May Marks Bitcoin’s Return — As the System Unravels

May Marks Bitcoin’s Return — As the System Unravels

The Redemption Month; All Time Highs

Bitcoin 2025 Las Vegas: Political Signals, Macro Realities and the Institutional Infiltration

- Debanking is a global issue. Everyone’s affected — from retail investors trying to access crypto to high-level political figures. Bitcoin provides a monetary escape hatch.

- Utility is scaling fast. As Nick noted, Bitcoin is already being used for everything from loans to services like golf bookings. Real-world application is catching up to ideology.

- Amongst altcoin debates, one thing is clear: “BTC is the best. Chuck out the rest.”

- The Lightning Network has made serious strides, becoming a frictionless way to send and receive Bitcoin for everyday transactions.

- Even among the most prominent Bitcoiners, such as Dorsey and Saylor, there’s still debate: is Bitcoin a store of value or a medium of exchange? Bisher summarised it best: “It’s both, and that’s what makes it so powerful.”

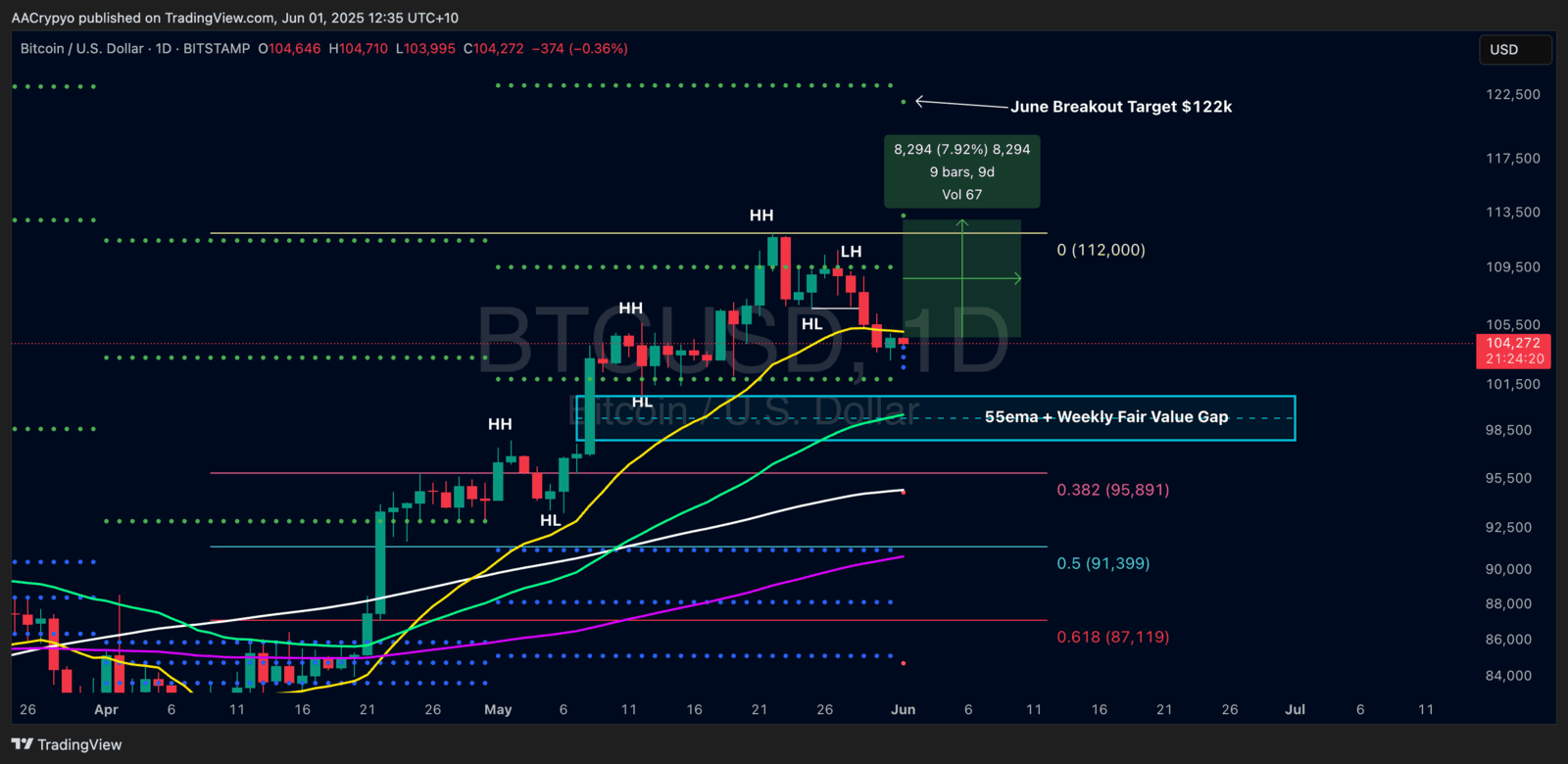

What Could June Have in Store for Bitcoin?

