This Weekend: A Lesson in Real Time

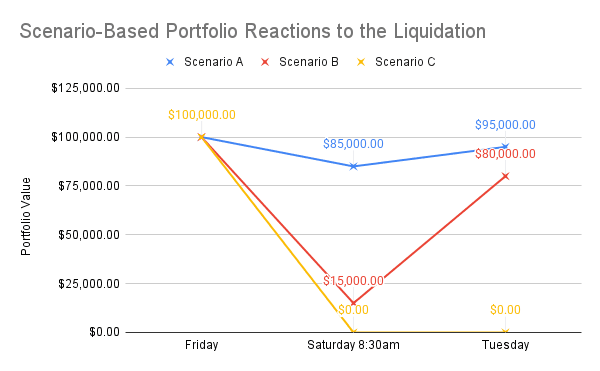

Scenario A: $100K Spot Allocation into Bitcoin

Investor A allocates $100K into Bitcoin on Friday, purchasing approx. 0.45 BTC

Saturday 8:30am: Portfolio is worth ~$85K

Today (Tuesday): Portfolio has recovered to ~$95K

Scenario B: $100K Spot Allocation into an Altcoin (SUI)

Investor B allocates $100K into SUI at $3.40 (approx. 30,000 tokens)

Saturday 8:30am: Portfolio worth ~$15K (SUI drops ~85%)

Today: Portfolio has recovered to ~$80K

Scenario C: $100K into a Leverage Strategy or Bot

Investor C allocates $100K into a leveraged strategy or bot on Friday

Saturday 8:30am: Liquidated, portfolio value = $0

Today: Despite recovery in BTC and altcoins, portfolio still = $0

The Stormrake Difference

Stormrake offers spot-only access to digital assets. We do not promote or facilitate margin trading, leveraged instruments, or derivative strategies. As a result, our clients were not impacted by this weekend’s record-setting liquidations.

Those holding spots through Stormrake remain in control of their portfolios and their assets.

If You’ve Been a Victim of Liquidations:

First of all, it’s not the end. Many have experienced the same. You’re not the first, and certainly won’t be the last.

But it’s what happens next that matters.

There are two types of responses to a liquidation:

1. "I’ll act differently next time."

A natural reaction. You may tell yourself you’ll manage risk better, exit positions faster, or tweak your strategy. But fundamentally, the risk remains the same. No one predicted this liquidation event, and there’s no reason to believe something similar or worse won’t happen again. In the current macro environment, where a single headline or tweet can move markets dramatically, risk management becomes even harder to execute reliably. The definition of insanity is doing the same thing and expecting a different result.

2. Learn and adapt.

The better path. Learn from the liquidation and reassess your strategy. Consider switching to spot positions, remove leverage from your portfolio, and take a long-term view. Avoid chasing short-term, promised returns and give your assets the time and space to grow sustainably.

Final Thoughts

The market delivered a clear message this weekend. Leverage can be lucrative, but it's also ruthless. And when volatility strikes, survival is the priority.

Spot holders ride through the storm. Leveraged traders often don’t.

Make sure you’re still in the game when the next wave comes.

Written by Alexandar Artis

Create a brokerage account today

Reach out to us at Stormrake for further market insight and allow us to help you navigate the sea of mania and laser-eye memes, so that you can realise your goals in the market!

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved