Blog tagged as CPI

"Nothing stops this train"

Is the tide is turning? Institutional flows favour Ethereum over Bitcoin.

As geopolitical tensions escalate and fiscal risks rise, Bitcoin holds key support and rallies as investors seek refuge in hard assets.

Bitcoin has started June on a positive note, even as tensions escalate between the US, China, and the EU.

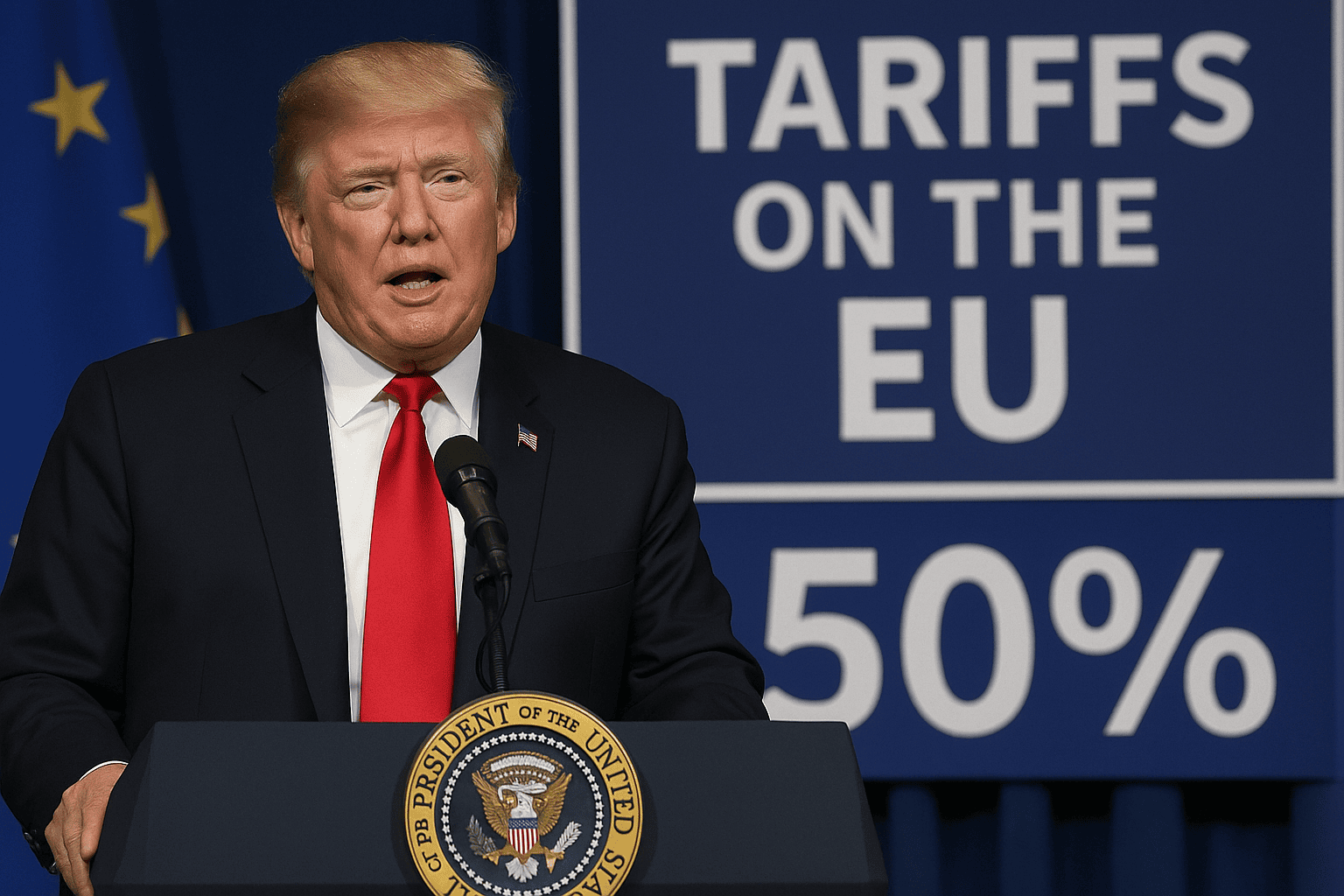

Further tariff drama has put a damper on a historic month for Bitcoin.

The White House has appealed the court’s decision to block Trump’s tariffs, resulting in their temporary reinstatement.

The U.S. Court of International Trade has blocked Trump’s ‘Liberation Day’ tariffs, ruling them unlawful.

Trump Media has announced plans to purchase $2.5 billion worth of Bitcoin

Bitcoin leads the market with rising dominance amid macro uncertainty and fading altcoin sentiment.

Trump pauses his recent tariff threat, giving risk-on assets a boost.

Trump proposes 50% tariffs on the EU and markets suffer.

As Bitcoin set another all-time high, one of the market’s major blockchains faced its largest protocol exploit to date.

Bitcoin has broken through $110,000, setting a new all-time high and entering price discovery as momentum and dominance continue to build.

Recent headlines have sparked debate over whether Bitcoin could become exempt from capital gains tax in Australia.

Bulls and bears were taken for a ride and liquidated, while spot Bitcoin holders sit comfortably at higher prices.

Bitcoin breaks out, once again outpacing its so-called competitors.

Nations are battling to become the world’s crypto hub—but only one will come out on top.

As altcoins pull back and Coinbase faces a security breach, Bitcoin continues to hold its ground.

Bitcoin consolidates between $104K resistance and $100K support as markets await Powell’s tone to dictate the next breakout or breakdown.

Markets rally as weaker inflation boosts risk appetite, with Ethereum leading crypto’s charge.