To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

2025 is now in the books. Bitcoin closed the year down just over 6% despite some major milestones and key foundations being laid for its long term success. The question now is, what happens in 2026? While we do not have a crystal ball, we outlined the Stormrake 2026 thesis in our latest Rake Review. For those who missed it, the full piece is linked below, but over the next few days we will be breaking down the key parts of that thesis here in the Morning Notes. And yes, we do anticipate 2026 to be bullish.

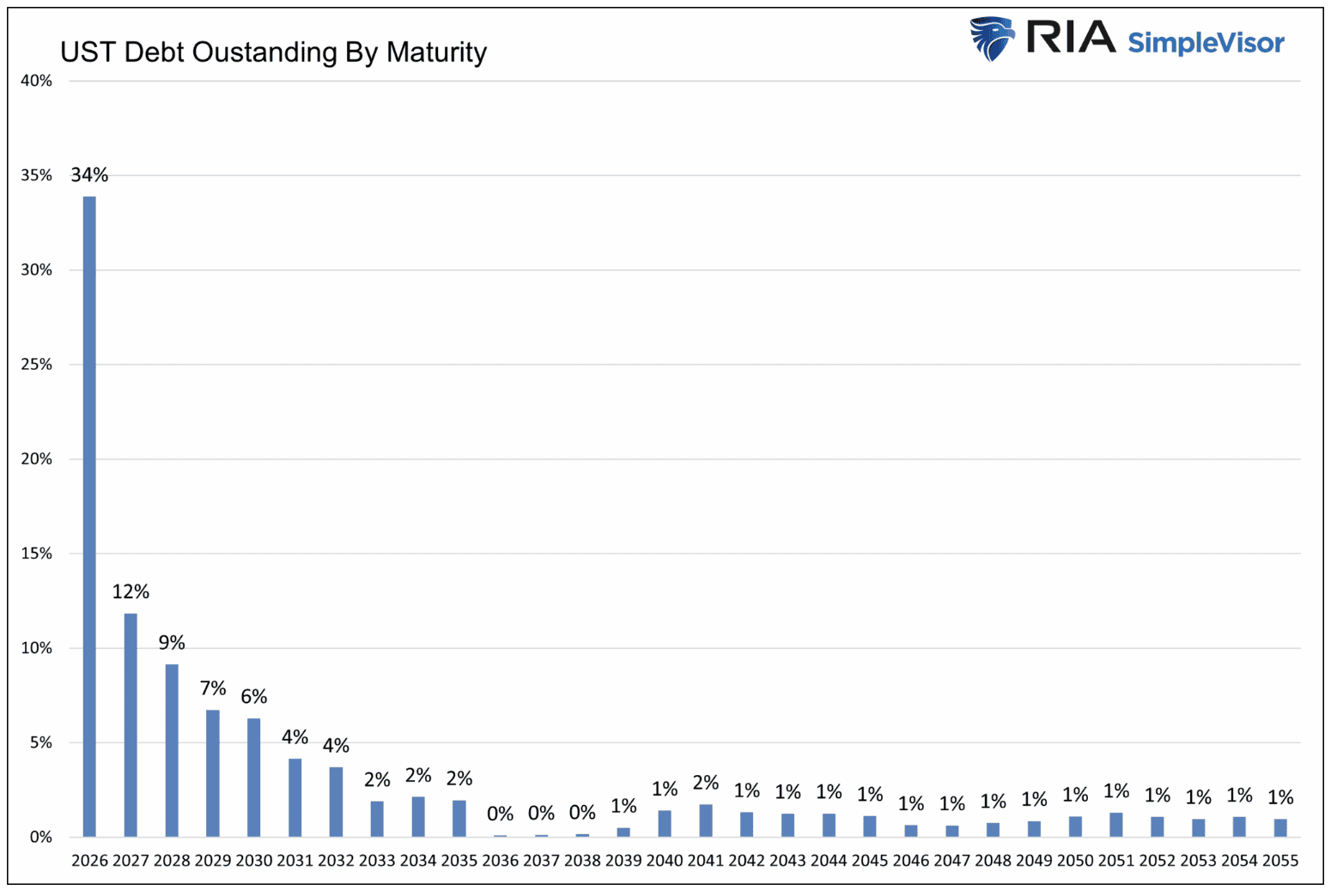

The first reason behind this bullish outlook is US debt. As we know, last year US debt hit a staggering $38 trillion, the highest it has ever been, and it is well past the point of return.

In Q1 of 2026, roughly $7 trillion of this national debt is set to mature, meaning the Treasury will be forced to roll over a massive portion of short dated bonds at significantly higher interest rates. Most of this debt was issued during the near zero rate era and will now reset closer to 4% to 5%, massively increasing interest expenses. This is not just a budget issue, it is a structural risk to the system. With debt servicing already exceeding $1 trillion per year, the US is sliding deeper into a debt spiral. Higher rates lead to higher repayments, which require more borrowing, which only compounds the problem. The pressure to monetise the debt builds, and that is where Bitcoin enters the picture.

When this debt matures, it must be refinanced at these higher yields, pushing interest expenses to astronomical levels. So what does this mean for Bitcoin? It is the escape hatch. As fiat credibility comes into question and the probability of rate cuts or renewed QE rises, Bitcoin stands to benefit as the anti dollar asset. It is not just a hedge against inflation anymore, it is a hedge against a sovereign debt crisis. Liquidity pivots will almost certainly favour BTC. The setup is not just macro bullish, it is structurally bullish.

And not to mention, over a third of that $38 trillion is set to mature in 2026, so we can expect the refinancing pressure we see in Q1 to persist throughout the year.

Read the full Rake Review and Stormrake 2026 thesis here: https://www.stormrake.com/blogs/post/the-rake-review-december-2025

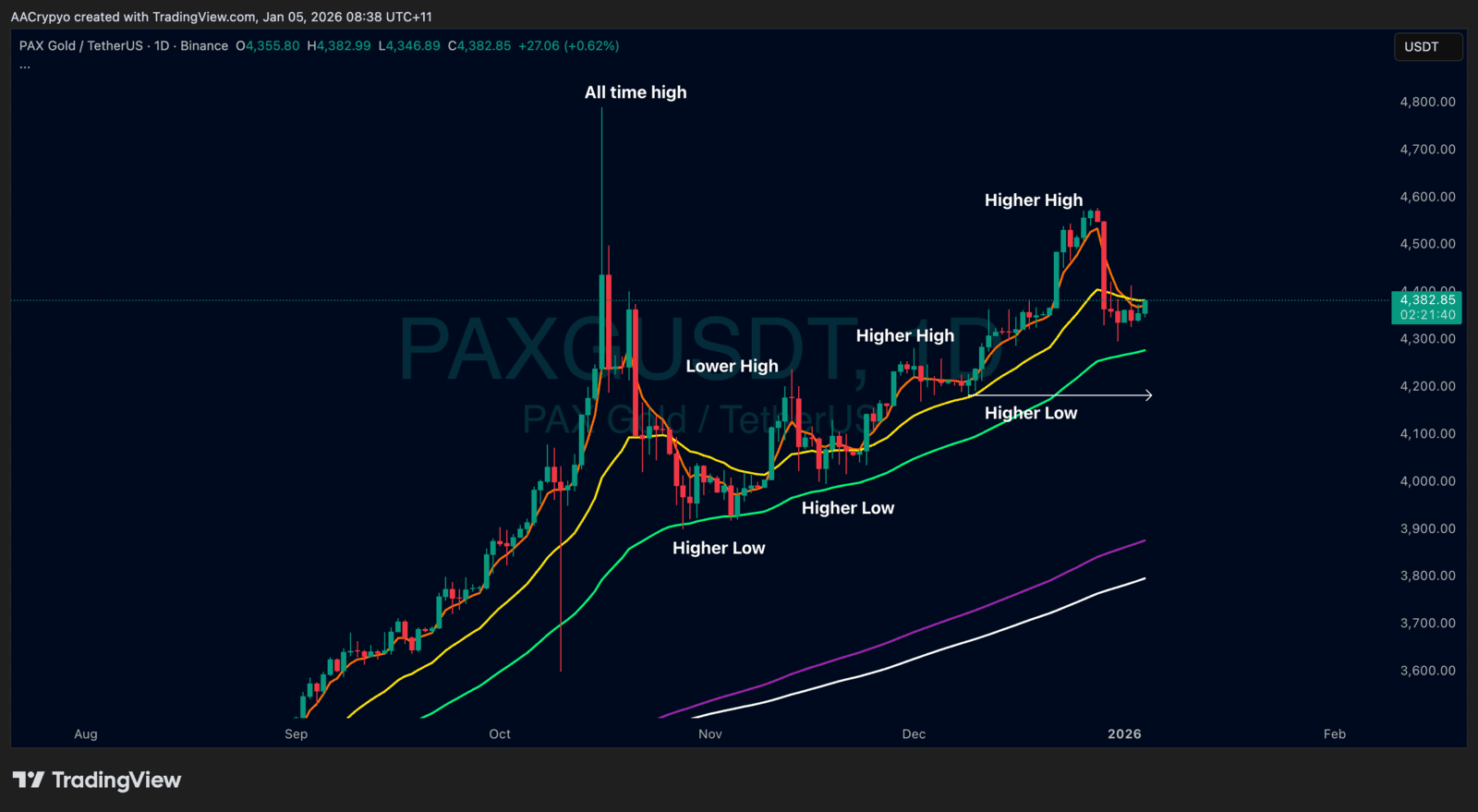

Stormrake Spotlight: Pax Gold (PAXG) ($4,382)

Stormrake Spotlight: Pax Gold (PAXG) ($4,382)