To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin was created to move away from banks, using decentralised technology that removes the need for a centralised third party in peer-to-peer transactions. But thanks to the success of Bitcoin’s price action over the years, many have quickly forgotten what its original use case actually is. Over time, countless individuals have become sovereign and completely exited the traditional banking system, achieving all of this through Bitcoin.

As Bitcoin has grown in popularity, it’s not just the asset itself that has gained traction. The real innovation has come from the development of Layer 2 infrastructure, particularly the Lightning Network, which is built on top of Bitcoin to improve speed and scalability.

Why does this matter? It gives anyone looking to step away from the banking system a clear path to do so, regardless of wealth.

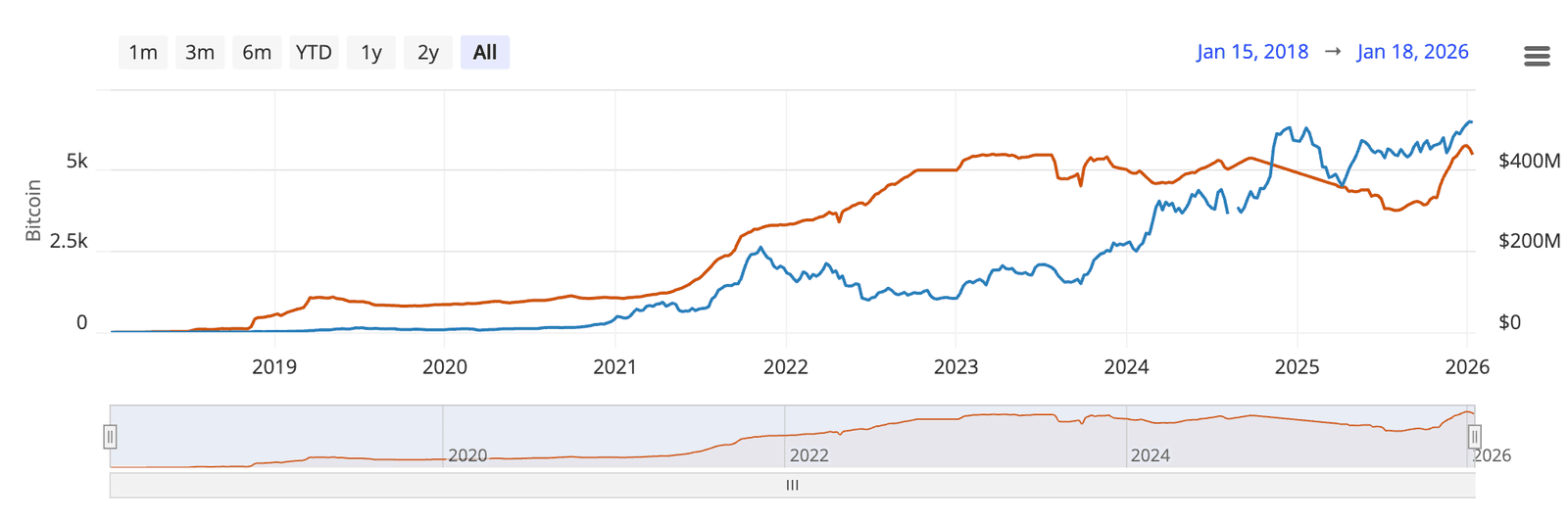

Lightning’s growth is clearly reflected in network capacity, which just hit an all-time high of over 5,480 BTC, valued at more than $480 million. While capacity isn’t a direct measure of usage, it shows how much liquidity is available to facilitate instant, low-fee transactions. The chart below makes this trend clear, capacity in both BTC and USD terms has rebounded sharply since mid-2025 and is now trending toward record highs. It’s a strong signal that more capital is flowing into Lightning channels and that the ecosystem is expanding.