To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The US Government is set to shut down for the first time since 2018 after Congress failed to pass funding legislation by the 30 September deadline. Partisan deadlock over spending levels, healthcare provisions, and border security policies has brought negotiations to a standstill. A prolonged shutdown could impact a significant number of jobs and is estimated to cost over minus 0.5% of quarterly GDP.

But what does this mean for markets?

Typically, government shutdowns create short-term volatility and increase macro uncertainty, which can push investors toward safe haven assets like gold. Historically, markets tend to shake it off. 86% of shutdowns since 1976 have seen the S&P 500 trade higher 12 months later, with an average return of 12.7%.

Interestingly, net shorts on the VIX (Volatility Index) are at their highest levels since 2022. That suggests investors are not positioning for turbulence and are instead expecting the bullish run to continue.

But we are in 2025 and nothing is making sense

Markets appear unfazed by the looming shutdown. Gold has hit another all time high, now edging closer to $3,900. Risk on indices are rallying again and are within touching distance of fresh all time highs.

Bitcoin has also recovered over the past 24 hours. After dipping 1.44% intraday, the US session brought renewed strength, pushing BTC back above $114K.

We are now in October, the most consistently green month for Bitcoin since 2011, with ten out of fourteen Octobers closing positive. It is also the fourth best month on average, with returns of 15.2%. Yet both Bitcoin and altcoins remain in a pullback phase, offering some solid opportunities before the rally really starts.

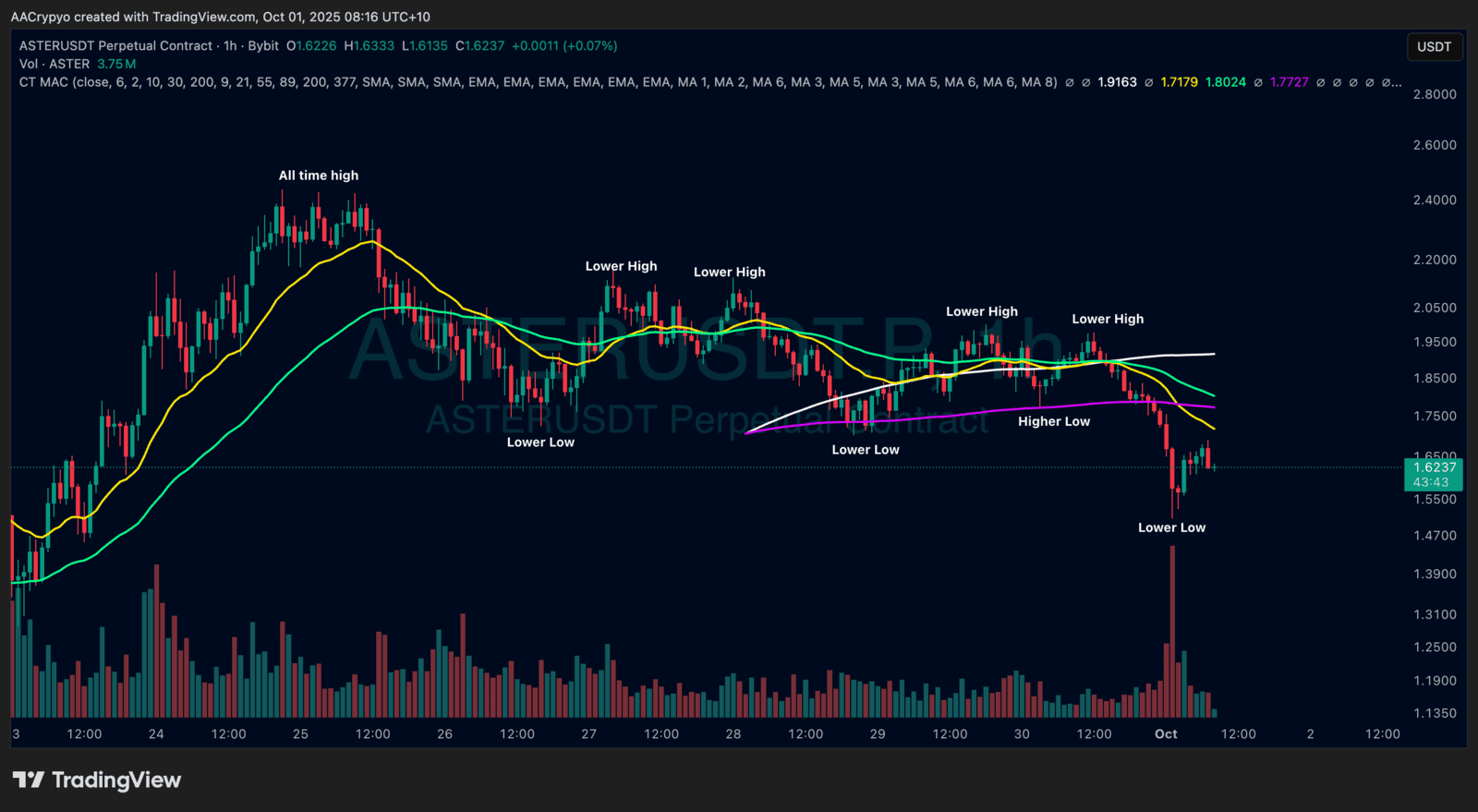

Stormrake Spotlight: Aster (ASTER) ($1.62)

Stormrake Spotlight: Aster (ASTER) ($1.62)