To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin had a green weekend, which was much needed after five straight red days from Monday through Friday. After dropping to a low of $103.5K on Friday, we saw a modest bounce on Saturday, followed by more constructive price action overnight. This shift came off the back of two key developments: improving geopolitical sentiment between the US and China and fresh regulatory momentum in Japan.

Overnight, Donald Trump announced he will meet with President Xi in South Korea on October 31. Markets welcomed the news, as any easing of geopolitical tensions tends to boost risk-on appetite, crypto included. With the FOMC interest rate decision set for October 29 and now this meeting on the 31st, the final stretch of the month is shaping up to be a critical one. That said, in crypto, a week is a lifetime and much can change before then.

On the regulatory front, Japan’s Financial Services Agency (FSA) is reportedly preparing to review policies that would allow banks to acquire and hold cryptocurrencies for investment purposes. This would mark a significant shift in stance, as existing guidelines introduced in 2020 effectively barred banks from holding crypto due to volatility risks.

Now the big question is whether Bitcoin can build on this positive momentum or if this is just another short-lived rally before the bears reassert control. At this stage, the latter still feels more likely. While the bounce is encouraging for bulls, it needs to be sustained before we can start talking about higher price targets.

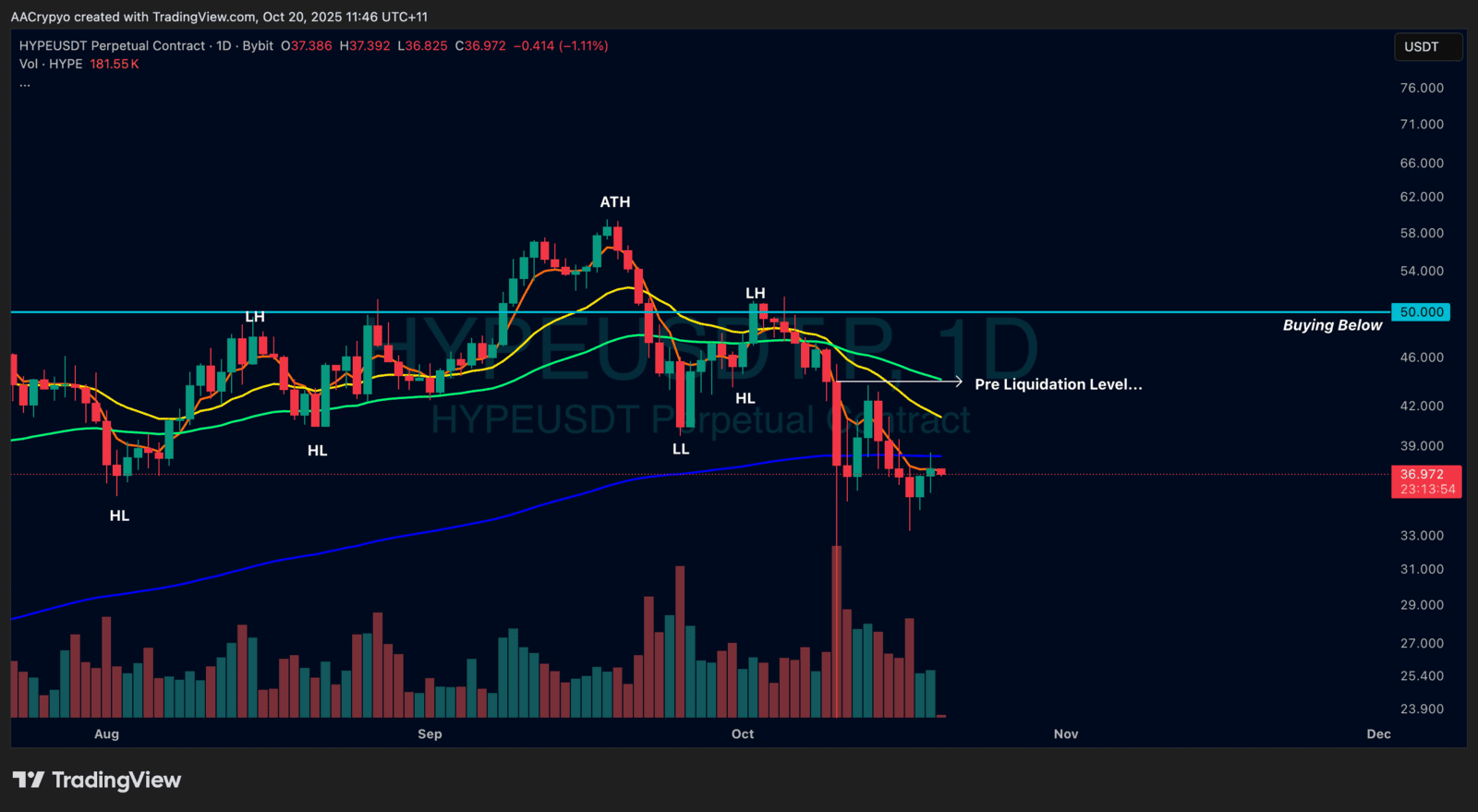

Stormrake Spotlight: Hyperliquid (HYPE) ($36.97)

Stormrake Spotlight: Hyperliquid (HYPE) ($36.97)