To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

If you’re a Bitcoin investor, the chances are pretty high that you know who Michael Saylor is. The general consensus is that he is Bitcoin’s biggest bull. Some may also be familiar with his company, Strategy (formerly MicroStrategy), which has been one of the largest corporate accumulators of Bitcoin, adding it directly to its balance sheet. While Strategy was one of the first companies to adopt this approach, many investors still don’t fully understand how it actually goes about acquiring Bitcoin.

Here’s a quick breakdown of how Strategy accumulates its Bitcoin. The company has built much of its position by issuing convertible bonds and notes. These instruments allow Strategy to borrow capital at relatively low interest rates by giving investors the option to convert their debt into equity at a later date. Rather than using this capital for traditional operating purposes, Strategy deploys the proceeds almost entirely into Bitcoin, effectively transforming cheap corporate debt into long-duration Bitcoin exposure on its balance sheet. If Bitcoin appreciates and Strategy’s share price rises, bondholders may choose to convert into equity, reducing the company’s debt burden. If they don’t, the debt remains outstanding but was typically issued at interest rates well below what unsecured borrowing would otherwise cost. This structure has allowed Strategy to accumulate a substantial Bitcoin position without issuing common equity upfront, while shifting risk and upside asymmetrically between equity holders and debt investors.

With that framework in mind, it’s not surprising that Strategy and Michael Saylor have attracted their fair share of critics. Some have gone as far as likening Strategy to the “FTX of this cycle”, a comparison that, while extreme, reflects broader concerns around leverage, concentration, and reflexivity rather than any suggestion of fraud.

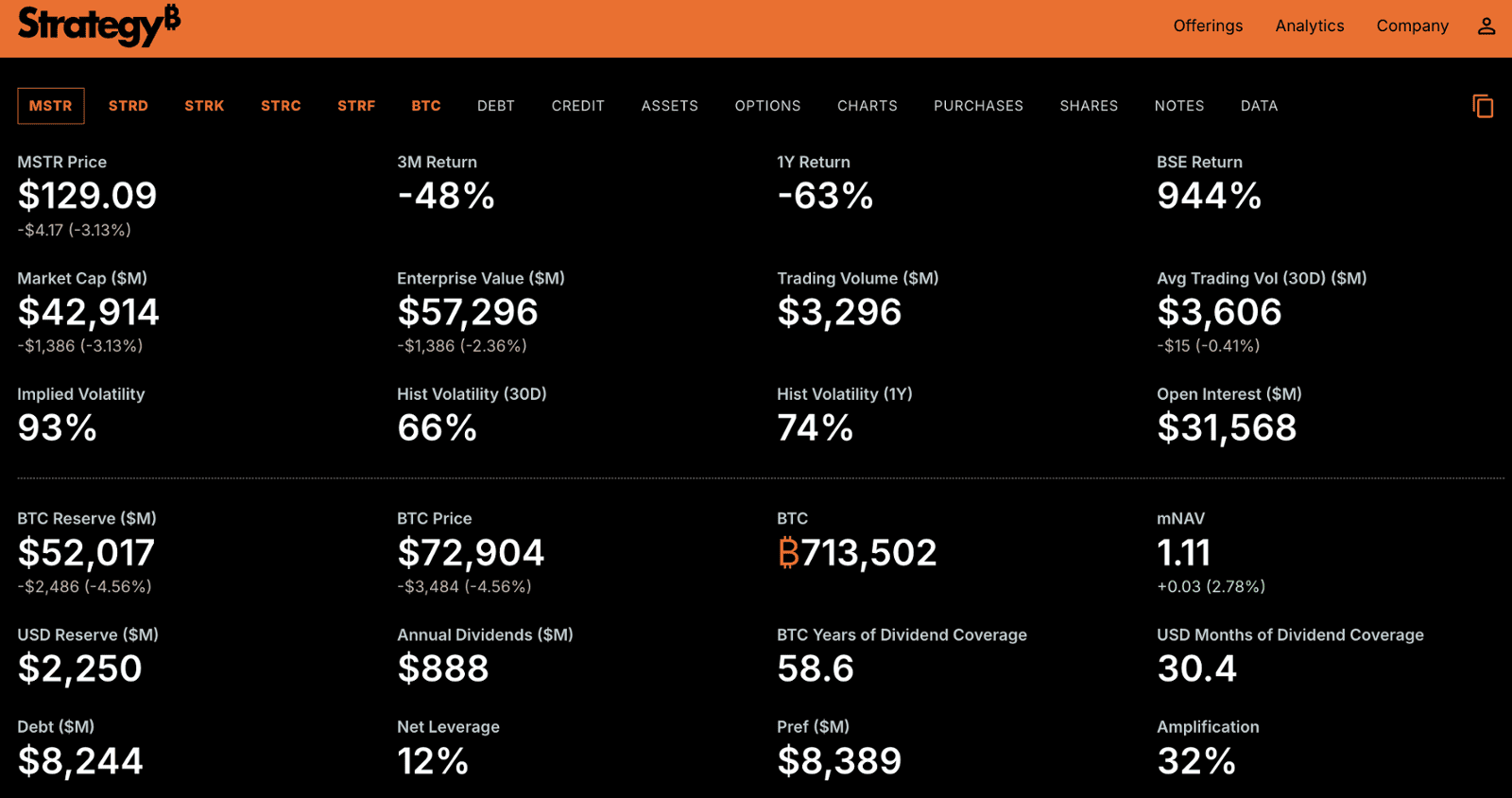

So why bring this up now? Bitcoin has recently sustained a move below Strategy’s reported average acquisition price of approximately $76,000 across its 713,502 Bitcoin, meaning the company is currently underwater on its Bitcoin holdings on a mark-to-market basis. This brings us back to comments made by CEO Phong Le a couple of months ago, where he noted that selling Bitcoin would only ever be considered as a last resort (mNAV falling below 1).

We covered this in our November Rake Review, where Le explained that any such decision would be heavily influenced by Strategy’s stock valuation relative to its Bitcoin Net Asset Value. Specifically, he pointed to the mNAV metric, the multiple at which Strategy’s market capitalisation trades relative to its net Bitcoin-backed assets. At the time, mNAV was sitting around 1.19x. It has since fallen to approximately 1.11x, bringing it closer to the critical level of 1x.