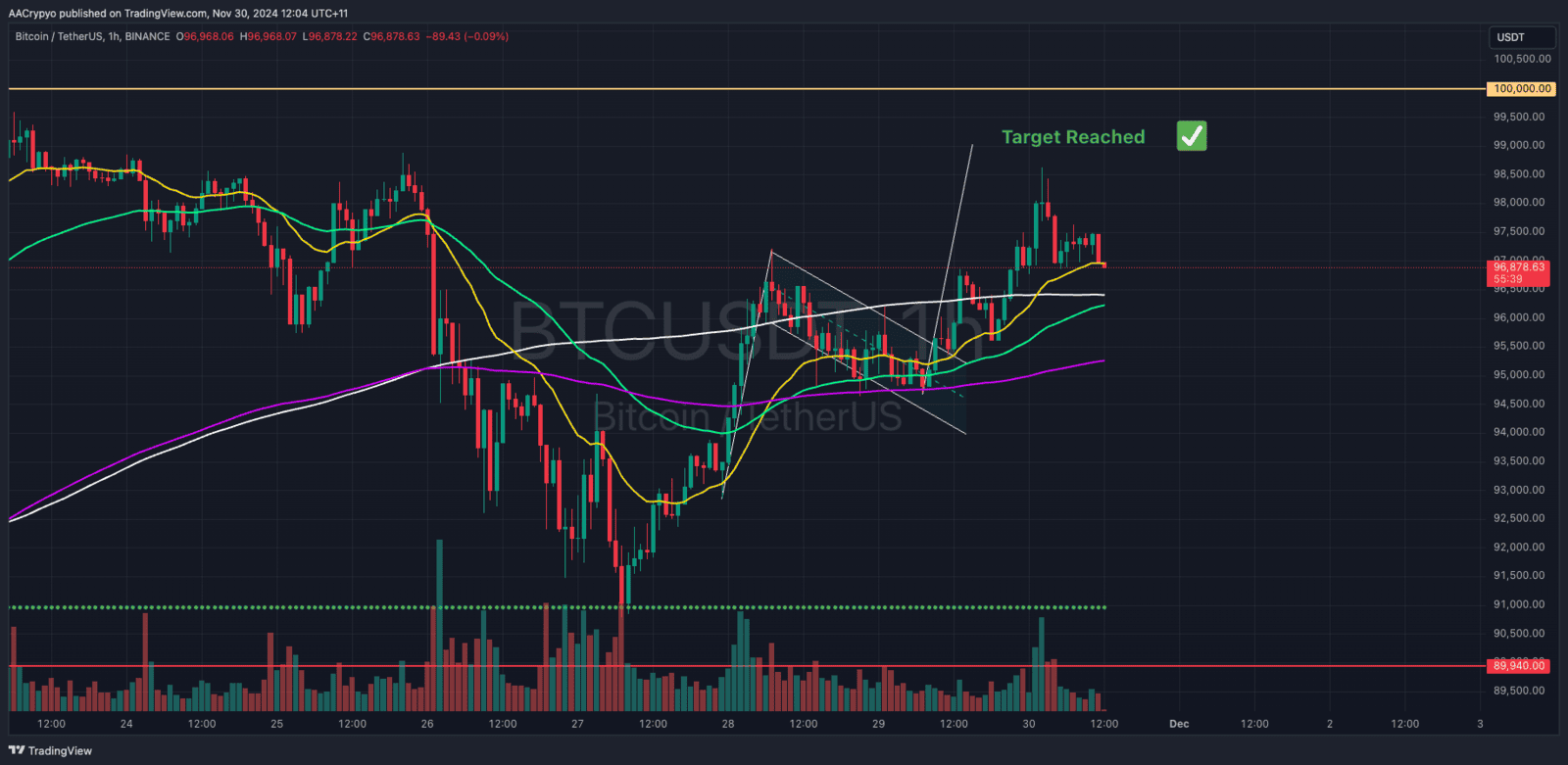

Despite the public holiday in the US, Bitcoin rallied overnight during the US trading session. Bitcoin reached a high of $98,620, putting it less than 1.5% away from $100,000. It has since pulled back to current levels of $97,000, reaffirming its bullish structure. The bullish structure remains intact as long as Bitcoin stays above the last higher low of $95,600. The hope that we see $100k before November still remains, however not as strong as it was a week ago. This recent move has set Bitcoin up perfectly to hit it in early December.

We can now confidently say that the correction is over. It came and went quickly, offering excellent “buy the dip” opportunities to proactive investors, who have been rewarded for their foresight. This does not mean we will go straight up for the remainder of the bull market; there will still be corrections, which may even be of a greater degree.

