To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

How US Intervention Could Impact the Yen Carry Trade?

How US Intervention Could Impact the Yen Carry Trade?

Yesterday we covered what could unfold if the US intervenes to strengthen the Yen. This would involve the US government selling dollars to buy Yen, effectively boosting the Yen’s value. While there has been no official confirmation, price action in the USDJPY suggests markets are already pricing in intervention, as the Yen has started to rally. Historically, this has led to assets priced in USD moving higher, as covered in yesterday’s note.

But today, we need to highlight the downside risk, which is how the intervention may accelerate the unwind of the Yen carry trade. Yes, the Yen carry trade might feel overplayed at this point, but it remains a real and ongoing threat.

When the Yen strengthens against the dollar, those who borrowed in Yen to fund trades in risk assets are forced to unwind. These investors typically borrow Yen at low interest rates, convert it into dollars, and then use that capital to buy assets like US equities, bonds or Bitcoin. As the Yen rallies, the cost of repaying those Yen loans increases. To cover their positions, they are forced to de-risk by selling assets and buying back Yen, which creates broad selling pressure.

This is nothing new. Bitcoin has already felt the impact of Yen carry trade unwinds several times over the past 18 months. From surprise Bank of Japan rate hikes to record-level Japanese bond yields, each event brought downside pressure. But each time, Bitcoin has recovered and offered strong buying opportunities.

While the long-term thesis remains intact, sharp moves in the Yen can lead to short-term volatility for BTC and other risk assets. These periods of weakness often become ideal buying moments for those who stay alert. Those who take action during uncertainty tend to thank themselves later when prices are higher.

Macro Deep Dive: Dollar Debasement, Bond Yields and Bitcoin’s Role

Macro Deep Dive: Dollar Debasement, Bond Yields and Bitcoin’s Role

The weakening of the USD is the cornerstone of our global currency debasement thesis. In this sense, nothing has changed for many years despite recent headlines. Yes - it’s possible this rare-occurance of a US intervention into the Japanese Yen may cause further uncertainty for the market, given that the USD dollar is weakening. It may even spark up fears again of another uptick in CPI inflation data for the US, potentially warranting higher interest rates for longer. In this scenario, the rapidly depreciating dollar will inversely put downward pressure on long-term US Treasury Bond prices as well, given the underpinning currency of said Bonds will be weakening.

This would feed into the already accelerating Bond yields that we’ve been observing, as these are inversely correlated to the Bond prices and directly affect interest rates. This feedback loop may accelerate the current re-pricing of sovereign assets, of which we expect Bitcoin to play catch-up once the dust settles, just like we’ve seen Silver do after being suppressed for well over a decade.

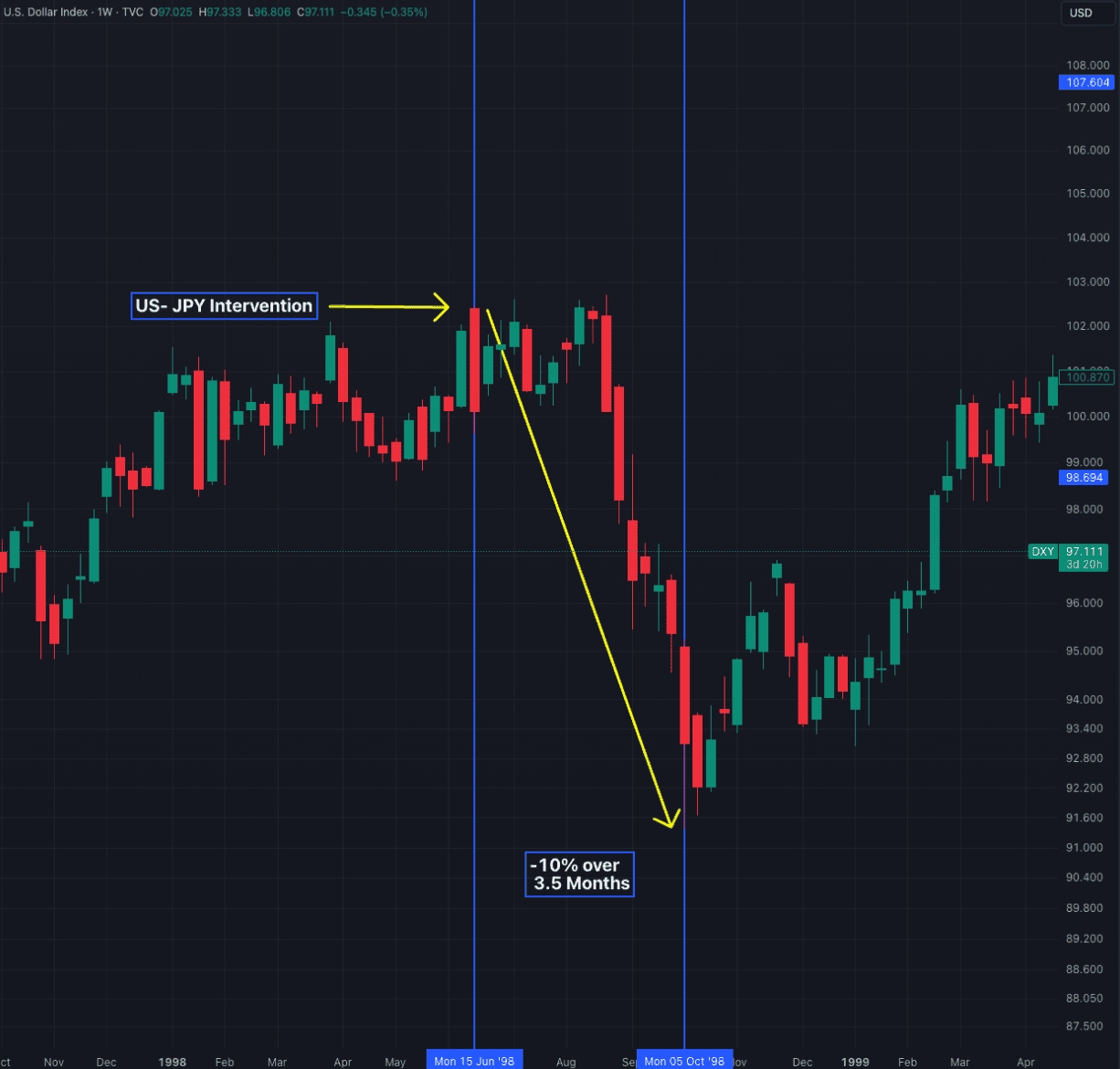

The last time we saw a significant US intervention of this scale into the Yen was during June of 1998. This was a time of extreme economic fragility on Japan’s behalf and was the consequence of a meteoric asset valuation bubble, fueled by global trade and manufacturing relations that couldn’t sustain itself. This led to a multi-decade bear market for the entire Japanese economy, commonly referred to as “the lost generation”. Upon the intervention, the USD nose-dived a whopping 10% in just three and a half months post-purchasing the Yen en-mass.