Bitcoin’s True Purpose

Bitcoin’s True Purpose

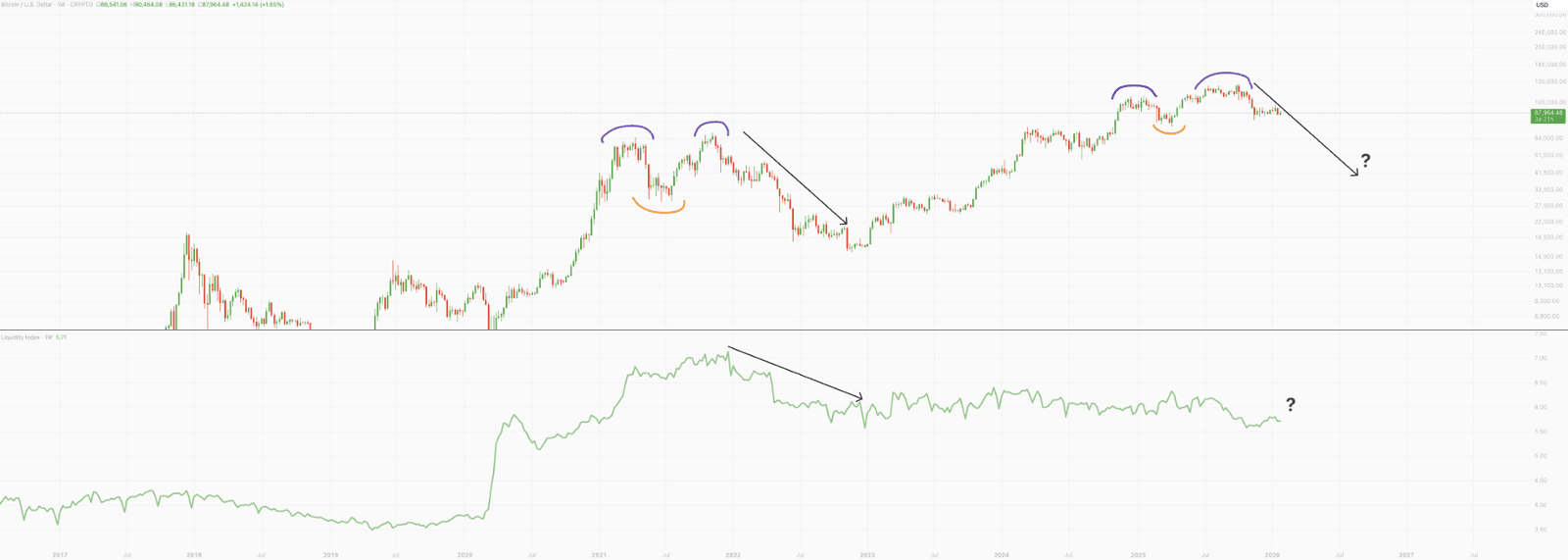

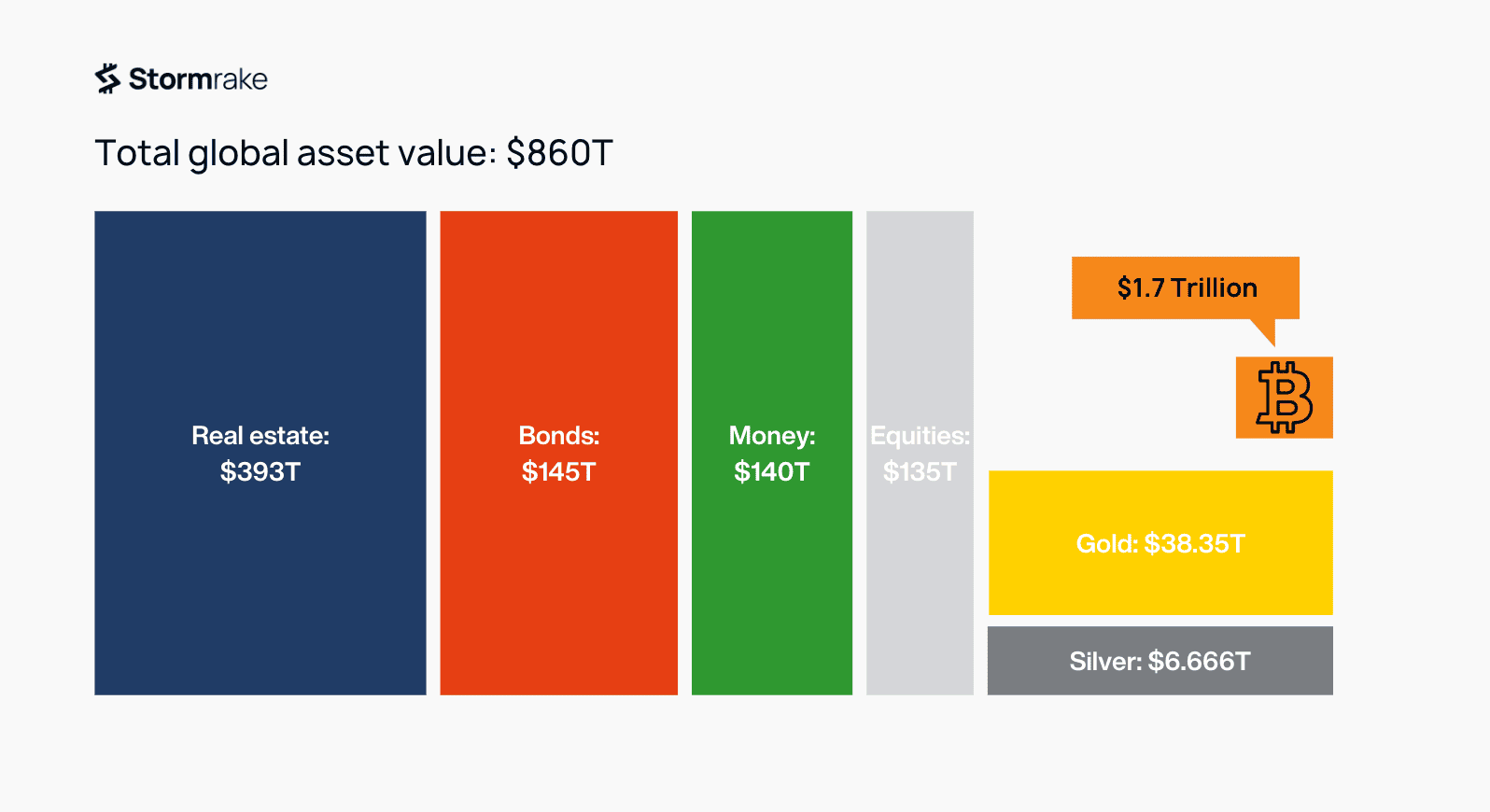