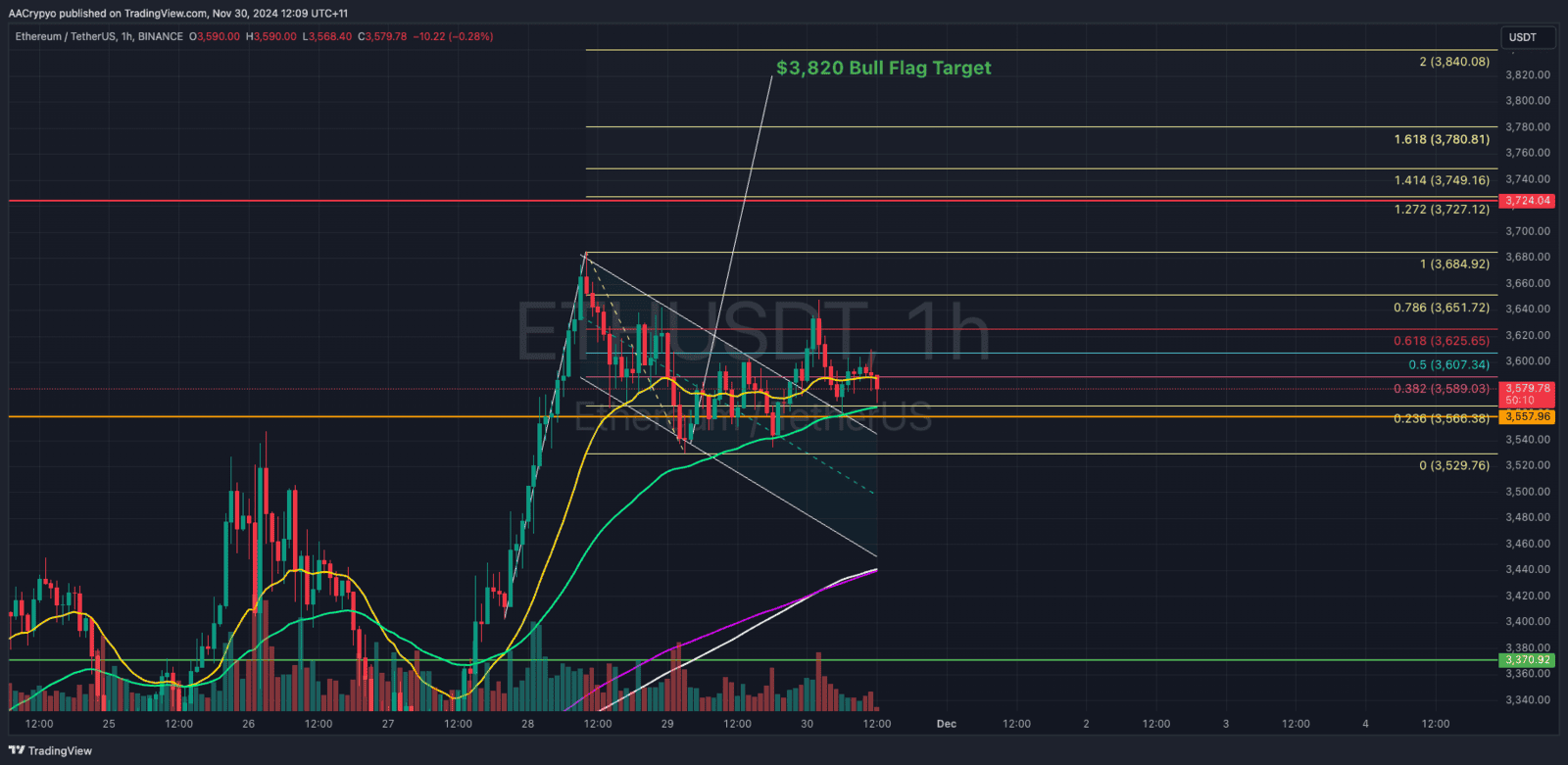

Despite Bitcoin’s rally, dominance continues to fall, and altcoins are delivering mixed performance. Some, such as CORE, HBAR, ALGO, and ONDO, have outperformed Bitcoin, while major coins like ETH and SOL have underperformed in the last 24 hours. Ethereum’s lack of consistency suggests we are still transitioning between phases one and two of the market cycle. However, the altcoin season index continues to rise, now reading 67. This indicates we may be later in the bull cycle than the traditional alt season timeline suggests.

Nonetheless, price action, charts, and fundamentals all suggest we are still in the early stages of this cycle. The majority of retail investors remain on the sidelines, and the largest Bitcoin buyer—the US government—has yet to begin buying. Reflecting on 2021, many indicators and on-chain analytics prematurely called the early peak the market top. However, the crypto market went on to achieve new all-time highs in the final months of that year.

We remain bullish, maintaining the conviction that this bull run will extend into late 2025.