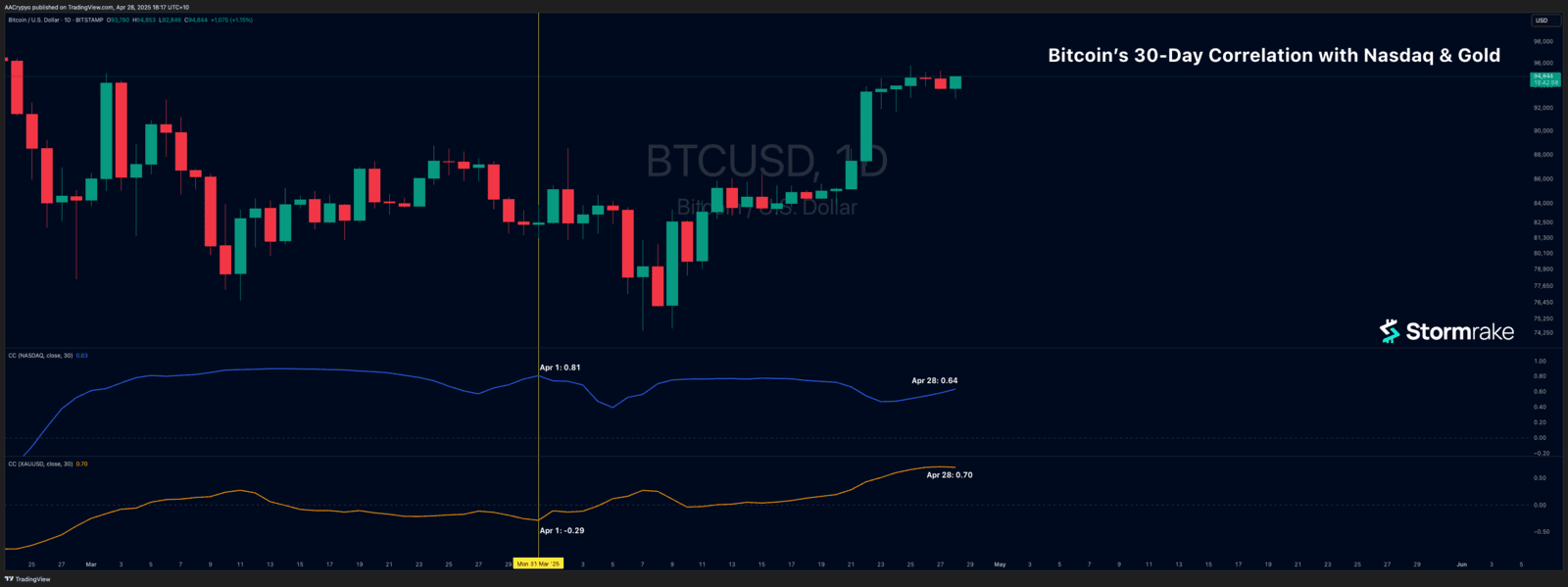

Foreshadowing Bitcoin’s Potential:

Stormrake at the Gold Coast Gold Conference:

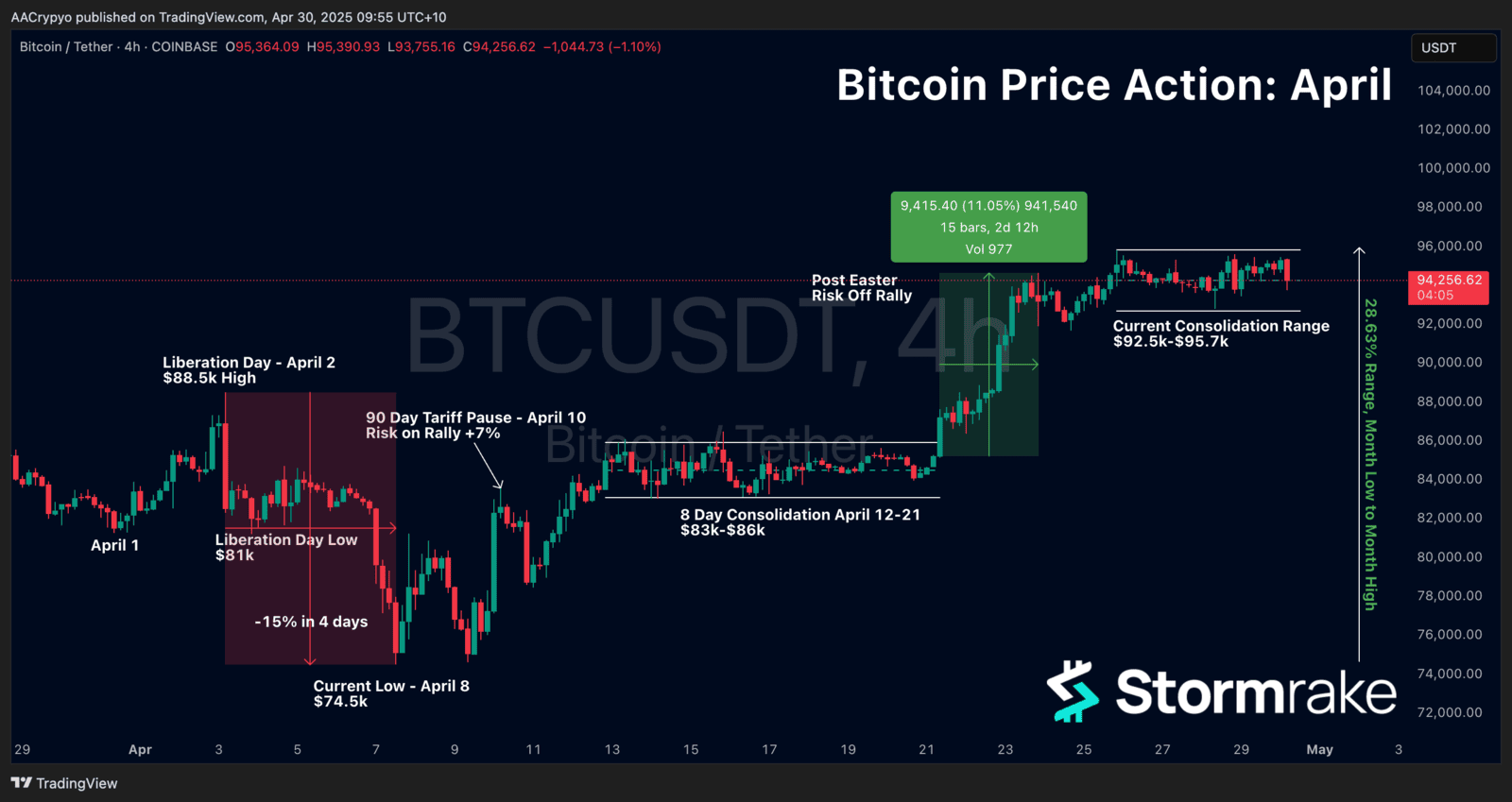

The Most Confusing Month in Recent History:

In the News:

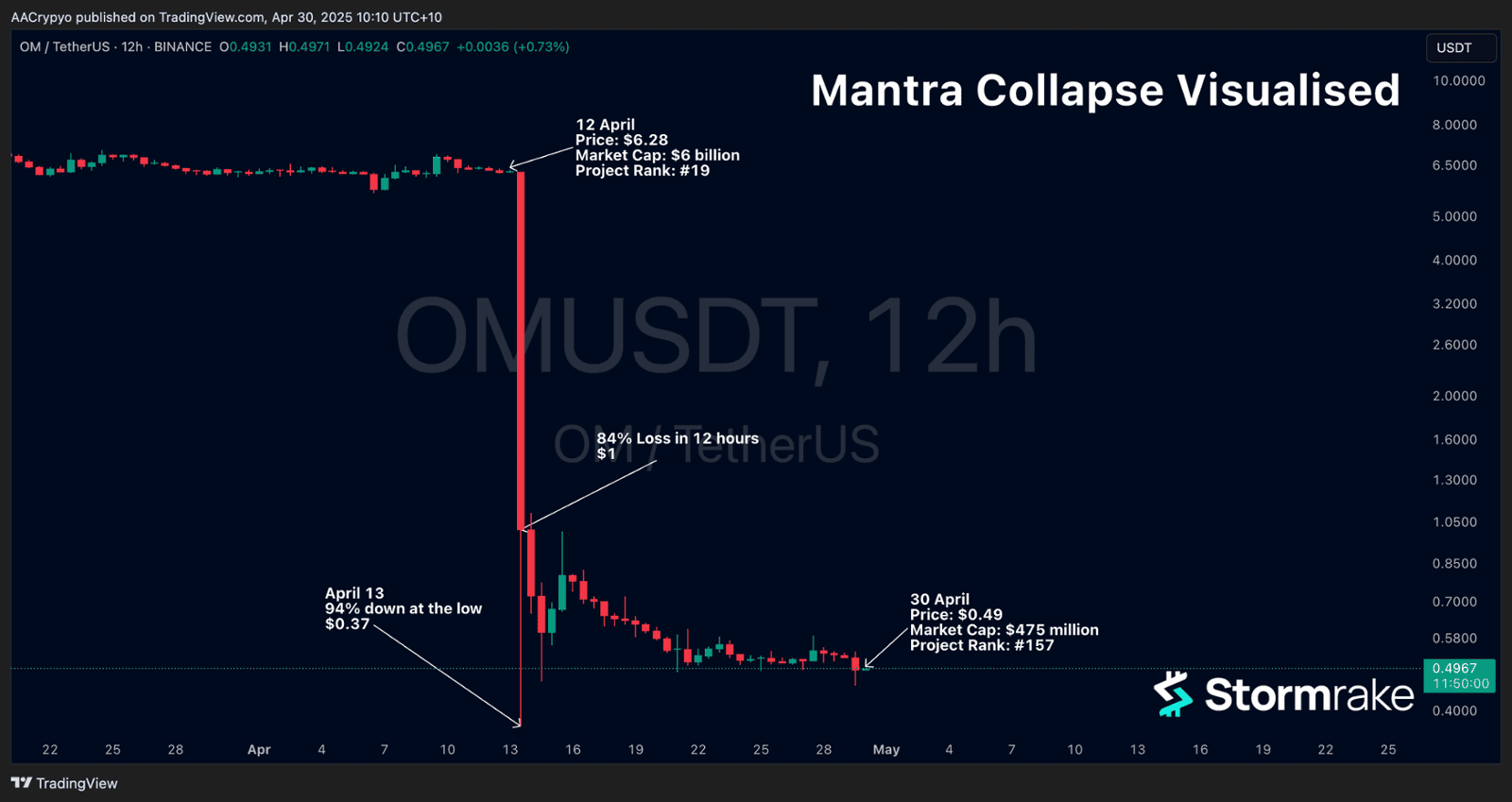

Mantra (OM) Collapse:

90-Day Tariff Pause:

Australian Super Funds Hacked:

Market Update:

