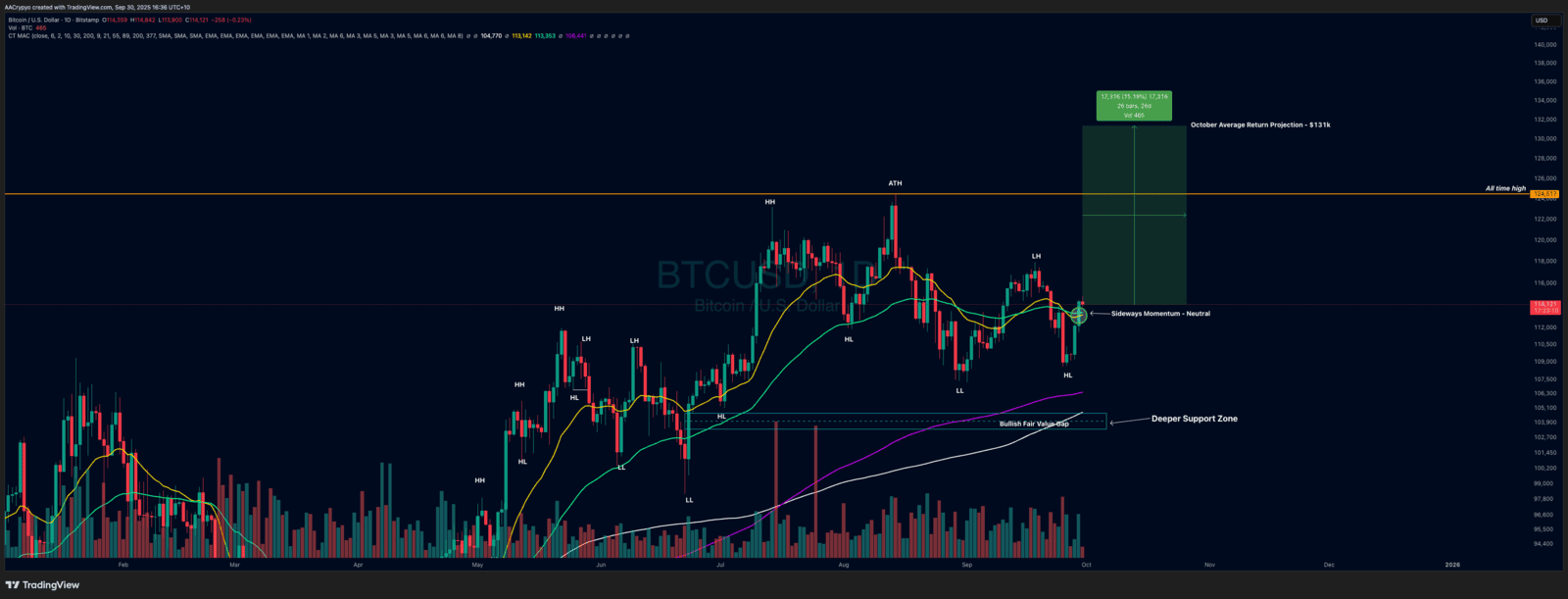

The Calm Before Q4’s Big Move

The Calm Before Q4’s Big Move

Driven by Expectations and Historical Patterns

Bull Markets Are Fuelled by Narratives

And then came a new narrative.

September Holds Strong, Uptober Now in Focus

In the News:

FTX Creditor Payouts Underway at Discounted Rates:

- Bitcoin: $30,000 per BTC

- Solana: $30 per SOL

- Ethereum: $3,900 per ETH

Wall Street Embraces Tokenisation:

US Government Shutdown Imminent Amid Political Deadlock:

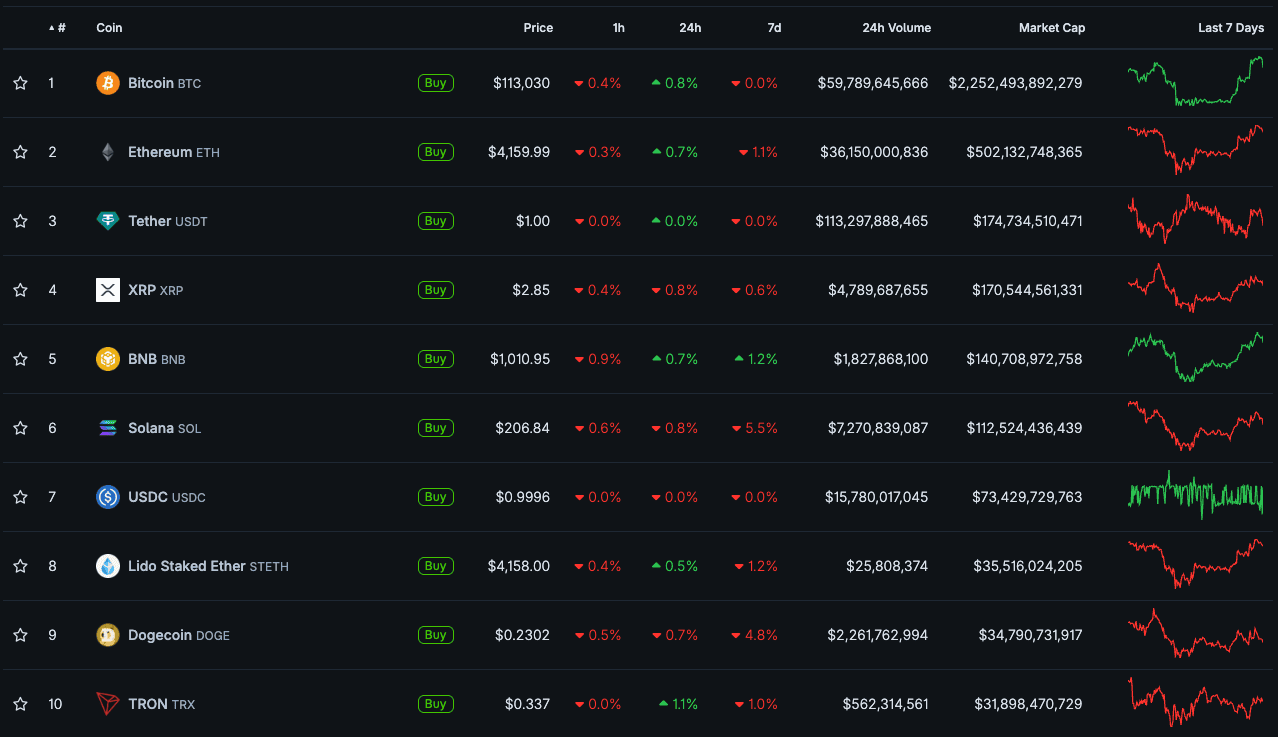

Market Update:

Here is the fast five of what you need to know about the market in September 2025:

- Bitcoin increased by 5.21%

- Ethereum decreased by 4.43%

- The top 10 remained unchanged from last month

- BNB was the top performer in the top 10, climbing nearly 20%

- ASTER exploded onto the scene and quickly became a top 50 crypto project

Video of the month:

Education: Bitcoin’s Correlation: Gold, Equities, or Its Own Path?

Bitcoin and Gold

Bitcoin and the S&P 500

Bitcoin Is Maturing, but Not a Hedge Yet

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved