To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The classic adage in investing is ‘buy low, sell high’ but that is easier said than done. Most retail investors tend to do the opposite. They chase the hype, pile in during bull markets, then panic and sell during downturns. Often, they sell undervalued assets at a loss and rotate into overvalued assets near the top. Before long, the new asset retraces sharply while the original investment they abandoned outperforms.

There is a common misconception that bull markets create wealth. In reality, wealth is built through multiple cycles of patience and disciplined accumulation. Those actively buying during bear markets rather than selling into fear are the ones quietly building long-term positions. They take advantage of panic sellers and depressed prices because they have conviction in Bitcoin’s future.

The ones who sell now, telling themselves they will buy back in at the bottom, rarely do. They often miss the opportunity entirely and end up rebuying Bitcoin at higher prices once the market is euphoric again. Time in the market beats timing the market every time.

The real question should not be ‘how low will Bitcoin go’ but rather ‘how high could it go’. If you understand Bitcoin, you know the answer. It is up and to the right. The same structural problems that make Bitcoin attractive as a hedge only continue to worsen. The use case strengthens, institutional and sovereign adoption grows, and many project Bitcoin could exceed $1 million per coin.

So if you bought Bitcoin at a higher price and are now considering panic-selling to rotate into other assets at all-time highs, take a step back. Assess the long-term picture. Do not get caught selling bottoms and chasing tops. There is a saying for investors who try to pick the bottom ‘he who tries to pick the bottom usually ends up with stinky fingers.’ Step back, stay calm, and dollar cost average. When the market turns, you will be glad you held your nerve.

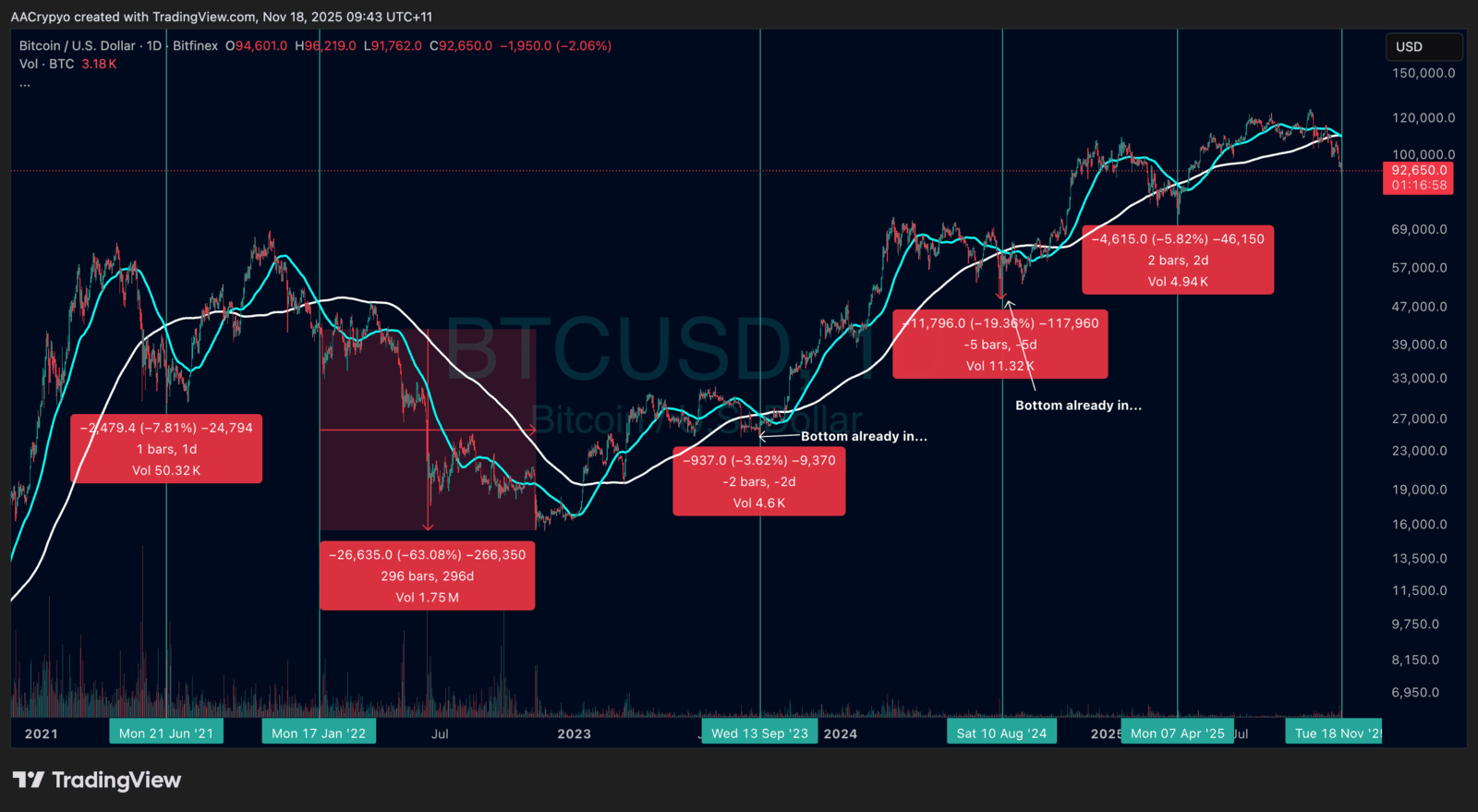

We have been here before. Bitcoin pulling back from a fresh all-time high is not new. Negative sentiment is recycled content for the media and influencers because it drives clicks. Earlier this year, Bitcoin hit $100,000 before pulling back to $75,000. People panic sold, hoping to re-enter at $50,000 or $60,000. Price is now $92,000. Last year, it dropped from $74,000 to $50,000 and people panic sold. Same story, price is now $92,000. In April 2022, Bitcoin was at $40,000 and the market rang the bear market bell again. Yes, it dropped further, but most investors disappeared only to return and buy back in higher. You get the picture.

The ones who sell during peak fear and listen to those saying to get out might laugh for a moment, but over time, they usually end up with egg on their face. The ones who buy during those moments are the ones who always have the last laugh. So what’s going to be different this time?

Now let’s look at one of the more talked-about signals: the death cross.

Death Cross: Not Always a Death Sentence

The death cross is when the 50-day simple moving average crosses below the 200-day simple moving average. It is typically seen as a bearish indicator. But let’s dig into the data.