To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

His/Her Excellency,

It is a great honour for me to send you this Morning Note…

This is how Trump has begun his letters to individual world leaders, informing them of the new tariffs they will face from August 1st. So far, Trump has announced tariffs on 14 countries, ranging from 25% to 40%. Some of the affected countries include Japan, South Korea, Serbia, Thailand, Malaysia, Kazakhstan, South Africa and Indonesia. It appears this is only the beginning, as the extension of the pause from July 9th to August 1st was intended to create new deals. However, these new tariffs are not negotiated agreements. They are unilateral measures Trump has imposed in an attempt to address trade deficits and what he calls ‘unfair trade practices’. He has also threatened that any retaliatory tariffs on the United States will be matched, with the announced tariffs added on top.

The first trading day for traditional markets since the Independence Day long weekend saw risk-on sentiment fade, with the S&P 500 and Nasdaq both losing 0.79%, marking the S&P’s worst day in nearly three weeks. Japanese automakers bore the brunt of the selloff, with Toyota and Honda down 4.1% and 3.8% respectively.

This spilled over into the crypto space, with Bitcoin falling nearly 1% as it battles to hold above $108K. Altcoins also lost ground, but the total altcoin market cap dropped slightly less than Bitcoin on the day, slipping 0.80% compared to Bitcoin’s 0.88% pullback in price. Sentiment remains firmly in the greed territory, sitting between a reading of 65 and 73.

Although risk-on markets still have bullish momentum overall, they are likely to stay reactive to further tariff announcements right up to the 1st of August and could remain volatile even afterwards.

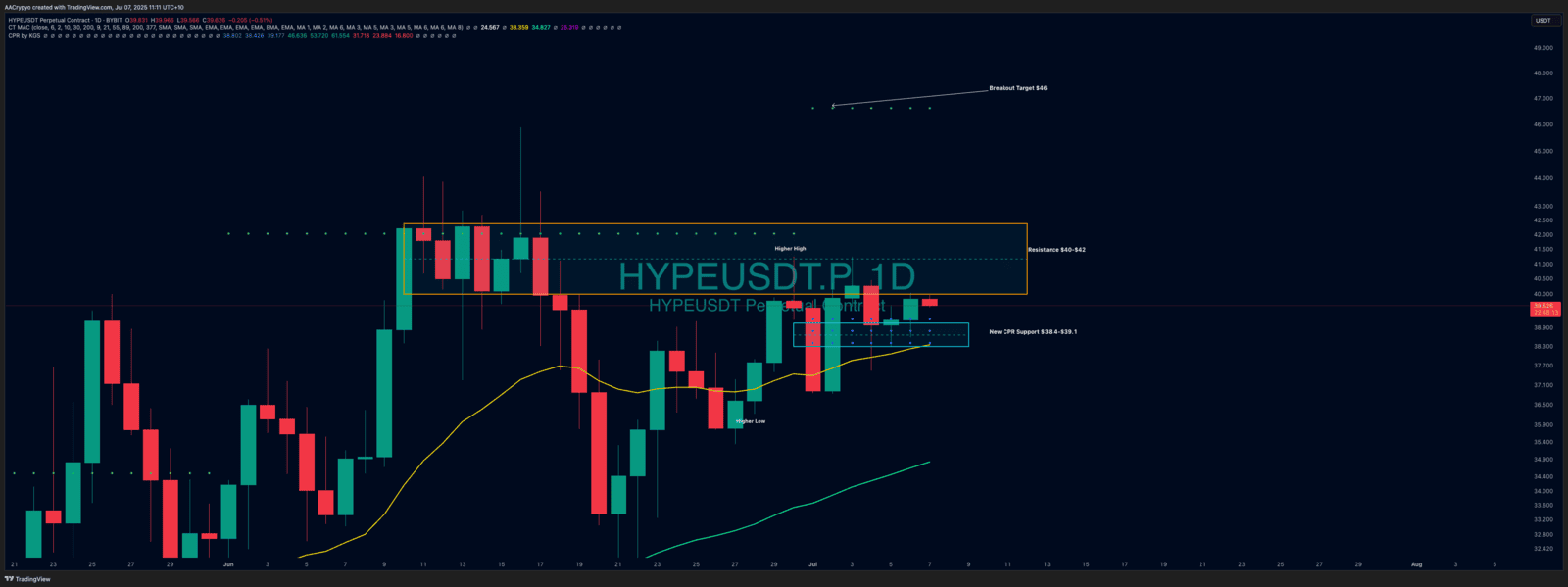

Stormrake Spotlight: Hyperliquid (HYPE) ($38.85)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.85)