In the last cycle, we saw the collapse of hedge funds, trading firms and exchanges that were once considered too big to fail, until they were not. The unraveling of 3 Arrows Capital, Alameda Research and ultimately FTX dealt brutal blows to the market during the bear phase, sending Bitcoin and the broader crypto space even lower. A common thread ran through all of them: they were overleveraged and, in many cases, trading with borrowed or misused funds. As the bear market deepened and drawdowns accelerated, they fell like dominoes.

This cycle, the spotlight has shifted. Some critics now argue that Bitcoin treasury companies, which are firms holding large amounts of Bitcoin on their balance sheets, could become the FTX or 3AC of this era. The concern is that they are similarly vulnerable to collapse and could amplify downside pressure on Bitcoin’s price during periods of stress.

The Bitcoin treasury model has been led by Strategy (formerly MicroStrategy) CEO Michael Saylor. Under his leadership, the company has accumulated one of the largest corporate Bitcoin reserves by purchasing BTC directly and raising additional capital through convertible notes and equity offerings to buy more. In some cases, they have used debt financing, which increases the risk profile of the strategy. Other companies, such as Tesla and Block, have taken a different approach by using internal funds, but none have matched Strategy’s scale or aggressiveness. Recently, a handful of other Bitcoin-focused businesses have signalled similar intentions, taking inspiration from Saylor’s model.

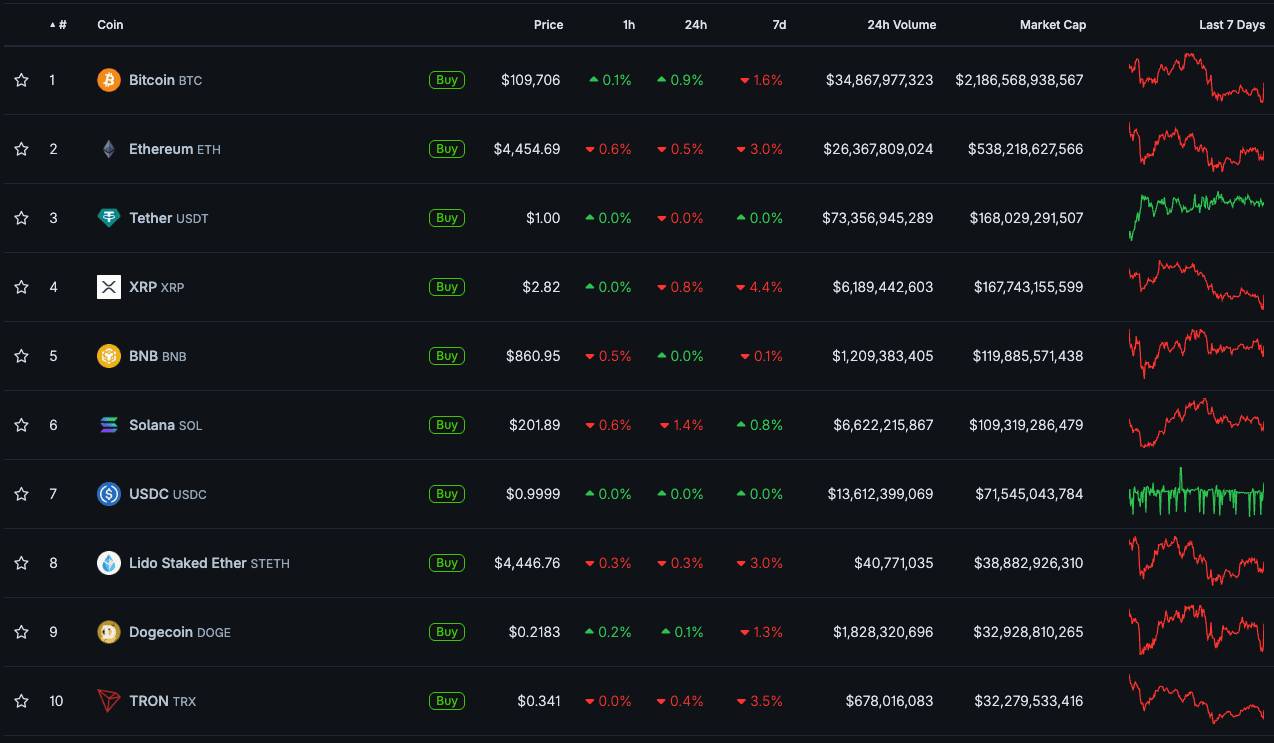

It is not just Bitcoin seeing this trend emerge. Companies are beginning to adopt a similar strategy with other digital assets, including Ethereum and Solana. BitMine is currently the largest Ethereum treasury company, while Upexi holds the largest corporate position in Solana. As more companies join the trend and a broader range of assets become part of corporate treasuries, the risks begin to increase. With fewer safeguards, less liquidity and greater volatility across altcoins, the danger and likelihood of forced liquidations, poor risk management and eventual collapse become much higher. This raises systemic concerns not just for Bitcoin, but for the wider crypto market if this trend continues to accelerate without proper controls.

The core concern is leverage. Strategy has issued billions of dollars in debt to build its Bitcoin position. If a deep bear market drives prices sharply lower, the value of its holdings could fall to a point where the company struggles to service or refinance that debt. In a worst-case scenario, this could trigger forced Bitcoin sales, accelerating downside moves and shaking market confidence. While Strategy has already weathered one full bear cycle, the risk grows as the model is adopted by others. Critics warn it only takes one major failure to temporarily destabilise the market.

That said, even if a Bitcoin treasury company collapses and is forced to liquidate, it is crucial to remember that this risk sits with the company, not with Bitcoin itself. The network and asset remain fundamentally unchanged. Prices could fall in the short term, but Bitcoin’s core qualities such as scarcity, decentralisation and security are not affected by the actions of any single firm.

The analogy to the Global Financial Crisis is useful. In 2008, banks created risky debt instruments tied to mortgages. When the debt collapsed, markets crashed, but the houses themselves were still there. Similarly, if overleveraged crypto treasury companies fail, the Bitcoin, Ethereum or Solana they hold remains the same. The long-term value proposition does not disappear just because the wrong balance sheet strategy blew up.

Whether these companies thrive or collapse, Bitcoin remains Bitcoin. And now, so does Ethereum, Solana and any other asset chosen as a corporate store of value. For long-term investors, the noise around strategy, leverage and risk exposure should not distract from the core fundamentals. Volatility is part of the market, but the technology and value behind these assets persist regardless of how any one company chooses to manage its books.