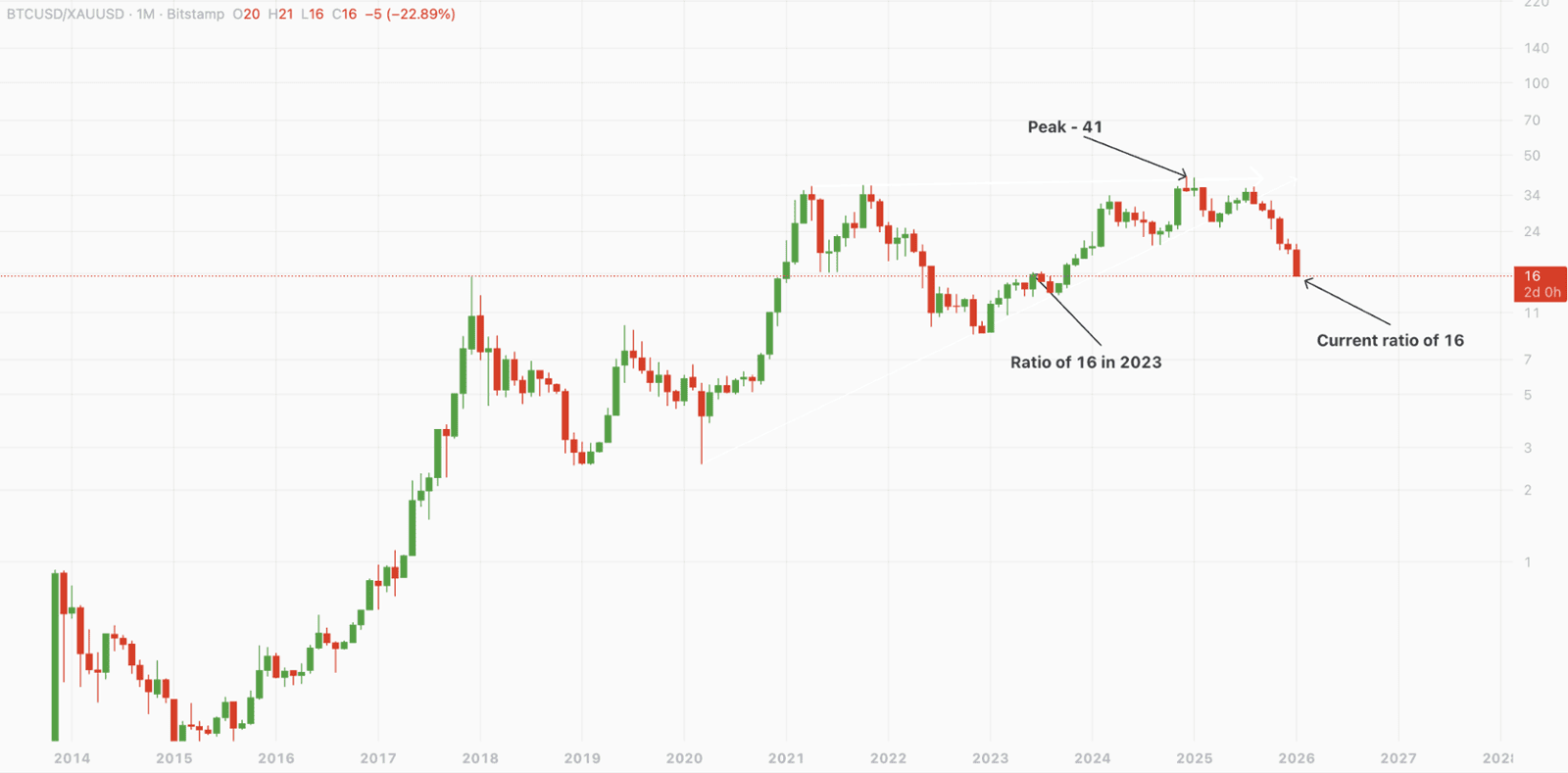

Bitcoin Is Not a Safe Haven but Something Bigger

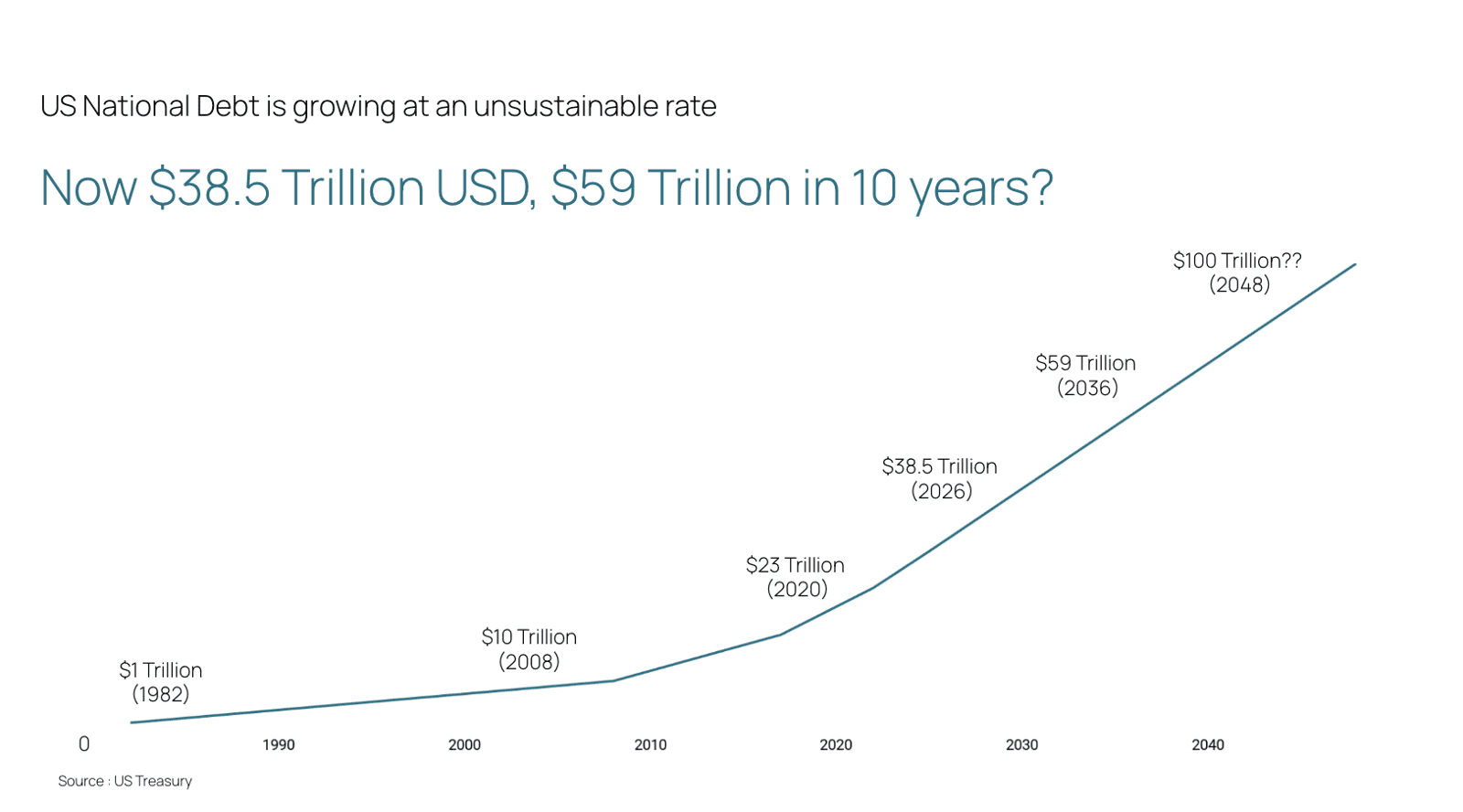

The US Government Are the Architects of Their Own Demise

The US Is Not on a Sustainable Path

2025 to 2026: A Replay of 2021 to 2022?

In the News

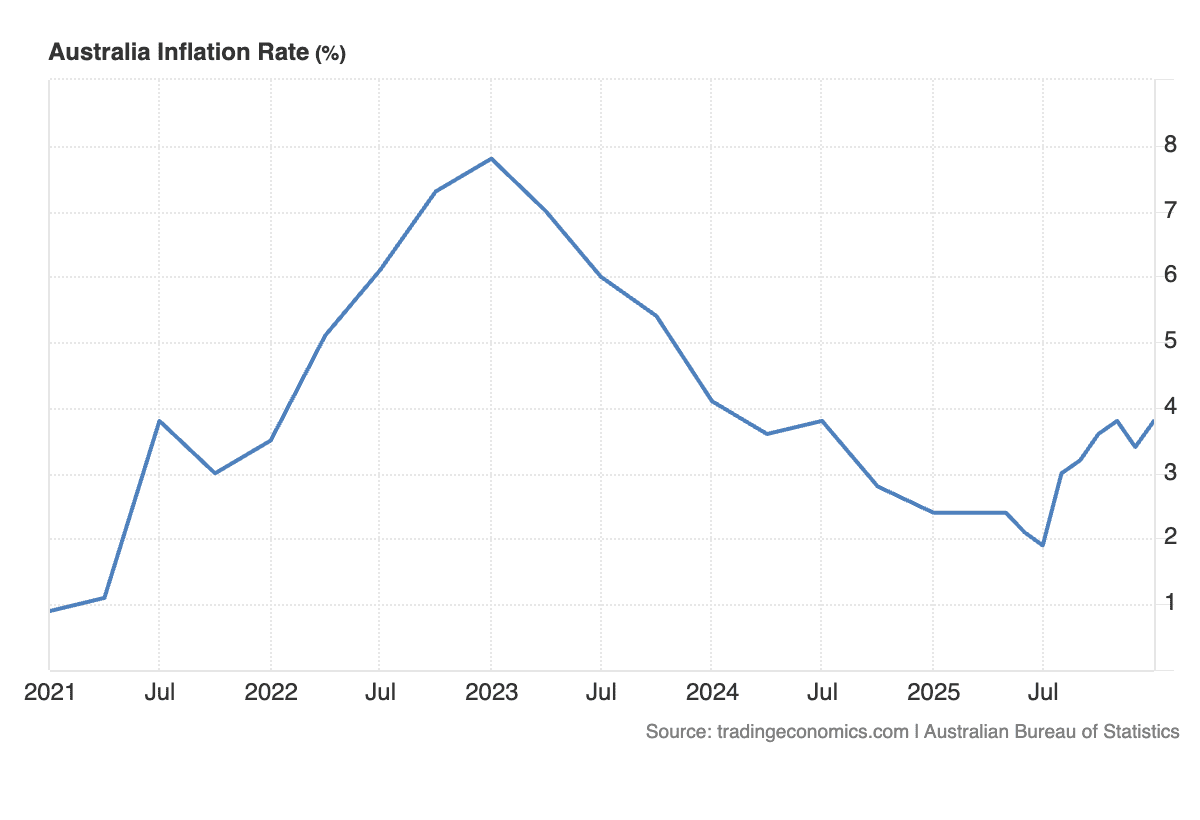

Australian Inflation Surprises to the Upside

A Second US Government Shutdown?

