To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

When it comes to investing, nearly everyone knows the phrase: ‘Be fearful when others are greedy, and greedy when others are fearful’. Yet very few actually act on it. This is even more obvious in Bitcoin, where volatility runs high and shakes out most participants.

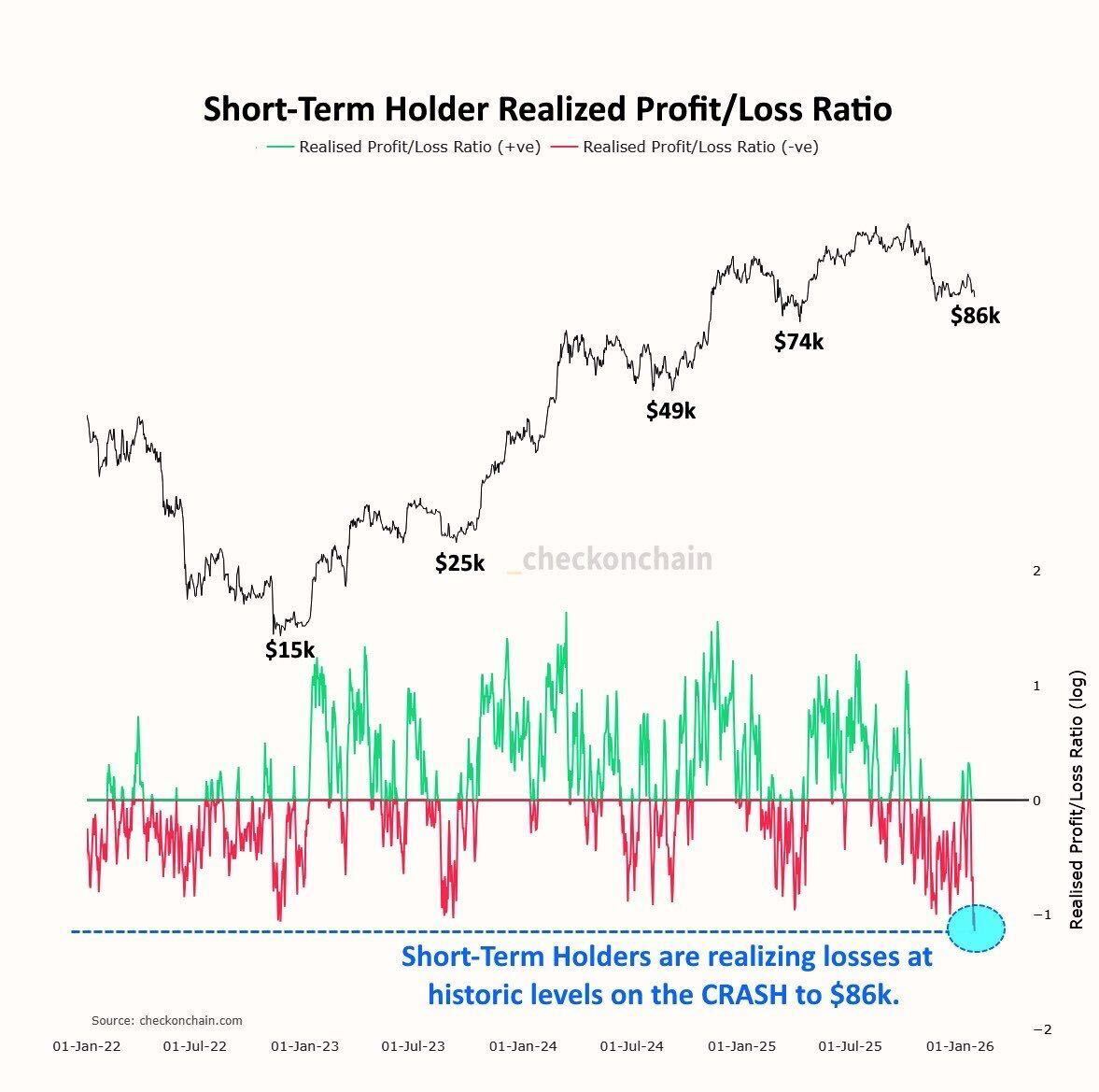

In this deep dive, we’re focusing on short-term Bitcoin holders, those who have held their coins for less than 155 days and how their behaviour often signals turning points in the market.