November Brought Bearish Price Action but Macro Tailwinds Are Building

November Brought Bearish Price Action but Macro Tailwinds Are Building

Bitcoin Enters a New Macro Era

The Hidden Hands Moving the Market

November Falls Flat as December Takes the Spotlight

In the News:

Strategy May Consider Selling Bitcoin:

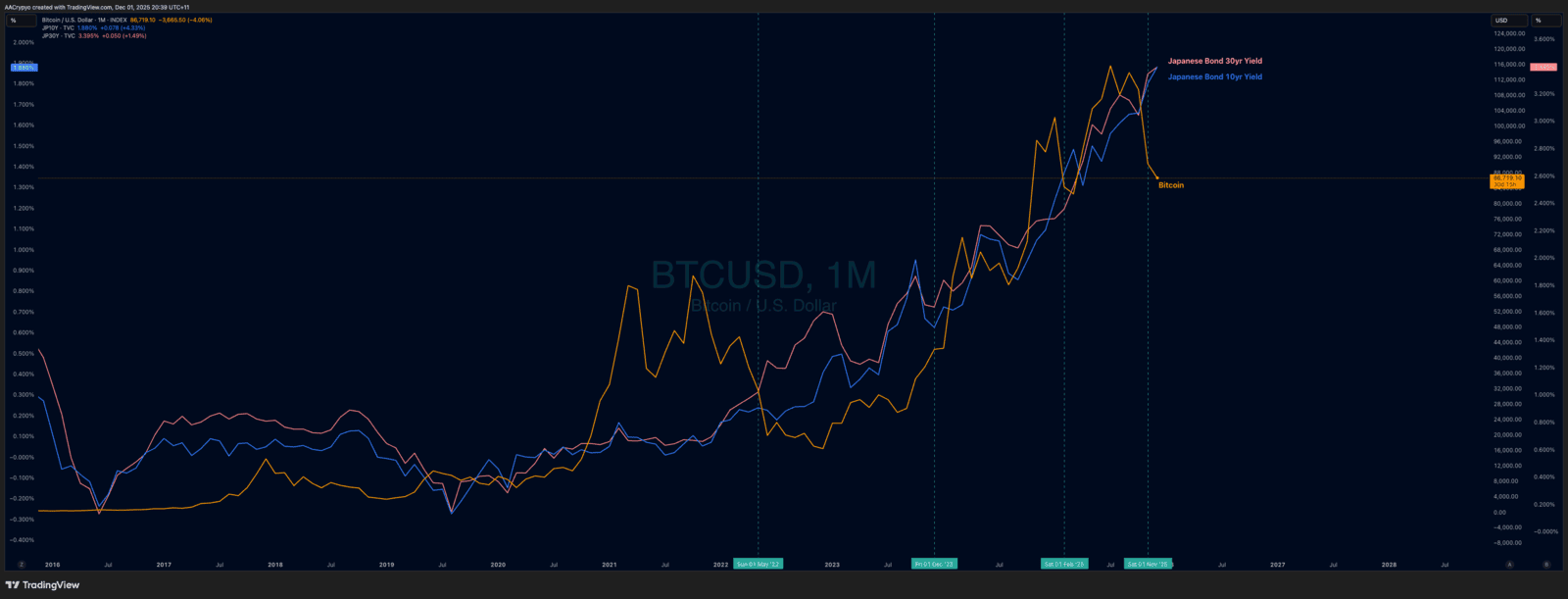

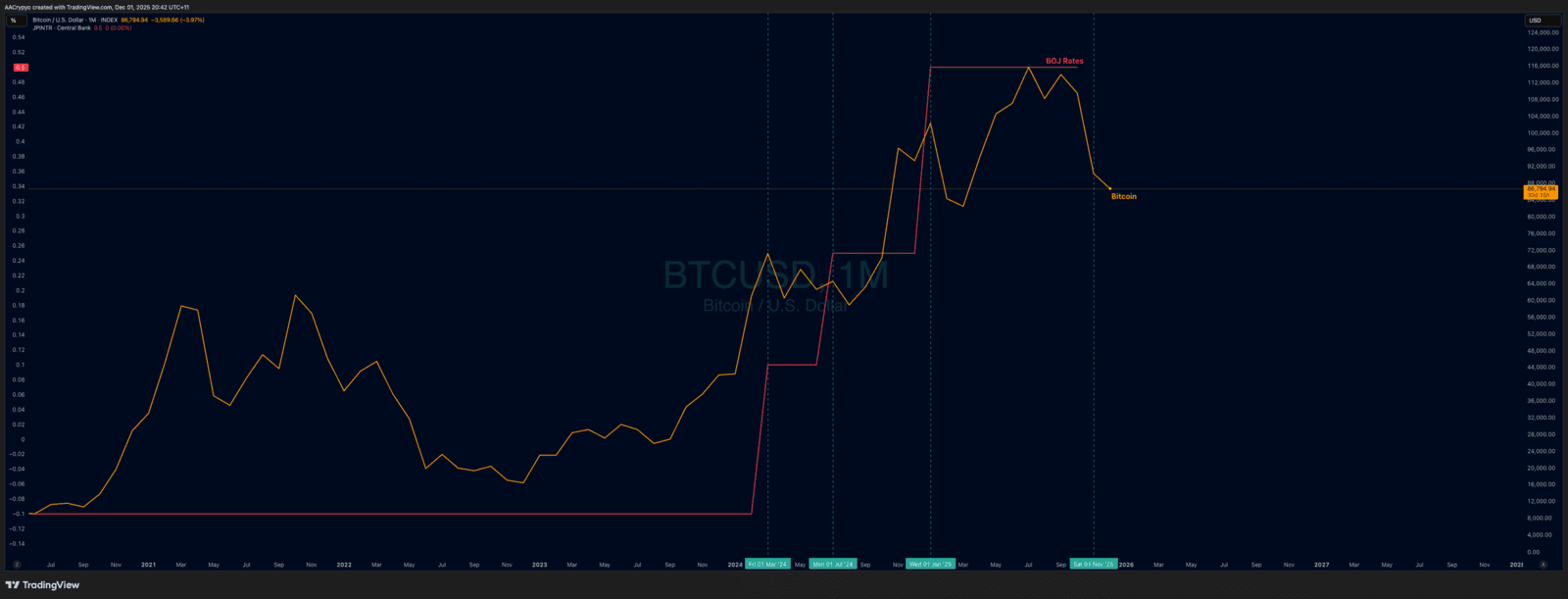

Japanese Bond Yields Hit Multi-Decade Highs:

BlackRock’s IBIT Becomes the Most Successful ETF in History:

