October Brought Lessons and November Brings Opportunity

October Brought Lessons and November Brings Opportunity

From All-Time Highs to Hard Lessons

The Shift from Shelter to Opportunity

From Setback to Setup

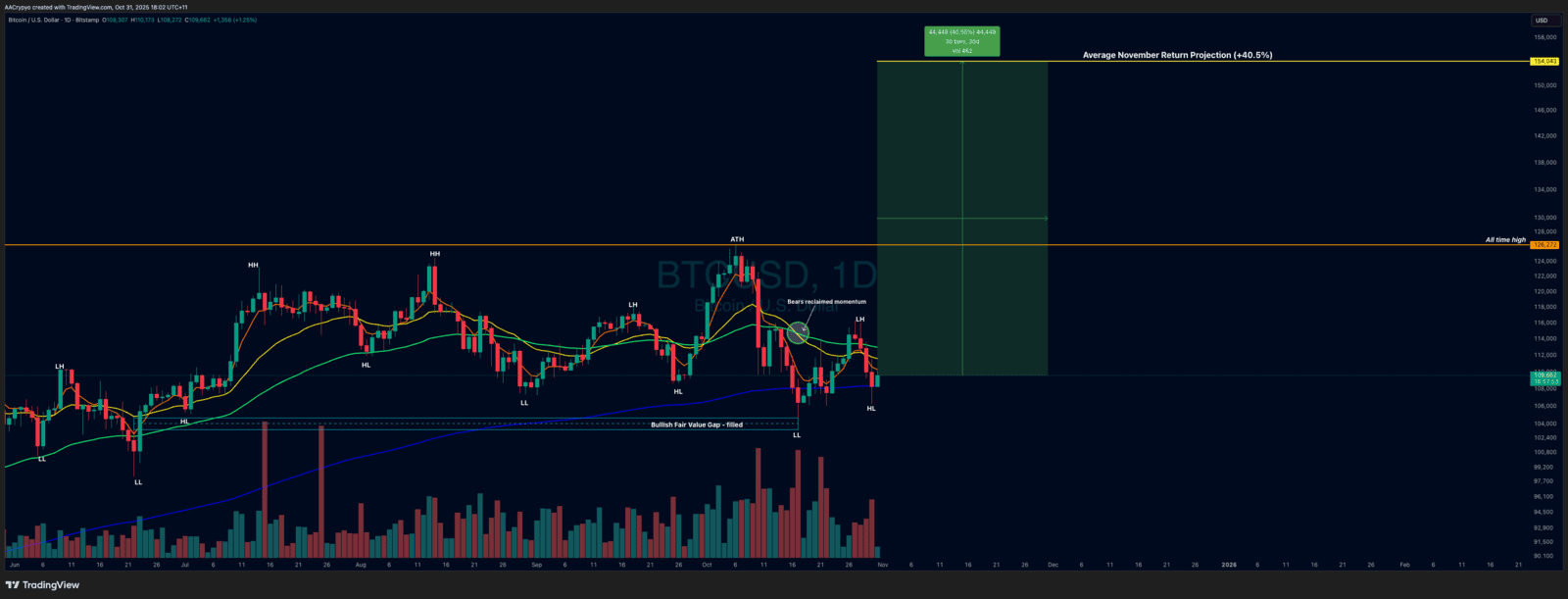

While October ended in the bears’ favour, the bulls have built a foundation for a potential November breakout. The bullish fair value gap, which acted as deeper support, has now been filled and offered the relief needed to stabilise price action heading into the new month.

Looking forward, if we take the historical November average and apply a 40.5% increase from current levels, Bitcoin could rally towards $150,000. While that scenario remains statistically unlikely – with Kalshi giving it just a 6% probability – it aligns with the 2025 projections many had been making for months. If it were to happen, November would be the month to watch.

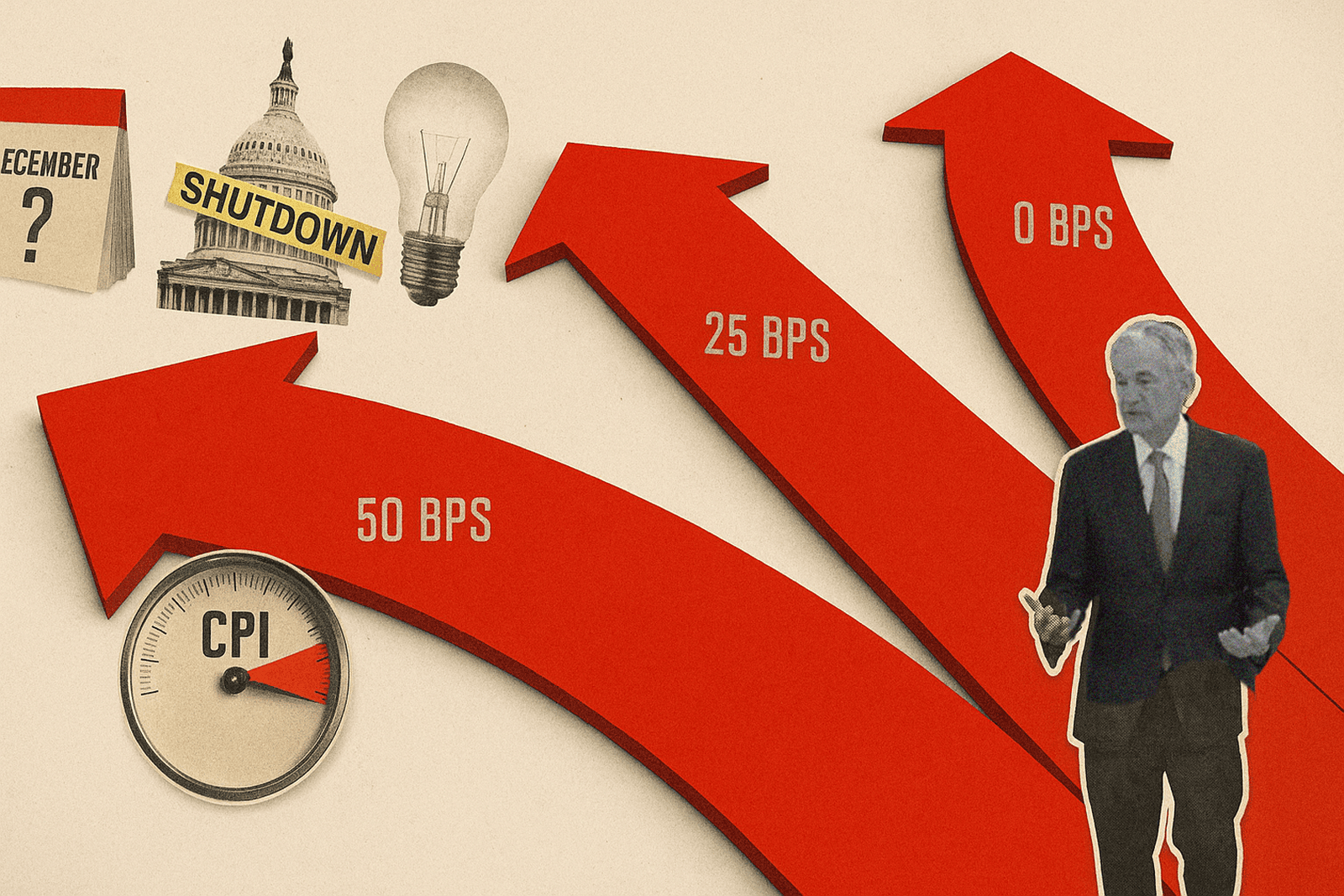

The macro backdrop is shifting. A resolution between the US and China now looks to be in place following a key meeting between Trump and Xi, which resulted in a trade deal. Interest rate uncertainty remains the main concern. With the US government still shut down, key data releases remain paused unless further exceptions are granted. However, there is growing expectation that the shutdown will end in November, potentially unlocking the economic data needed to guide the Fed's final rate decision in December.