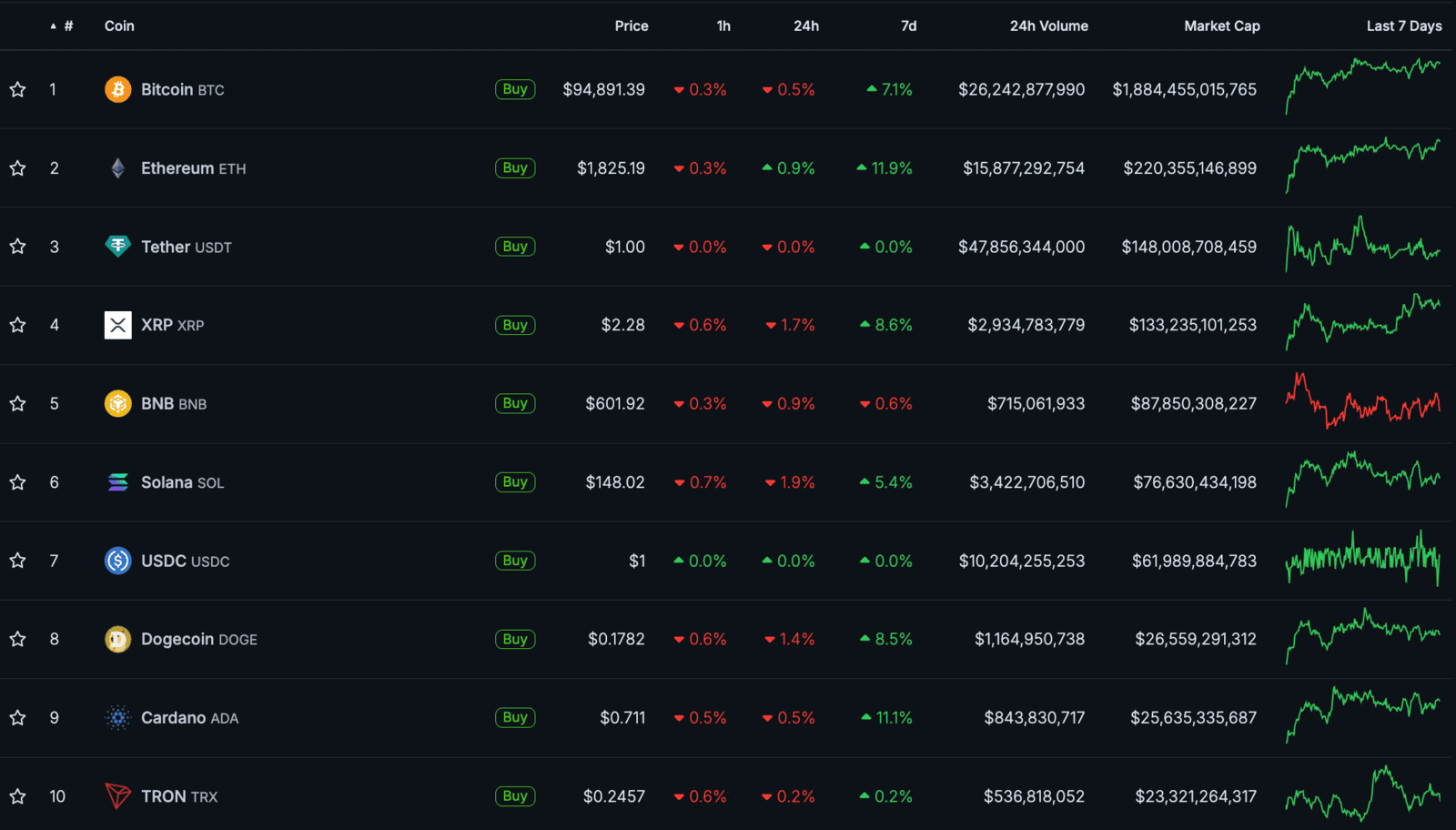

Here is the fast five of what you need to know about the market in April 2025:

- Bitcoin rose 15.1% in April

- Ethereum struggled, ending the month down 2% despite Bitcoin’s strength

- The top 10 coins and their rankings remained unchanged from March

- Memecoins led the charge — 3 of the top 5 performers in the top 100 were memecoins

- After a 50% gain in April, Sui is now just three spots away from breaking into the top 10

Video of the month:

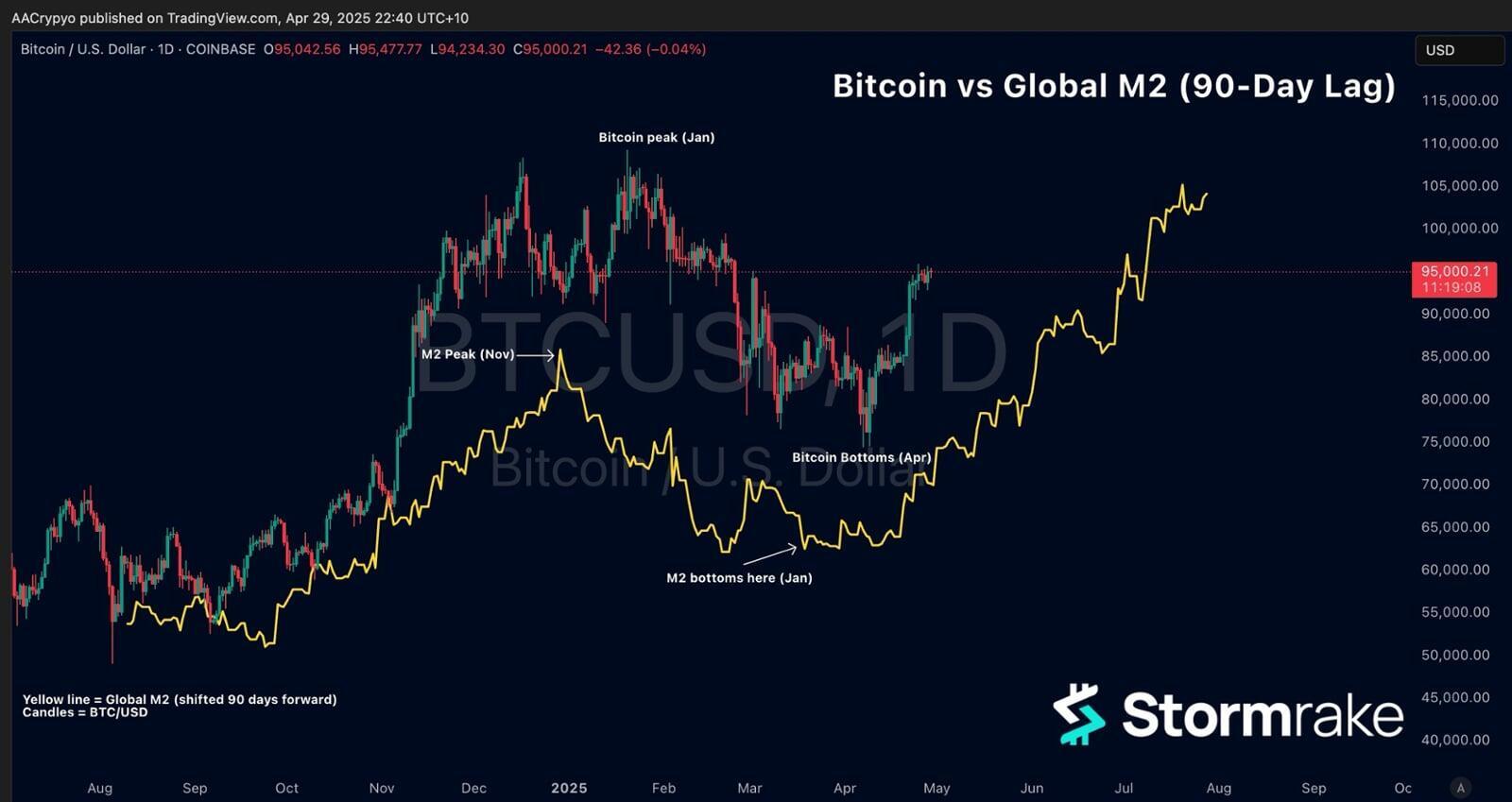

Education: Bitcoin’s Correlation to M2 Money Supply

- M2 peaked in November 2024—Bitcoin topped out in mid-January 2025, almost 80 days later.

- M2 bottomed in late January; Bitcoin followed with its local low in mid-April.

- M2 has since surged higher—suggesting the next move for Bitcoin could already be underway.

Memes of the Month

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved