To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Moving onto the second part of the returning liquidity thesis: yield curve interventions and regulatory nudges.

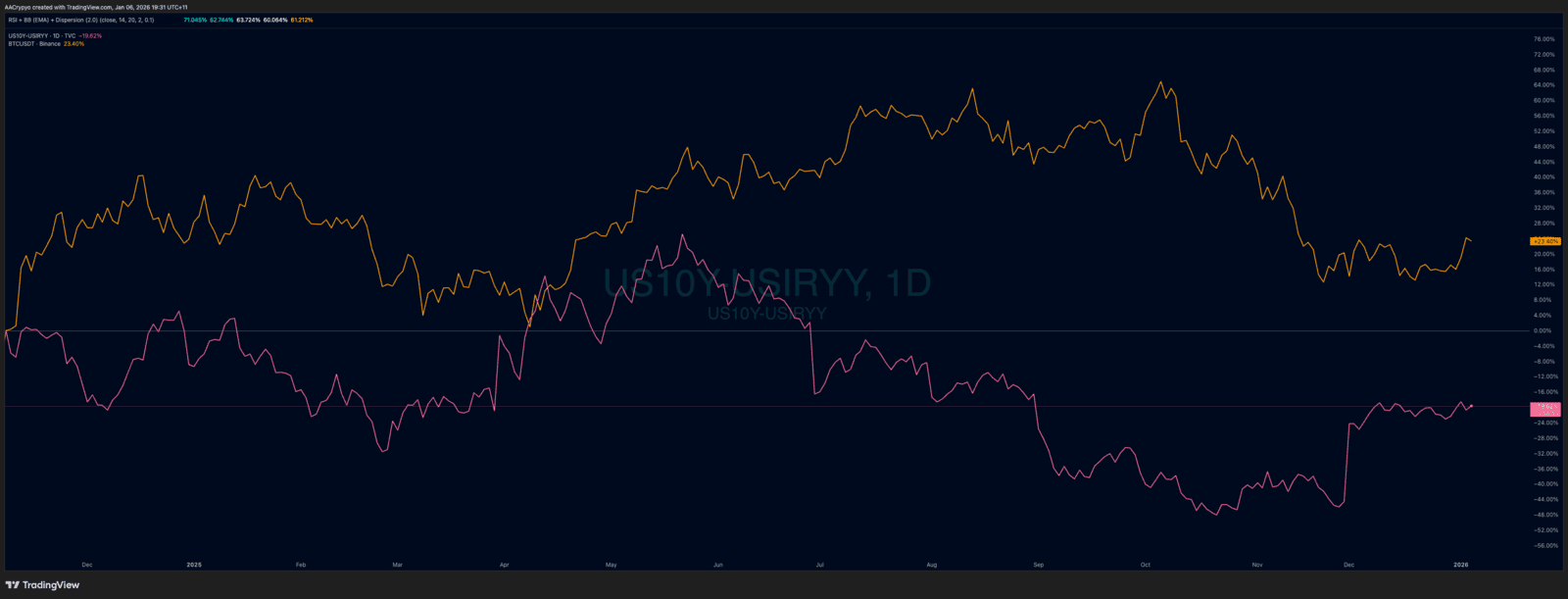

Whilst repo flows are steadily adding liquidity in the short term, we are now seeing subtle but meaningful shifts further out on the curve. Long-dated yields have begun to ease, despite sticky inflation and only two rate cuts last year. This is not random. The Fed is guiding expectations lower, and Treasury buybacks are now back on the table. In late December, Jerome Powell confirmed that the Fed would be buying back $40 billion worth of Treasuries over the following 30 days. That is a clear signal of active curve management.

This is what is known as yield curve intervention when central banks take steps to influence interest rates across different maturities in the bond market, particularly the long end. It can be done through direct bond purchases, forward guidance, or policy tweaks. The goal is to manage borrowing costs and prevent disorderly moves in the market, even if no formal easing is announced.

Investors are now anticipating anywhere between two to four rate cuts throughout 2026. That would further support long-end easing, reduce funding pressures, and reinforce the broader rotation back into risk assets. When the cost of capital comes down, liquidity conditions improve and Bitcoin tends to respond early and aggressively.