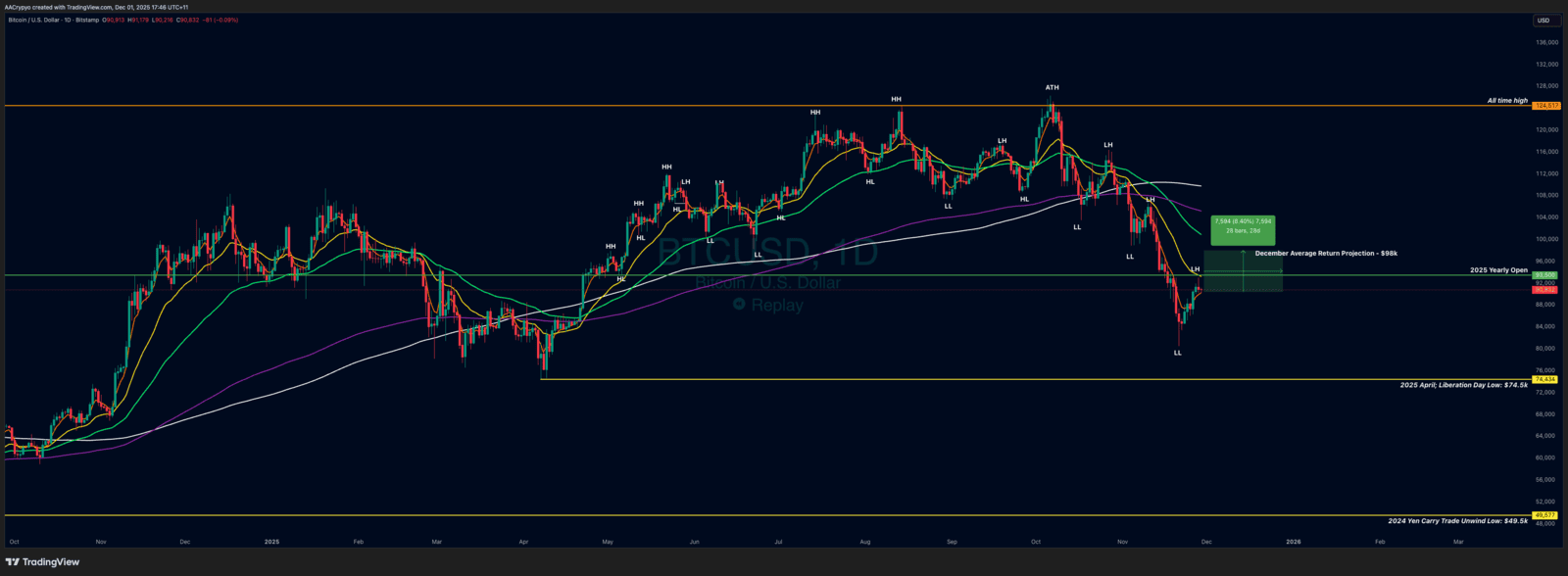

Market Update:

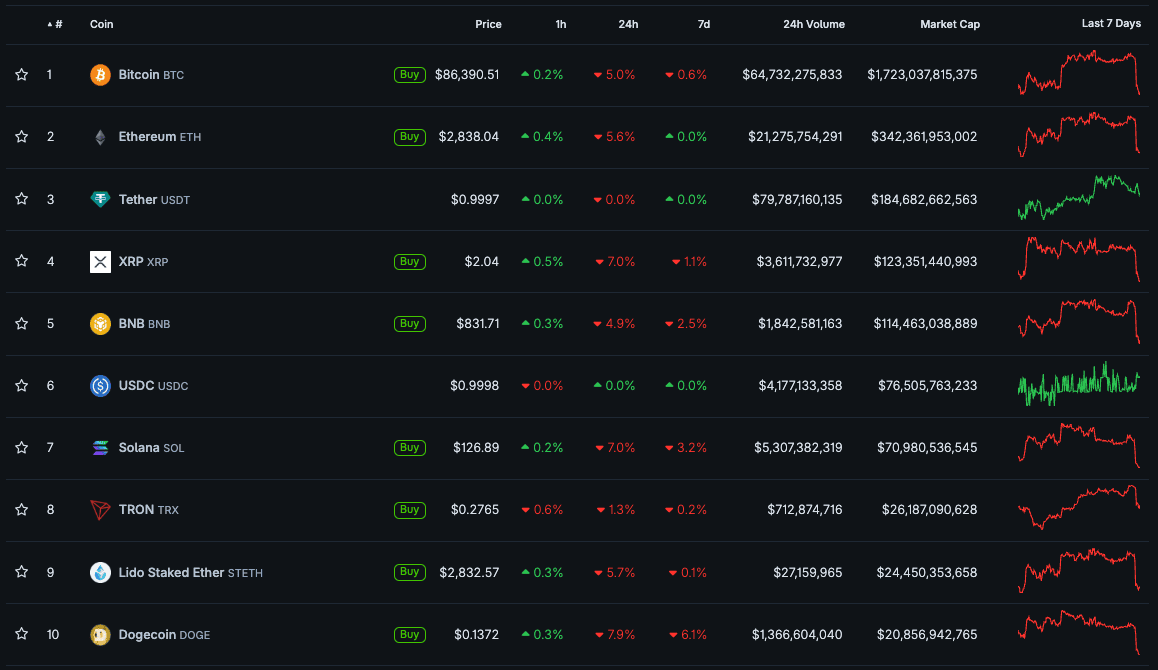

Here is the fast five of what you need to know about the market in November 2025:

- Bitcoin fell 17.5% in November

- Ethereum fell 22.2% in November

- Solana and Tron both jumped in their rankings, SOL from seventh to sixth and TRX from tenth to eighth

- PAXG was a standout, up 6.1% when the majority of the market was red

- The total crypto market cap fell by 16.80%

Video of the month:

Education: How Japanese Monetary Policy Impacts Bitcoin

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved