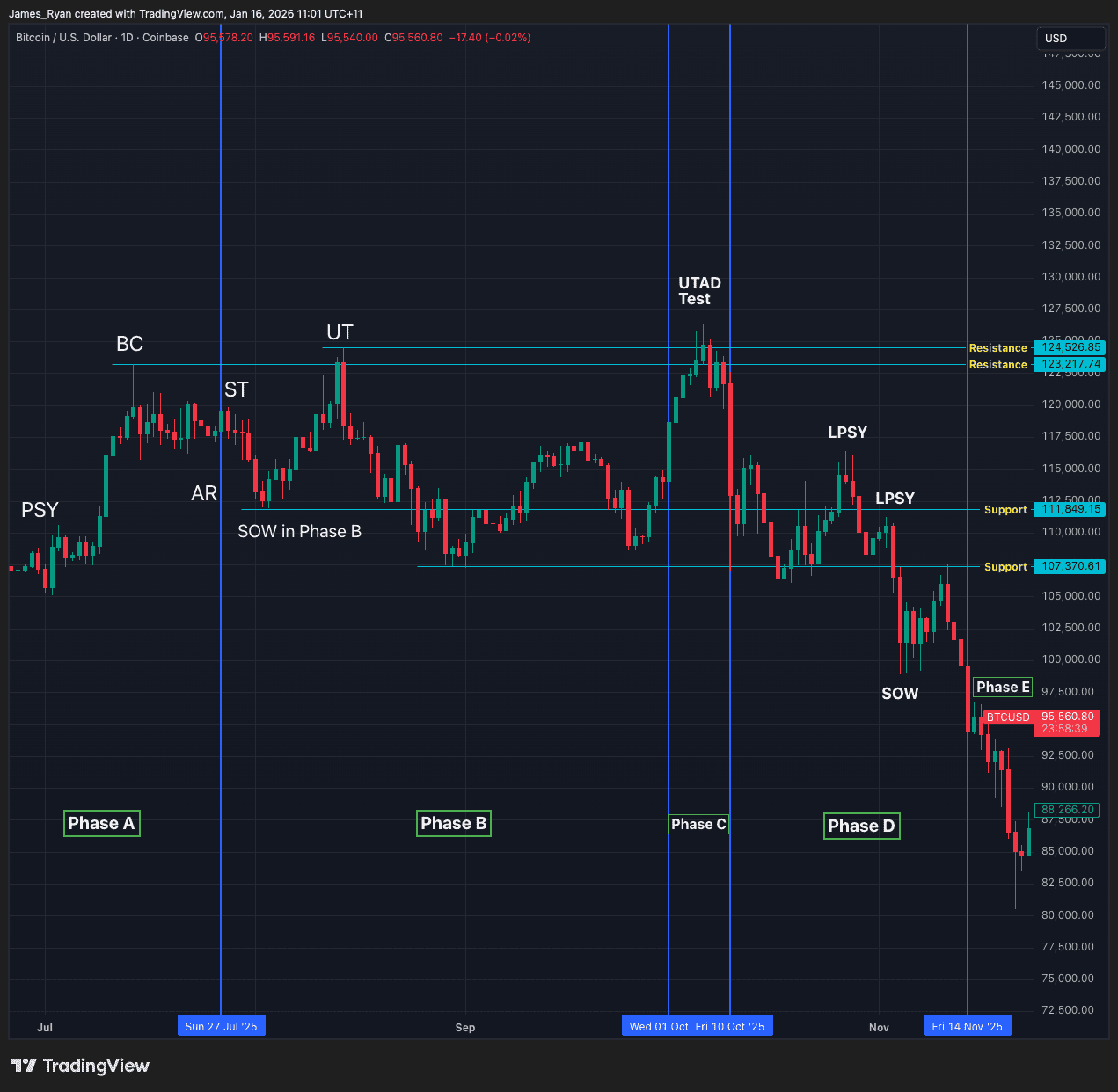

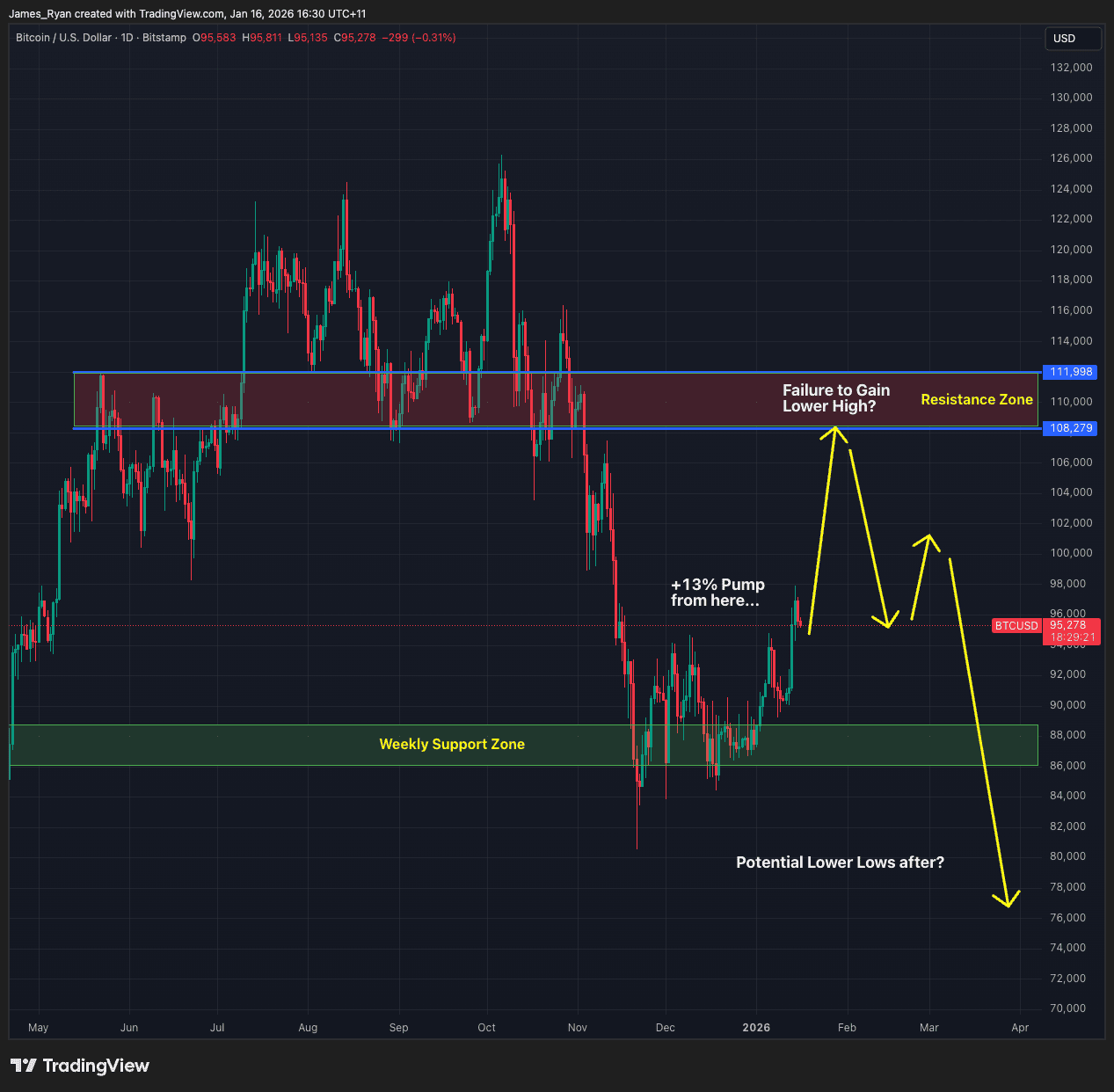

Whilst at first glance this might seem like bad news, it absolutely isn’t. This type of market price-action gives both bulls and bears an excellent opportunity to capitalise off volatility, before getting even better long-term entries to add to their bag sizes before the next generational Bitcoin bull market begins. Volatility = opportunity, and seasoned traders/investors can make the most out of this brief window of time to ensure they’re on the right side of the trade at all times. When generation lows do come, if you’ve made the right decisions along the way, you’ll hopefully have the most amount of capital available to you at the bottom - then loading up the truck becomes much more viable as you can scoop up what little BTC supply is available then, given the asset will get even more scarce, whilst other retail investors likely wait until it’s too late to pile in again at astronomical prices. Getting ahead of the curve in a bear market is arguably even more important than during a bull market cycle. Consistency and patience is rewarded usually in spades for those that execute and keep increasing their position sizes, this will be paramount over the next 9 - 12 months. Don’t get caught out again, just like those that waited for sub $10K BTC in 2022, just to end up buying back in at all time high prices yet again…sometimes a price too low really is too good to be true.

In the coming months we’ll be looking at what viable generational low targets might look like, and depending on how price action behaves over the next few months, we will outline a number of likely scenarios using historical price performance to get a head start on strategizing what the next most optimal moves are for this market moving forward into the years ahead. One thing will remain unchanged; Bitcoin is extremely well positioned to take advantage of the aggressive repricing of global asset valuations currently taking place. Gold and Silver bulls waited nearly two decades for the current skyrocketing prices where long-term participants that remained steadfast in their positions for as many years are now quite easily doubling their position valuations every couple of months - and consecutively too, all in just a short span of time. Time in the market will always remain the single most important aspect to long-term investing, and that’s been proven true for Bitcoin from cycle to cycle over its 17 year long existence. The only tangible edge available to investors is execution: staying liquid, staying disciplined, and being able to act decisively when the market offers sublime windows of opportunity that close as soon as the market regains stability. That is exactly where Stormrake fits. When price is moving fast in either direction, we make it simple to accumulate, rebalance, or scale out with intent through a private, professional desk built for high-conviction decision-making. Direction is noise - but access, timing, and consistency are the best advantages for long-term success in this industry.

Create a brokerage account today

Reach out to us at Stormrake for further market insight and allow us to help you navigate the sea of mania and laser-eye memes, so that you can realise your goals in the market!

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved