To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Risk-on markets took a major step back overnight as the US Dollar continued to show strength. Bulls once again failed to gain ground, with price action falling to $86K for the first time since late April as another key support level gave way.

Despite extremely strong economic data yesterday and green US equity futures, the session closed red. The S&P 500 saw its weakest close since 10 September, while the Nasdaq finished at its lowest level since 11 September. Both indices are now trading lower than they were during the mass liquidation and tariff mixup on 10 October.

NVIDIA failed to build on its strong earnings momentum. After a very green day yesterday, it dropped more than 3% yesterday, fully engulfing those gains and closing at its lowest level in a month.

Earlier this week, we discussed the potential impact of the Yen carry trade unwinding, particularly as rising borrowing costs force institutions to sell risk assets in order to repay borrowed Yen. That pressure has continued, with the Dollar strengthening further against the Yen. The question now is whether the Bank of Japan will step in to intervene. A likely move would involve selling US bonds to buy back Yen, which would cause the Dollar to weaken against the Yen. We saw the yen strengthen against the dollar last year during the previous unwind, so it’s definitely something to watch closely over the coming weeks.

We also got the first unemployment figures since the US government shutdown. The rate has ticked up, adding more uncertainty to whether the Fed will cut rates at its next meeting. As of now, markets are pricing in a 60% chance of no change and a 40% chance of a 25bps cut. With the decision due in early December, we should get clearer signals soon on how the Fed plans to proceed and what that means for markets.

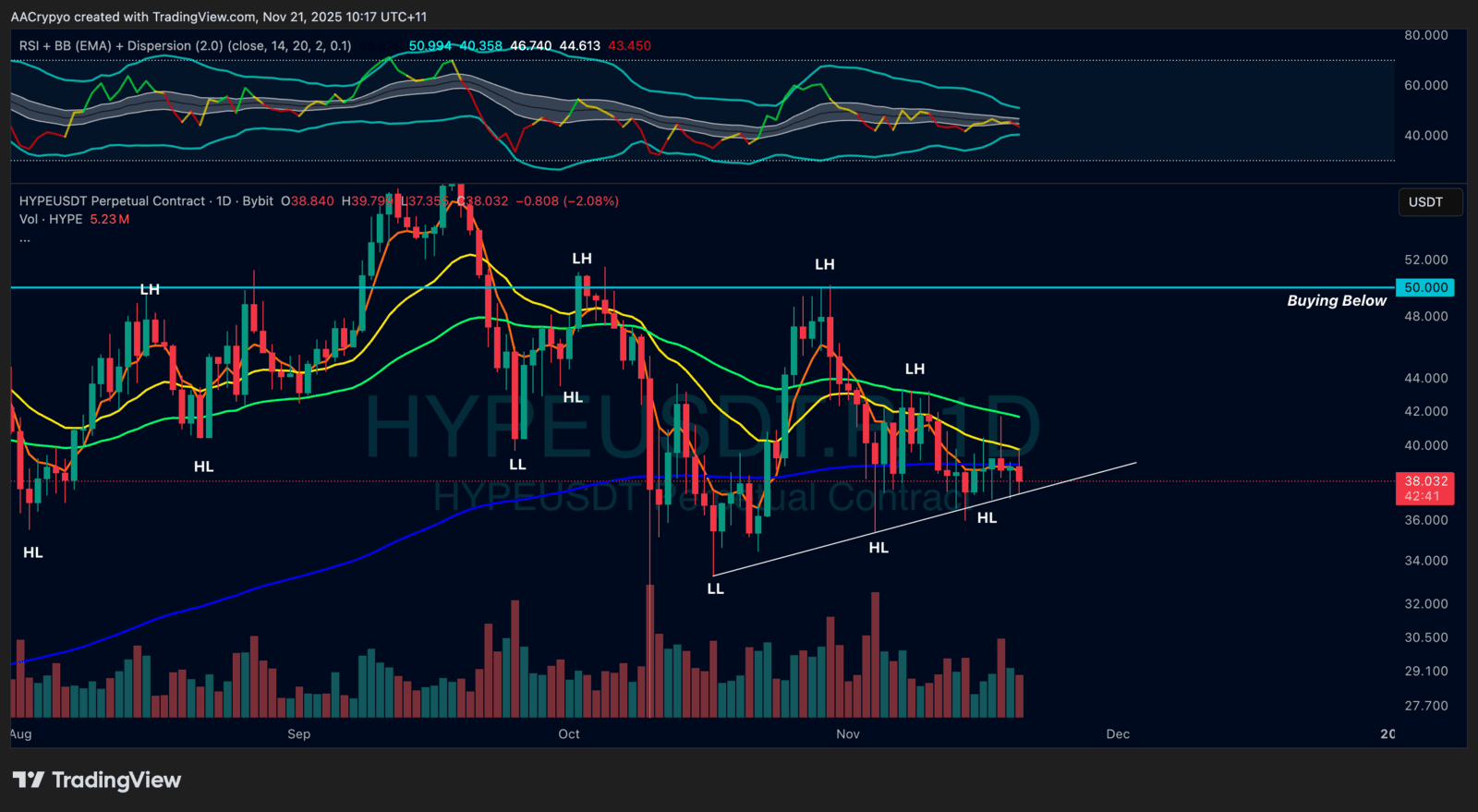

Stormrake Spotlight: Hyperliquid (HYPE) ($38.00)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.00)