To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Just seven days ago we witnessed the largest liquidation event in history, with $20 billion wiped out and many investors left completely liquidated with portfolios showing zero. But it seems lessons still have not been learned. Yesterday, Bitcoin dropped from over $109K to a low of $103.5K in the space of five to six hours. This sharp move liquidated nearly $1 billion worth of leveraged positions, with a quarter of that occurring in just 60 minutes.

Bitcoin has since recovered slightly and now trades around $107K. But the pattern is clear. Those attempting to outsmart the market or chase losses have been caught out again. Last week’s liquidation should have been a wake-up call. Last night proved some are still asleep at the wheel. It may have been a smaller move, but it was another liquidation event all the same.

As expected, altcoins were hit harder than Bitcoin, though they have rebounded in line with BTC’s recovery. Investors now have a choice. Either learn from these shakeouts or continue to repeat the cycle. Those still trying to chase losses by levering up or using bots and copycat strategies they have found online will likely meet the same fate. On the other hand, those buying spot Bitcoin and quality crypto assets immediately remove the risk of liquidation and set themselves up for long-term wealth and growth rather than the illusion of fast or falsely promised gains.

I covered this mindset shift in more detail in our latest breakdown: When Leverage Fails, Spot Prevails — a look at why these events keep happening and how to avoid being on the wrong side of them.

Learn from these moments. Do not keep making the same avoidable mistake

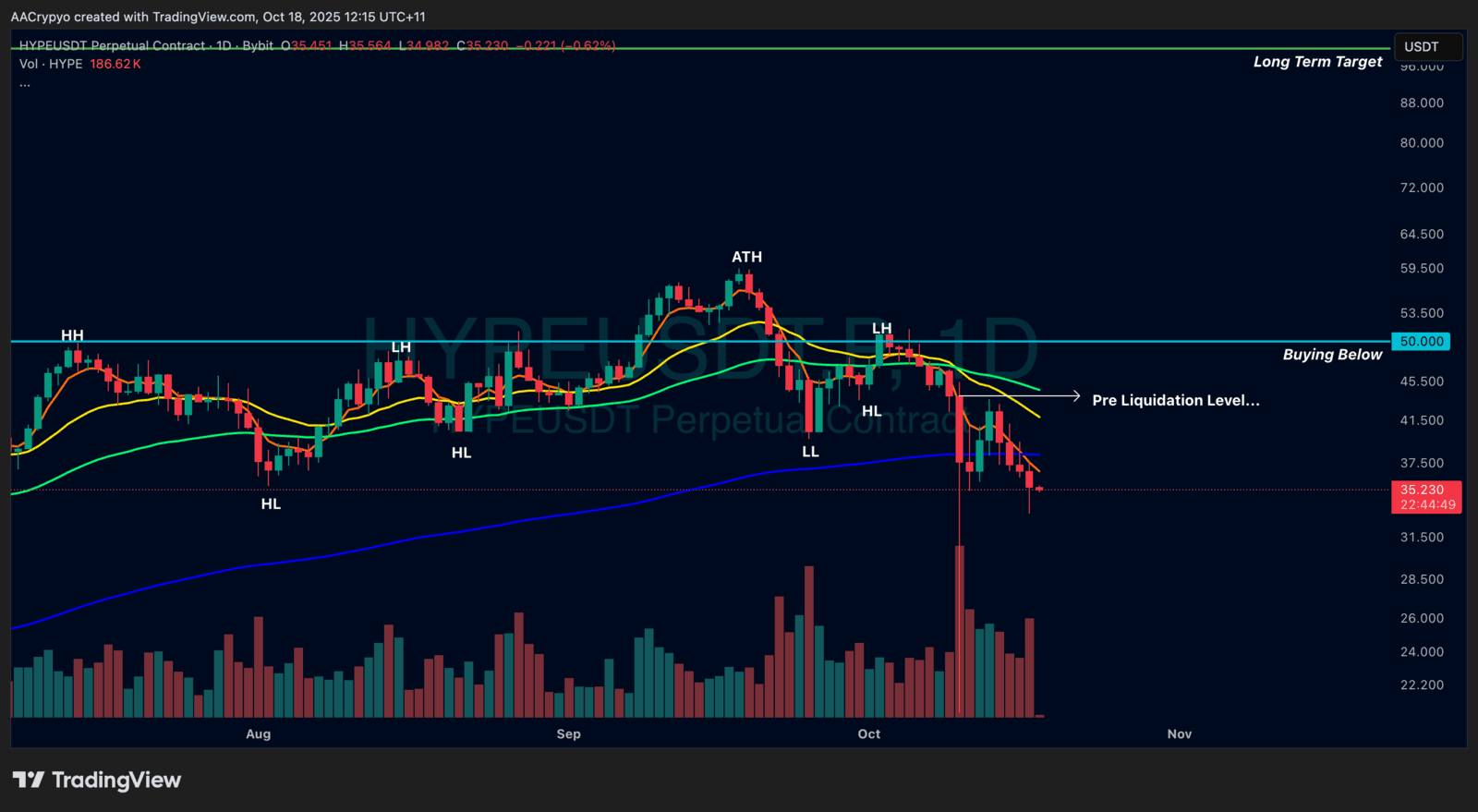

Stormrake Spotlight: Hyperliquid (HYPE) ($35.24)

Stormrake Spotlight: Hyperliquid (HYPE) ($35.24)