Crypto Exchanges Rush Into Gold and Silver Derivatives

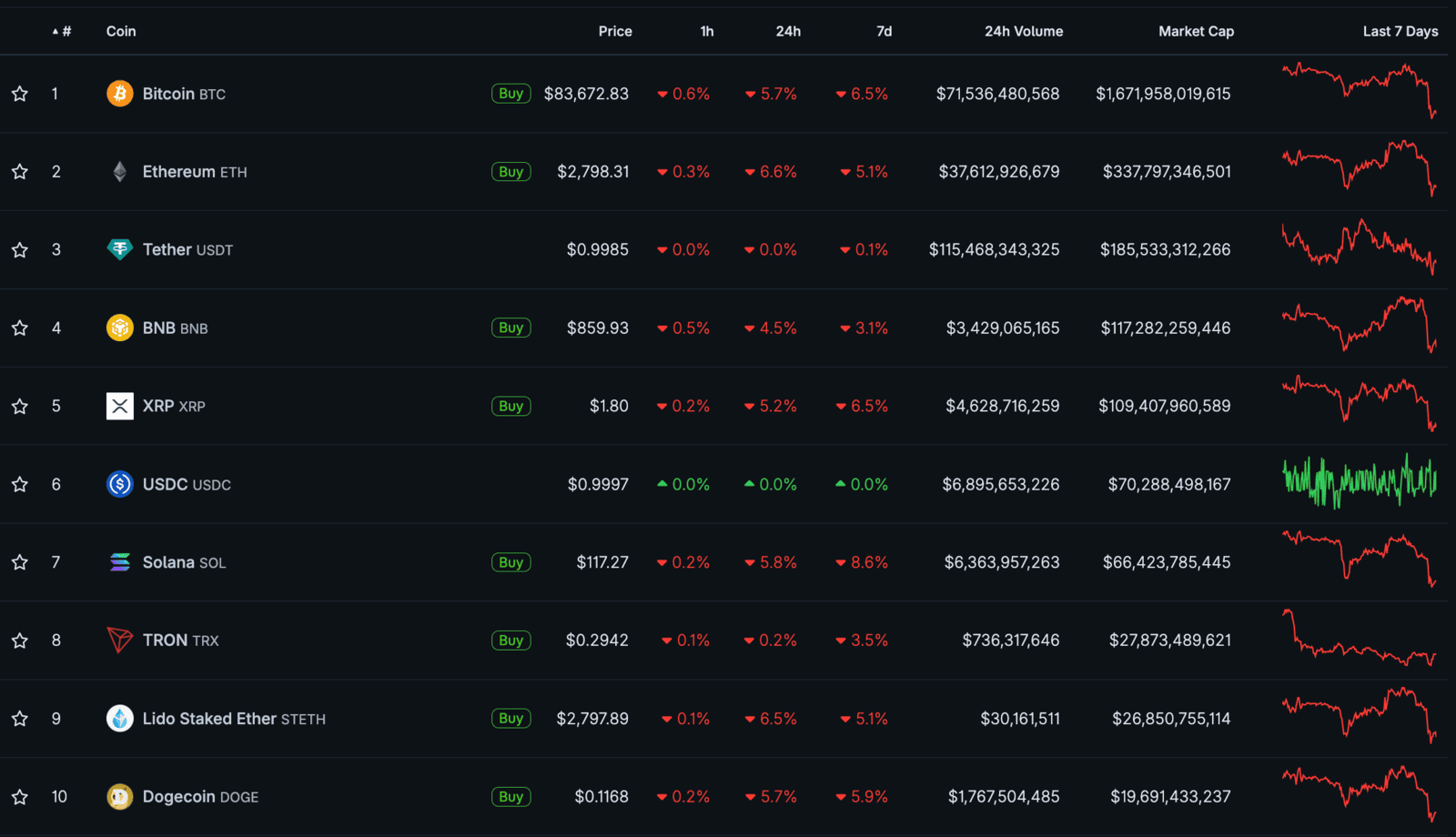

Market Update

Here is the fast five of what you need to know about the market in January 2025:

- Bitcoin fell 4.3% in January

- Ethereum fell 5.5% in January

- BNB flipped XRP to climb into 4th spot

- PAXG was a standout, up 25% when the majority of the market was red

- The total crypto market cap fell by 3.7%

Video of the month

Education: Understanding Global Macro Asset Classes

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved