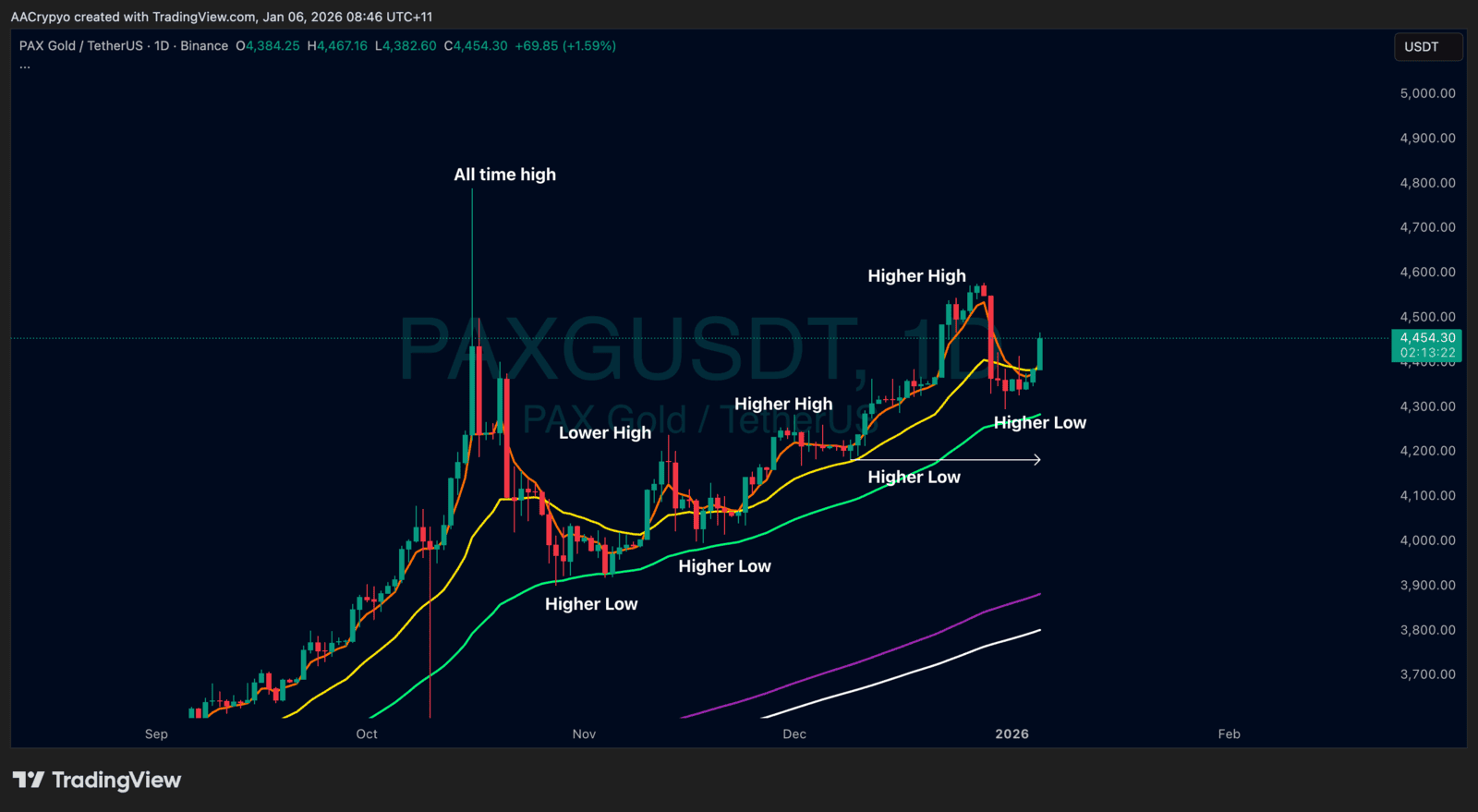

We can see this in the chart above. After months of near-zero usage, the Fed’s overnight repo facility suddenly surged in late 2025, hitting nearly $50 billion before fading back to zero. This sharp spike shows how quickly liquidity tools can be deployed when stress emerges. While it may not be labelled as QE, these short-term liquidity injections help stabilise markets and restore confidence. However, they are often a response to underlying fragility in the system, and in the short term, that stress can spill over into asset prices. For Bitcoin, this tends to show up as downside volatility and sharp pullbacks, especially during periods of funding stress or broader risk-off sentiment. But historically, these pullbacks are often precursors to strong reversals, as liquidity injections take hold and capital begins to rotate back into high-beta assets. The message is clear: the tools are available, and the Fed is prepared to use them when needed. This is the exact environment in which Bitcoin tends to outperform traditional assets.

For Bitcoin, this matters more than most realise. Historically, Bitcoin has shown strong correlations with global liquidity cycles. When liquidity expands, capital seeks risk, and Bitcoin often outperforms as a high-beta, supply-constrained asset. Liquidity flows are usually the early signal before broader market participation follows. It creates the right conditions for momentum to build. With liquidity steadily returning, Bitcoin is positioned to benefit from both a macro and structural perspective.

Tomorrow we break down yield curve interventions and regulatory nudges, two more key pillars of the liquidity return.

Read the full Rake Review and Stormrake 2026 thesis here:

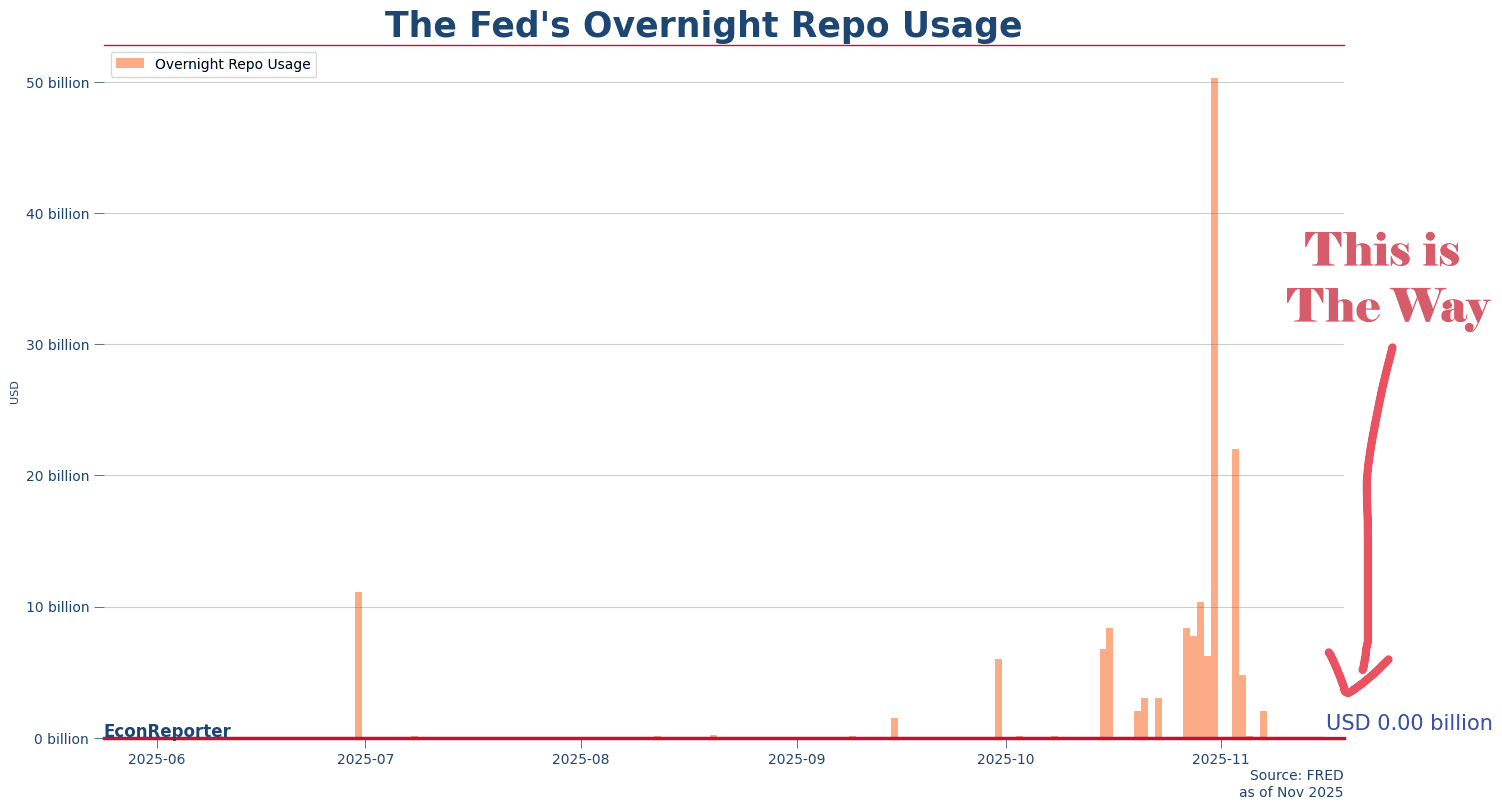

Stormrake Spotlight: Pax Gold (PAXG) ($4,454)