In the News:

Morgan Stanley Recommends Crypto Allocations:

Interest Rate Cut and the Road Ahead:

October’s Cryptocurrency ETF Momentum:

Market Update:

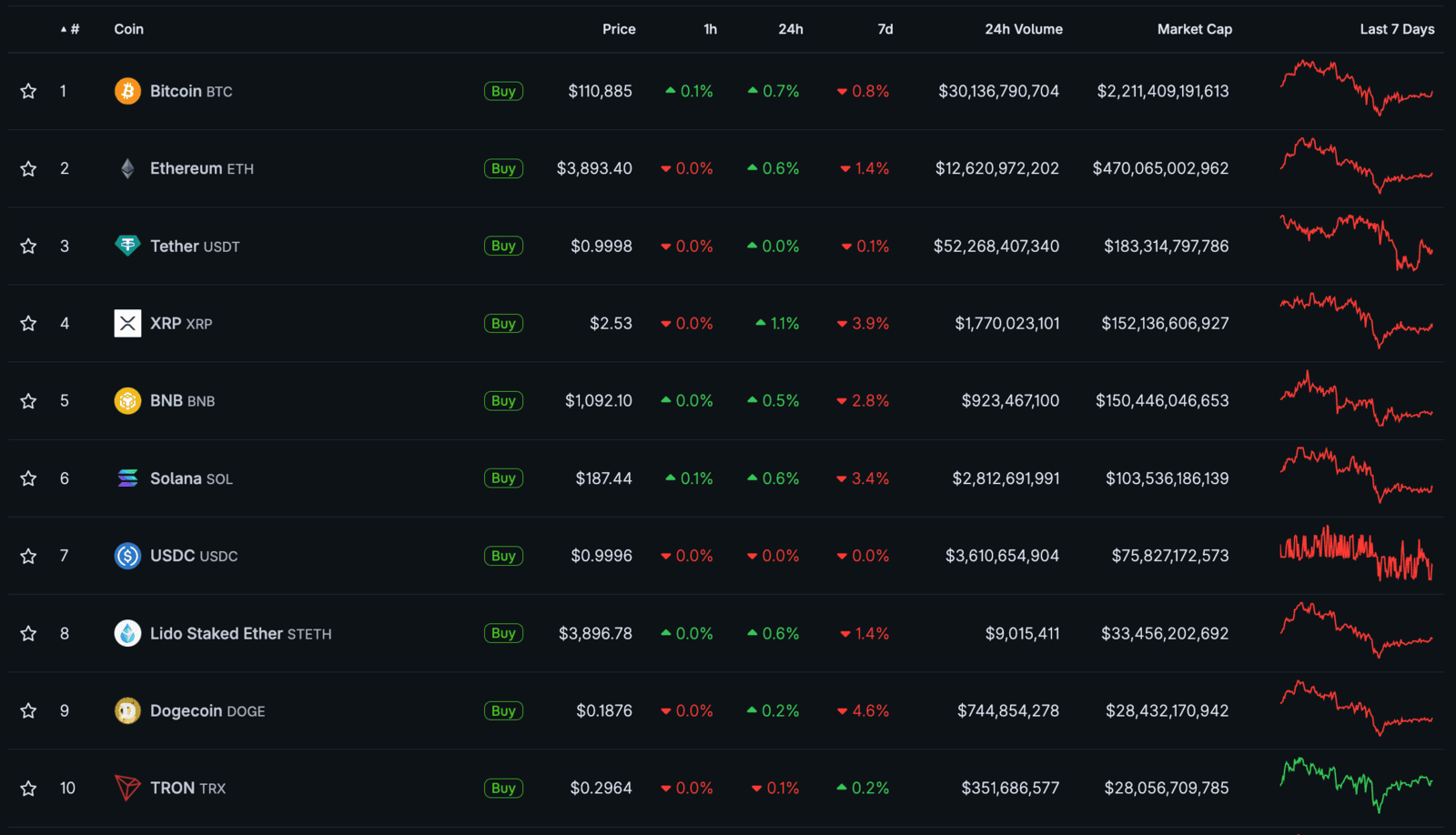

Here is the fast five of what you need to know about the market in October 2025:

- Bitcoin fell by 3.79% in October

- Ethereum fell by 7.64% in October

- The top 10 remained unchanged from last month

- Bittensor (TAO) was a standout performer of the month, up 38% for the month

- The total crypto market fell by 5.50%

Video of the month:

Education: The Painful Truth About Leverage

Stormrake returns to the Australian Crypto Convention

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved