To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

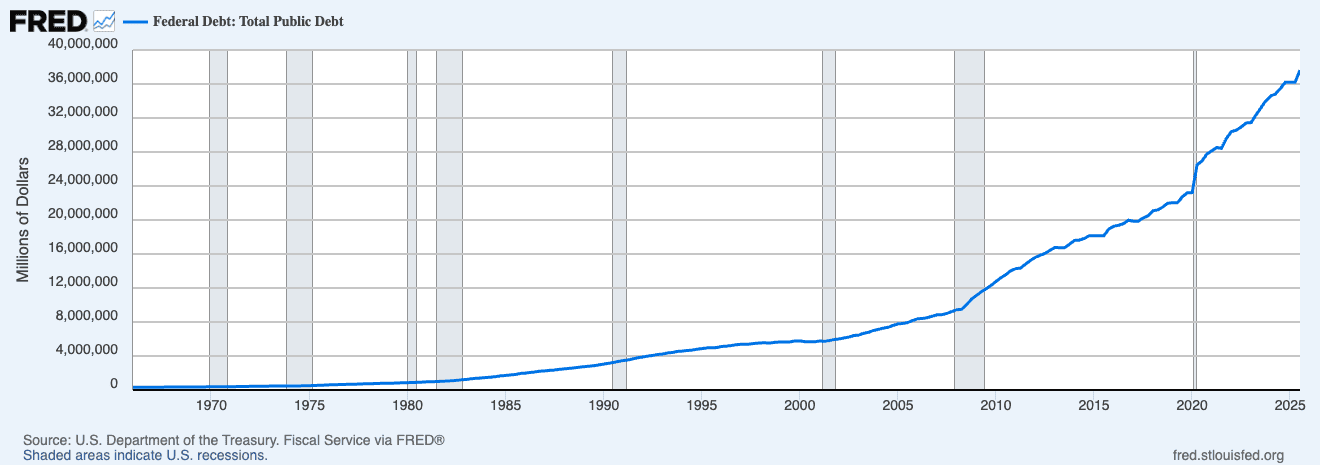

In our first Morning Note of 2026, we covered the scale of US government debt and the fact that over a third of it is due to mature this year. US national debt currently stands at approximately $38.5 trillion, a remarkable figure and one that has grown by more than 50% since the start of the decade, when total debt sat closer to $23 trillion.

For years, those who recognised the unsustainable trajectory of US government borrowing have sought refuge in hard assets such as gold, silver and Bitcoin. As debt levels have risen, money creation has accelerated, inflation has remained structurally elevated, and the purchasing power of the US dollar has continued to erode.

Over the same period, hard assets have materially outperformed fiat currencies. Since the start of the decade, gold is up approximately 250%, silver has risen around 550%, and Bitcoin has appreciated by more than 1,200%. This is not coincidence. It reflects a growing recognition of monetary debasement and fiscal fragility.

Perhaps the most important confirmation of these concerns, however, came not from market participants but from the Chair of the US Federal Reserve, Jerome Powell, himself.