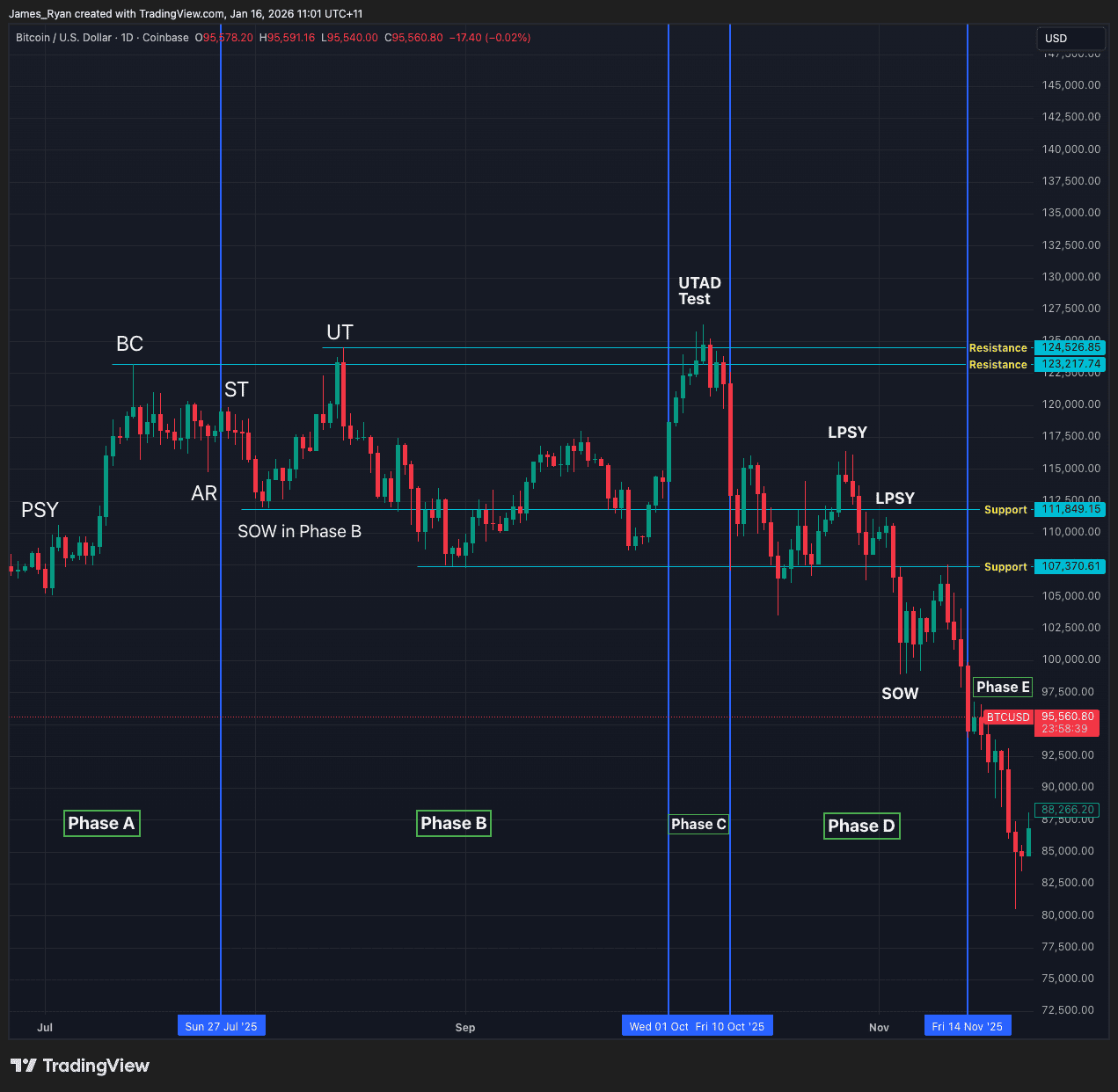

A shock macro market capitulation over the last 24 hours has seen equities, commodities and crypto sell off aggressively.

MSTR has continued to underperform, pushing its mNAV lower and raising questions about whether Strategy could be forced to sell some of its Bitcoin.

Historically, ISM breakouts have led to major blow off top bull runs, will history repeat?

Kevin Warsh’s pro Bitcoin Fed nomination has brought volatility, but strengthens Bitcoin’s long term upside.

Market corrections test more than portfolios. They test process.

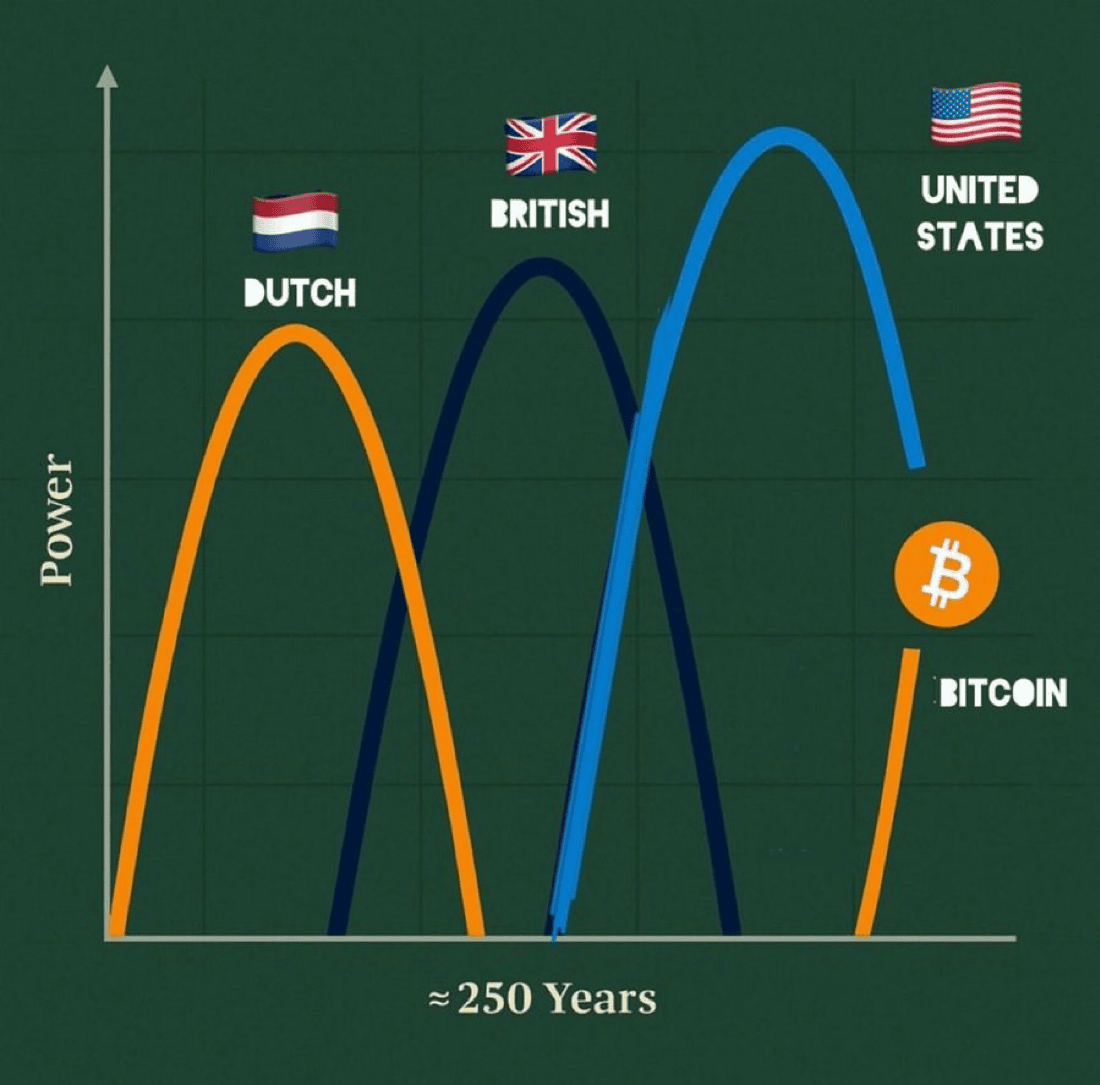

Bitcoin is not the next safe haven but the next global reserve currency. As fiat systems crack and liquidity returns, Bitcoin’s true role is emerging. This is not a repeat of past cycles but a structural reset. Still undervalued, still early.

Leverage once again proved to be the market’s weakest link, triggering forced liquidations across assets and punishing overexposed traders while spot buyers held firm.

Jerome Powell warns the trajectory of US government debt is unsustainable.

A rare Yen intervention may trigger a global repricing of sovereign assets, with Bitcoin positioned to benefit once the volatility clears.

Panic selling from short-term Bitcoin holders has historically marked major bottoms and is a signal that smart money is paying close attention to.

Silver’s resurgence should not make Bitcoin investors defensive. It should make them bullish.

Most investors do not choose their path. They inherit it.

While gold thrives as the safe haven, Bitcoin was built for something else entirely. The global reset.

A look at global markets through the Bitcoin Standard, as the Greenland tariff drama adds fresh momentum to BTC’s evolving macro narrative.

Investors are closely watching the pending Supreme Court decision on Trump’s tariffs, with uncertainty weighing on markets and Bitcoin reacting to the macro pressure.

Where banks create friction, delays, and restrictions, Bitcoin offers open access, speed, and financial freedom.

With Japanese bond market turmoil, yields hitting highs not seen since 2008, a possible new Fed chair, and the end of the longest US government shutdown in history, we’re at a key turning point that could set the stage for a massive 2026 and beyond.

Adopting Bitcoin is proving to be a clear pathway to success, as demonstrated by the growing number of businesses integrating it into their operations.

Coinbase's rejection of the US crypto bill highlights growing tensions as global powers race to define the future of digital asset regulation.

Bitcoin faced sustained, possibly coordinated selling after the October capitulation. Has the suppression ended as it now pushes higher?