Macro Pressures and Trade Tensions

Breakdown or Breakout

In the News:

US Credit Rating Downgraded for the First Time in History:

Traditional Bitcoin Adoption Accelerates:

Australia Sparks Legal Debate on Bitcoin and Capital Gains Tax:

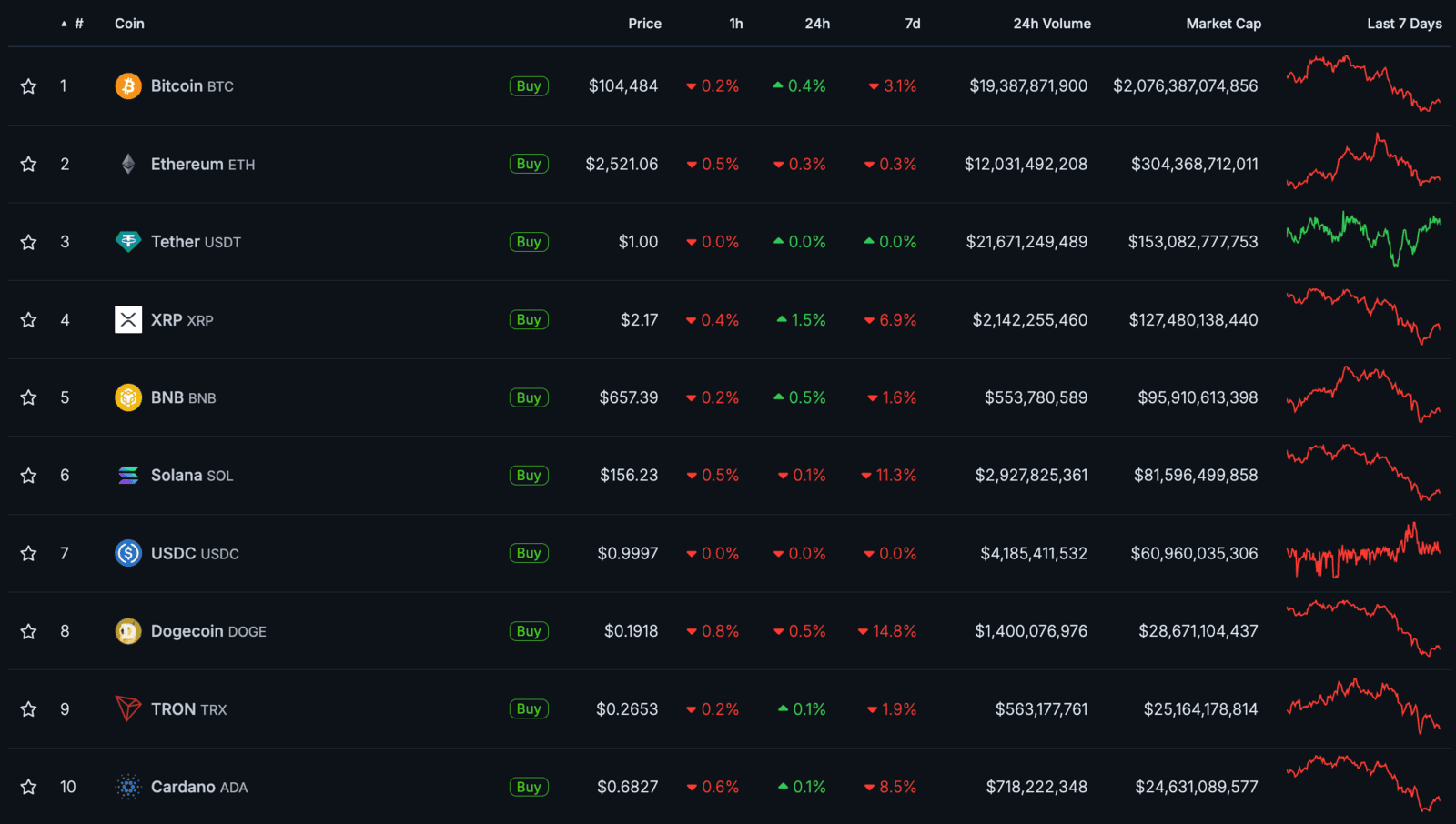

Market Update:

Here is the fast five of what you need to know about the market in May 2025:

- Bitcoin rose by 11.1% in May.

- Ethereum stole the show, up 41.1% in May.

- Tron flipping Cardano was the only change inside the top 10 this month.

- The total crypto market cap grew by 10.31% to $3.23 trillion.

- Hyperliquid was the dominant crypto outside of the top 10, outshining all majors and increasing by 64.4%.

Video of the month:

Education: The Debt Spiral and Why Bitcoin Is the Lifeboat

The Fork in the Road: Control vs Reality

- Adjusting Supplementary Leverage Ratio (SLR) rules to force banks to hold more Treasuries.

- Proposing legislation that requires stablecoin issuers to back tokens with US government debt.

- Promoting narratives that GDP can outpace debt growth — not through productivity, but through inflation-driven nominal gains.

Bitcoin: Designed for This Environment

Urgency in Rotation

How Stormrake Can Help

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved