From Dormant Wallets to Record Highs and the Dawn of Altseason?

From Dormant Wallets to Record Highs and the Dawn of Altseason?

Blast from Bitcoin’s Past

Everyone wishes they bought Bitcoin earlier. Back in 2011, it was under $1. But even if you had bought it then, would you have held it until today? The likely answer is no. Most would have sold at $100, $1,000, or maybe $10,000.

The first challenge would have been simply buying it. Stormrake didn’t exist, so you couldn’t just call your broker for an allocation. Storing Bitcoin was also a headache. Hardware wallets like Ledger and Trezor didn’t exist, and the main exchange at the time, Mt. Gox, was hacked in 2013, with 7% of the total Bitcoin supply stolen.

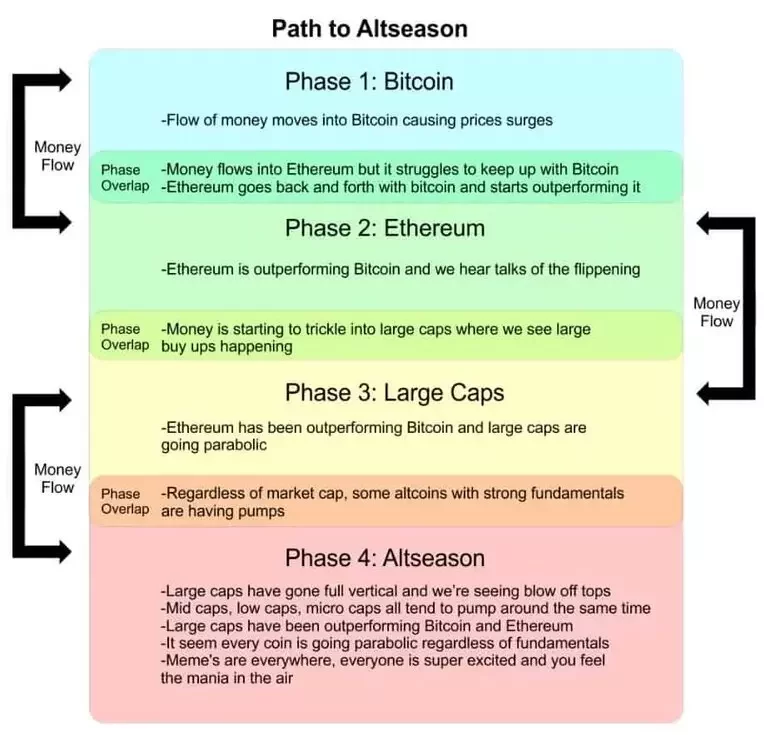

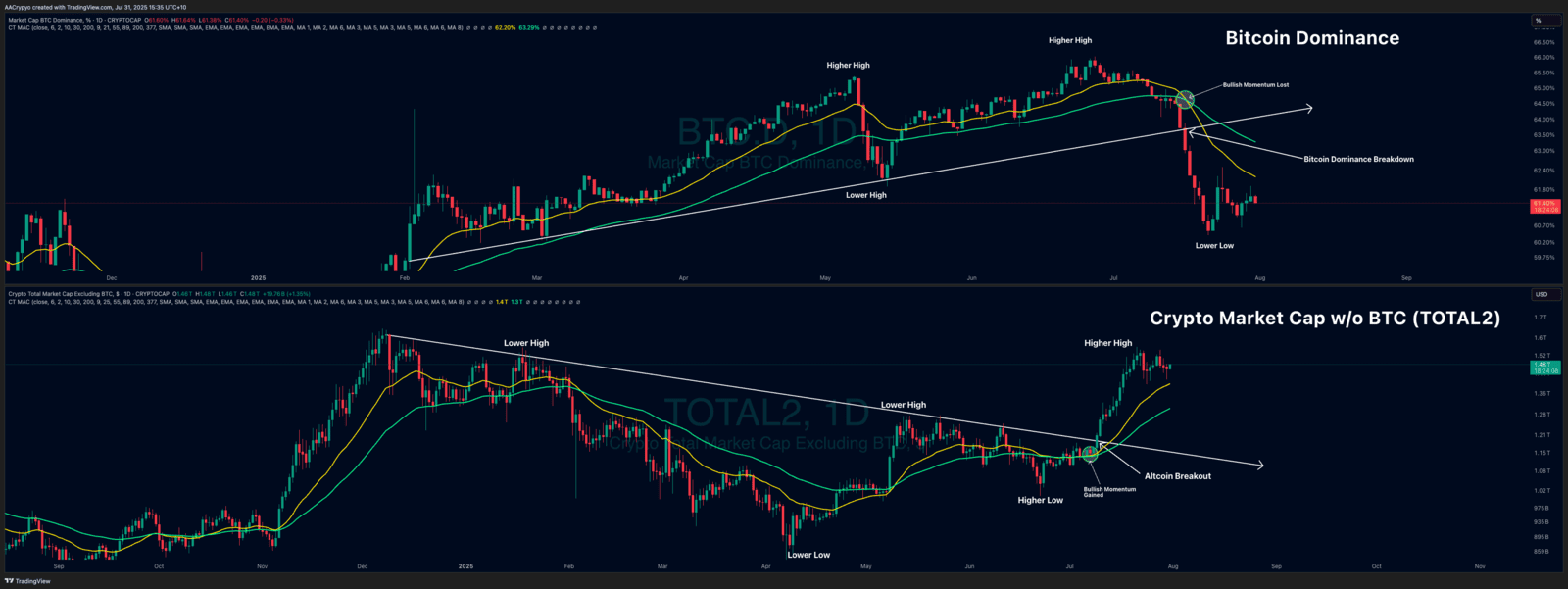

The Altseason Question

The charts above show Bitcoin dominance breaking down and the total altcoin market cap breaking out. Dominance now has a confirmed bearish structure with lower highs and lower lows, while the altcoin market cap has reversed into a bullish structure of higher highs and higher lows. Together, this is the strongest confirmation of altseason we have seen in this cycle.

It finally seems like altseason is here. The signals are clear, the false starts are behind us, and institutions are now showing a preference for Ethereum over Bitcoin. But altseason does not mean you should rotate your entire position from Bitcoin into altcoins. Experienced cycle traders know that the real strategy is to let altcoins grow your Bitcoin stack. Accumulate altcoins, take profits during the outperformance, and use those gains to buy more Bitcoin.

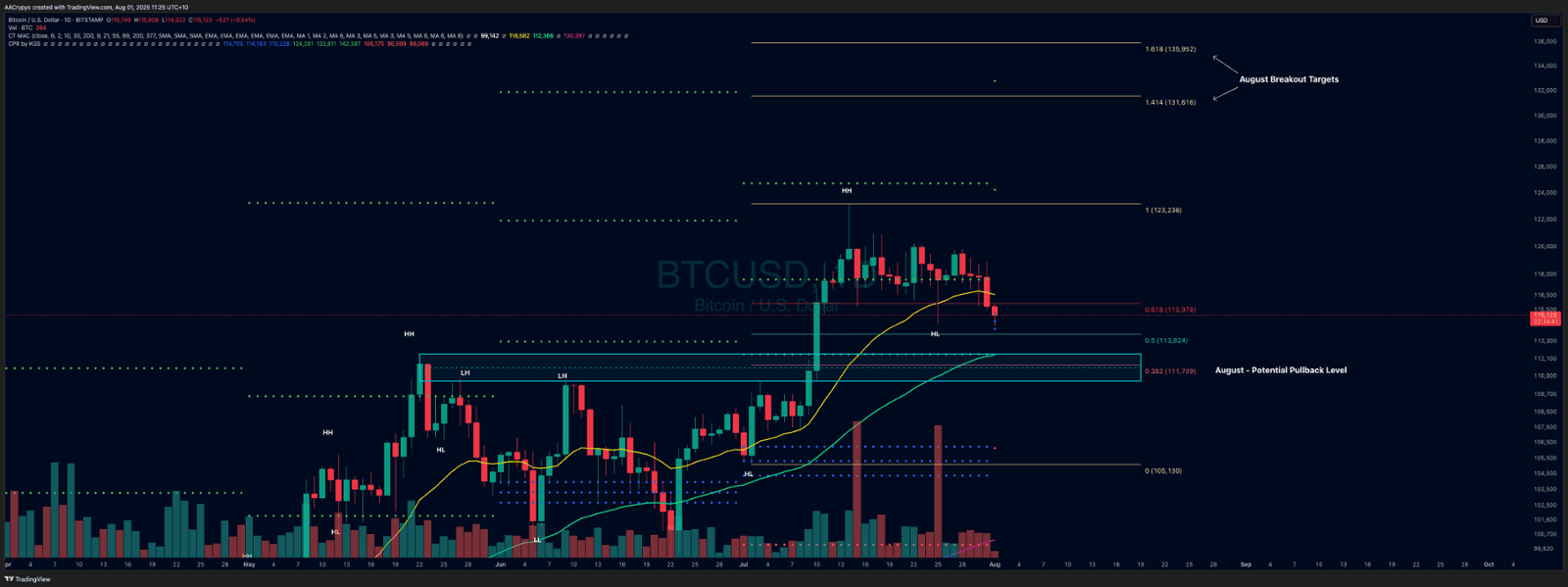

July Delivered. What’s Next for August?

In the News:

Liberation Day Tariffs Set to Resume on August 1:

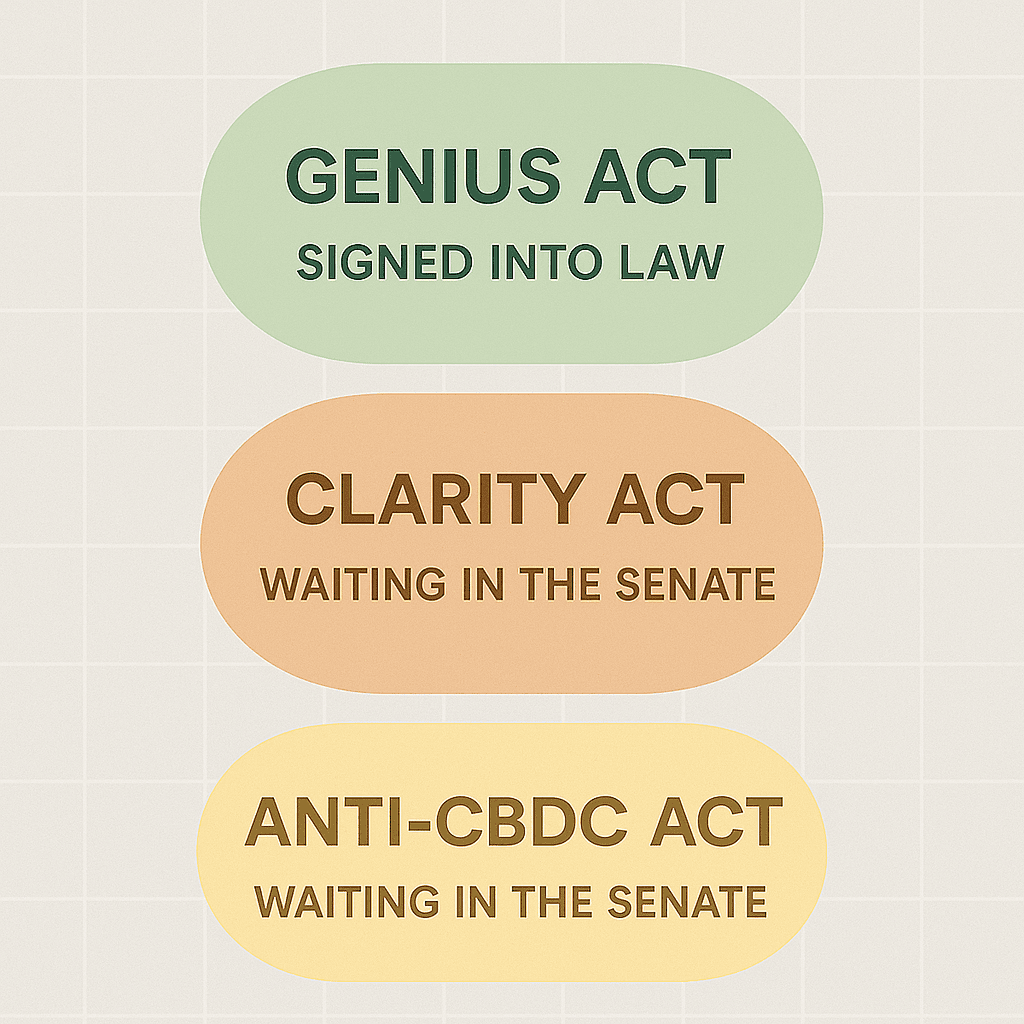

Three Major Bills Passed During Crypto Week:

Geopolitical Escalations:

Market Update:

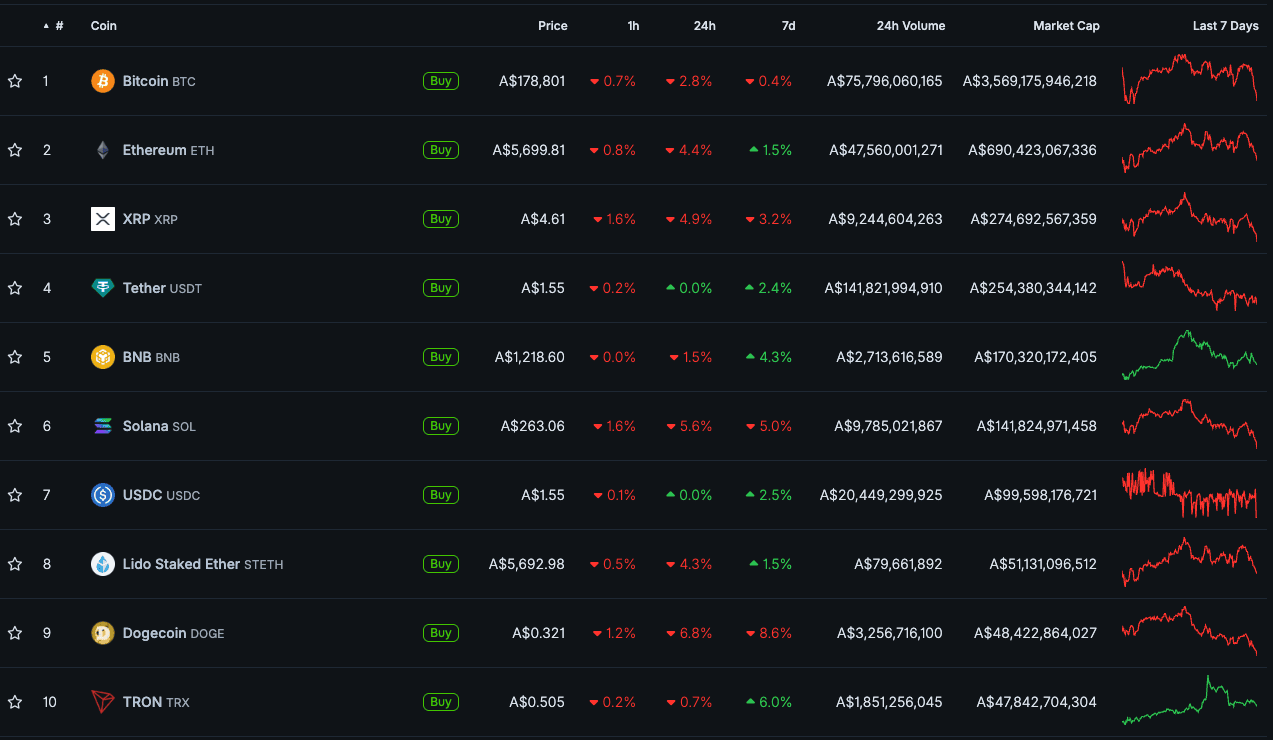

Here is the fast five of what you need to know about the market in July 2025:

- Bitcoin rose by 8% in July.

- Ethereum dominated, rising by 49% in July.

- Tron slipped to 10th, being jumped by Lido Staked Ethereum and Dogecoin.

- HBAR continues to climb the ranks, up 67% and into the top 20 projects by market cap.

- The total crypto market cap grew by 14.18% in July.

Video of the month:

Education: What to Avoid This Altseason

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved