To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As Lyn Alden aptly put it, “Nothing stops this train”—and in the context of US debt, it couldn’t be more accurate. The fiscal circus playing out in Washington has been on full display this past week, with political figures from all sides weighing in as the numbers become impossible to ignore.

The US national debt has surged to a staggering $36.21 trillion, setting yet another all-time high. This runaway train shows no signs of slowing. Even the Department of Government Efficiency can’t rein in spending meaningfully. Elon Musk, speaking under his DOGE persona, highlighted that interest payments alone now consume 25% of all US government revenue, describing the situation as "debt slavery" for Americans.

Vivek Ramaswamy added fuel to the fire, noting that the US now spends more on debt interest than the entire military budget, with projections suggesting the debt could balloon to $60 trillion within the next decade.

Despite this fiscal brinkmanship, Treasury Secretary Bessent assured markets that the US is "never going to default." Yet, in a rare moment of agreement, Trump and Senator Warren have floated the idea of removing the debt ceiling altogether, a move that would give the government unlimited borrowing power. If mishandled, this could dangerously inflate the debt-to-GDP ratio even further.

But a potential lifeline is emerging from an unexpected source. Senator Cynthia Lummis has proposed that a Bitcoin Strategic Reserve could eliminate half of America’s debt burden.

Bitcoin: The Hedge Against Fiat Failure

As fiat continues to fracture under the weight of systemic mismanagement, more investors are rotating into hard assets. And Bitcoin isn’t just a hedge, it was purpose-built for this exact scenario. When fiat fails, Bitcoin shines. And the system is more than just failing, it’s spiralling.

The key question: Are you staying on the train, or stepping off before it derails?

With fiat devaluation accelerating alongside debt expansion, it’s simple, get allocated into Bitcoin and safeguard your purchasing power. Contact your Stormrake Broker to position yourself ahead of the curve and learn more about the real implications of the debt crisis.

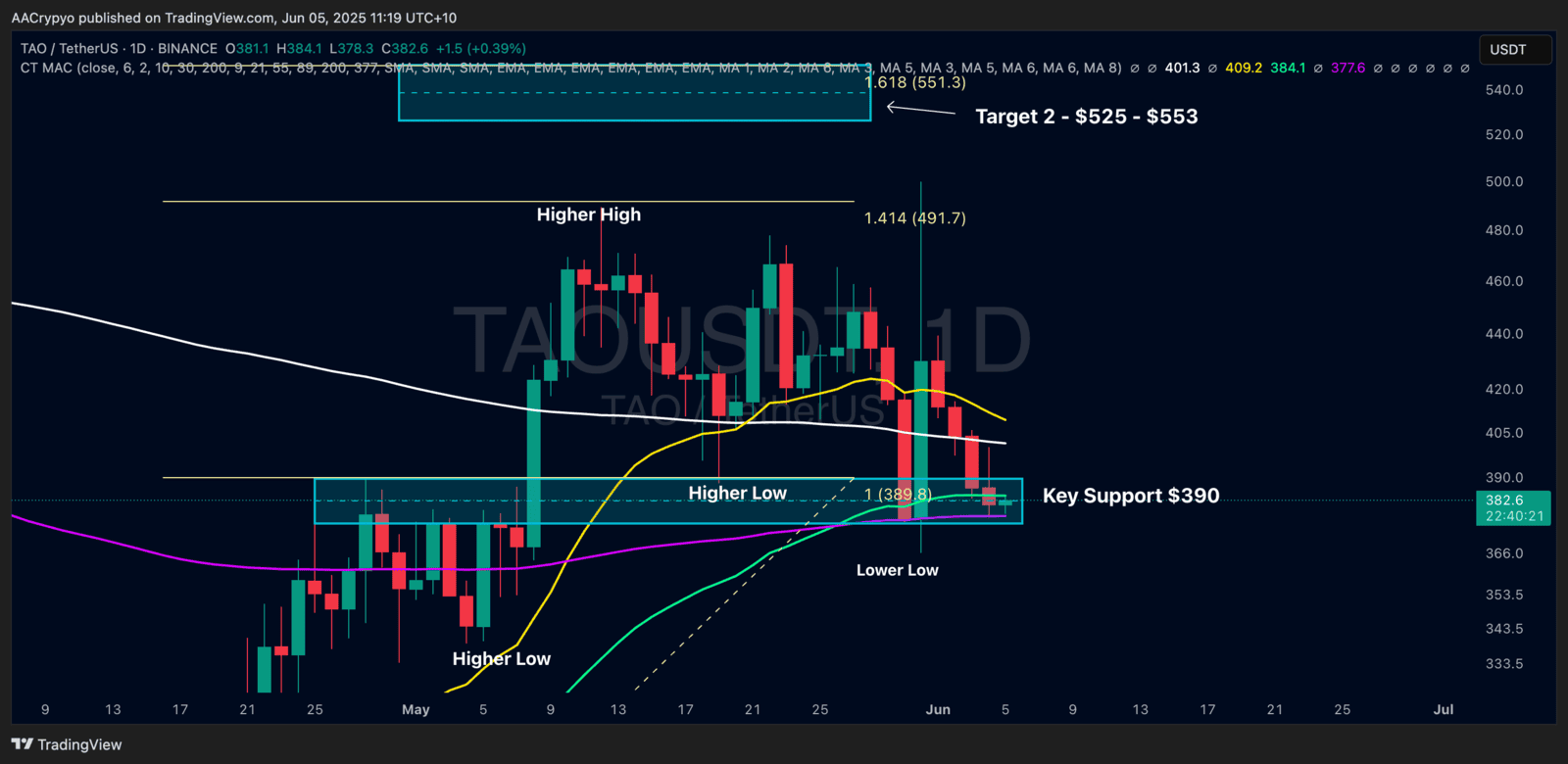

Stormrake Spotlight: Bittensor (TAO) ($382)

Stormrake Spotlight: Bittensor (TAO) ($382)

TAO is teetering within its key support zone, and any break below could hand control to the bears. Still, the 55 and 200 EMAs are acting as critical support levels, which could offer near-term relief.

But let’s be clear—TAO will mirror Bitcoin's trajectory. If Bitcoin pulls back, TAO is almost certain to follow.

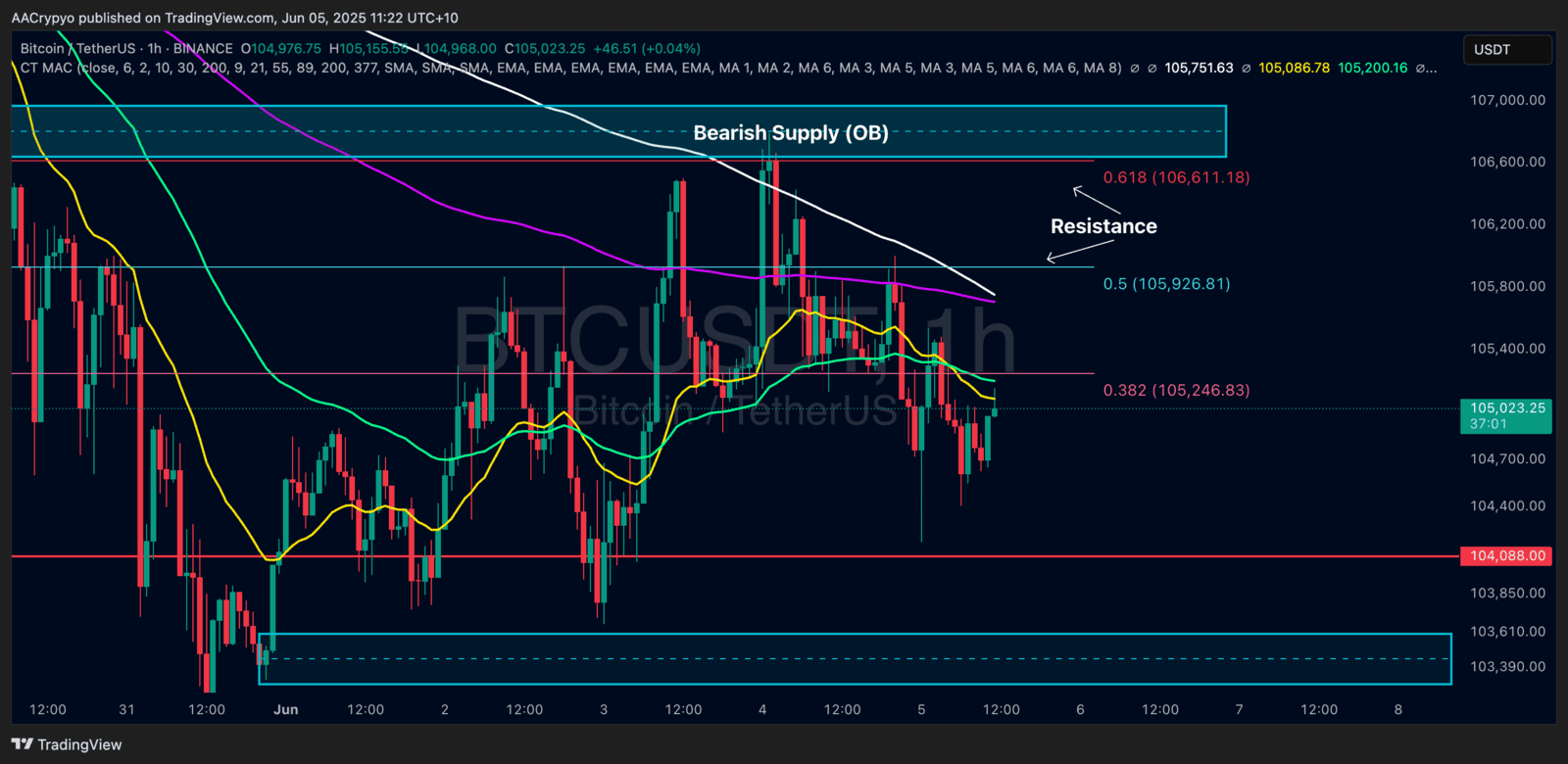

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: