The controversial bill passes the Senate in a narrow vote, sparking heated debates and setting the stage for significant economic consequences.

As with much of the first half of 2025, June's price action was largely influenced by news and decisions from the White House, alongside ongoing conflicts in the Middle East, but it has set itself up for a potentially bullish second half of the year.

Equities push into record highs while crypto stalls, with Solana leading the market on news of its first US staking ETF.

After a shaky start, Bitcoin shows signs of reclaiming momentum heading into H2.

Bitcoin remains flat as ETF inflows quietly build, with bulls watching for a breakout towards the $110k target.

Bitcoin holds steady below all-time highs while traditional markets break into new record territory, waiting for risk-on flows to rotate into crypto.

Powell holds a cautious line on tariffs and inflation, while Bitcoin extends its dominance across the space.

Markets rally on ceasefire optimism as capital rotates out of safe havens and into risk assets, setting the stage for another Bitcoin all time high...

Risk assets rally as Trump announces Israel-Iran ceasefire, easing geopolitical tensions

US strikes Iran in push for ‘peace’, but Iran won’t back down — Bitcoin tumbles as tensions rise.

Russia makes its stance clear on Iran, and markets sell off in response.

Markets are full of mixed signals, with no clear read on where the conflict is heading.

Powell offered no surprises, while markets hold steady awaiting clarity on Middle East risks.

With US involvement in the Middle Eastern conflict looking increasingly imminent, market fear is mounting fast.

Trump’s Tehran evacuation warning triggers market sell-off, halting Bitcoin’s breakout just as bullish momentum returned.

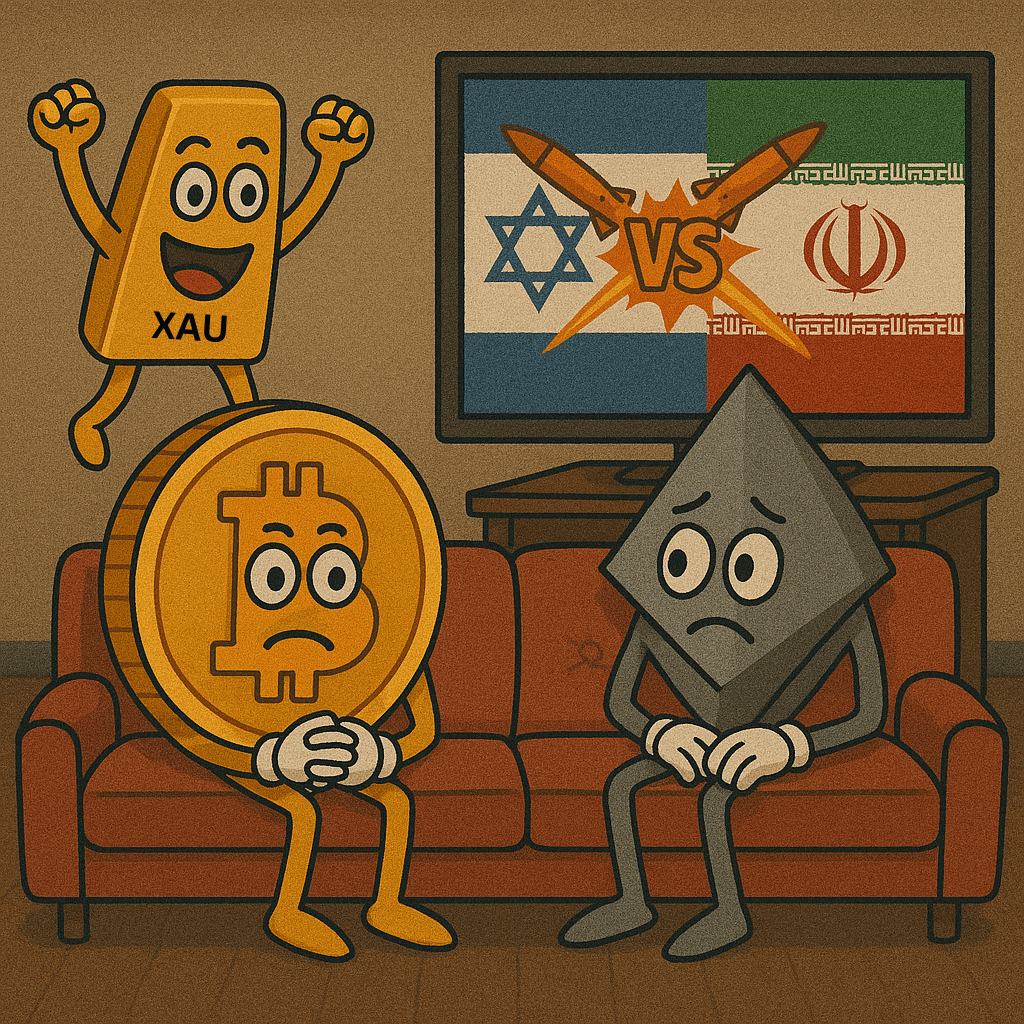

Risk-on assets sit on edge while Gold rallies amid escalating conflict.

Iran retaliates to Israel’s strikes as risk-off sentiment continues to deepen across markets.

Israel has launched a preemptive strike on Iran, and markets are firmly in risk-off mode.

Softer-than-expected CPI data sparked a brief rally in risk assets, but Bitcoin failed to hold gains as momentum faded and capital rotated toward Gold.

As we approach the end of the financial year, here’s a quick way to stay prepared for tax time. Stormrake has partnered with Syla to provide a complete crypto tax report, fully tailored to Australian tax requirements.