To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Tomorrow is the day many investors have been waiting for. The first rate cut of 2025 looks all but confirmed. At 4am AEST, the US Federal Reserve is expected to announce its latest interest rate decision, with markets currently pricing in a 96% probability of a 25bps cut. The remaining 4% leans towards a more aggressive 50bps move. There is little doubt that a cut is coming. The focus now shifts to how many cuts we will see this year, and what their magnitude will be.

With just three Fed meetings left in 2025, tomorrow's outcome is critical. In the past week alone, market expectations have shifted from anticipating two rate cuts this year to now forecasting three, totalling 75bps before year-end.

Bitcoin’s momentum continues to build, now trading above $116.5K. Gold has printed yet another all-time high above $3,700. Silver sits at a 14-year high. Both the S&P500 and Nasdaq posted fresh all-time highs yesterday.

Risk-on sentiment is dominating across all major markets. With Bitcoin still slightly below its all-time high, it seems only a matter of time before capital rotates back into crypto. The first domino that could trigger this shift is a Fed rate cut. Lower rates typically stimulate the economy and increase liquidity, creating the ideal conditions for crypto inflows.

This is shaping up to be a very bullish period for Bitcoin and digital assets. You do not want to be on the sidelines once the cuts begin and capital starts moving.

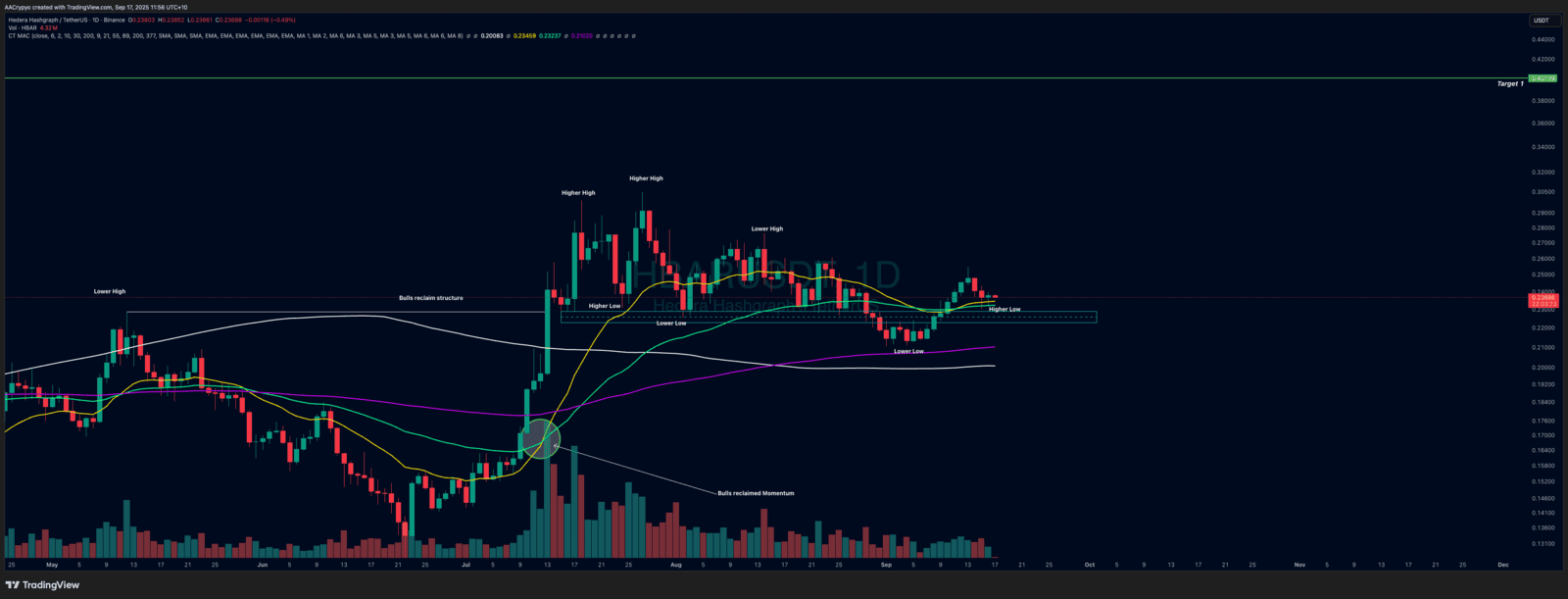

Stormrake Spotlight: Hedera (HBAR) ($0.236)

Stormrake Spotlight: Hedera (HBAR) ($0.236)